IRS data shows that roughly 6% of American taxpayers earn $200,000 or more annually. While that figure includes income from investments, most reported income comes from salaries and wages. Across all occupations, the average worker earns $56,310 annually. In some of the highest-paying occupations, however, the average worker makes nearly three, four or even five times as much each year. These kinds of earnings in turn affect adjusted gross income (AGI), taxes and potentially savings. With that in mind, SmartAsset decided to take a closer look at some of the highest-paying jobs in America.

In this study, we identify the jobs with the best pay both nationally as well as across the 15 largest metro areas. Specifically, we look at average earnings data from the Bureau of Labor Statistics’ Occupational Employment and Wage Statistics to determine rankings at the national and metro area levels. For details on our data sources and further information about how we put together our findings, check out the Data and Methodology section below.

Key Findings

- Specialty healthcare jobs stand out for their high pay. Data shows that 12 out of the 15 best-paid jobs in the U.S. are in specialty healthcare. Furthermore, eight of the highest-paying jobs in the largest metro areas are also in healthcare. Notably, national average earnings for each of these eight healthcare occupations exceed $220,000.

- Chief executives earn the most in four out of the 15 largest metro areas. Chief executive is the highest-paying job in the New York, Los Angeles, Dallas and Houston metro areas. On average, they also make at least 22% more in those areas than the national average for this occupation, $197,840.

A National Look

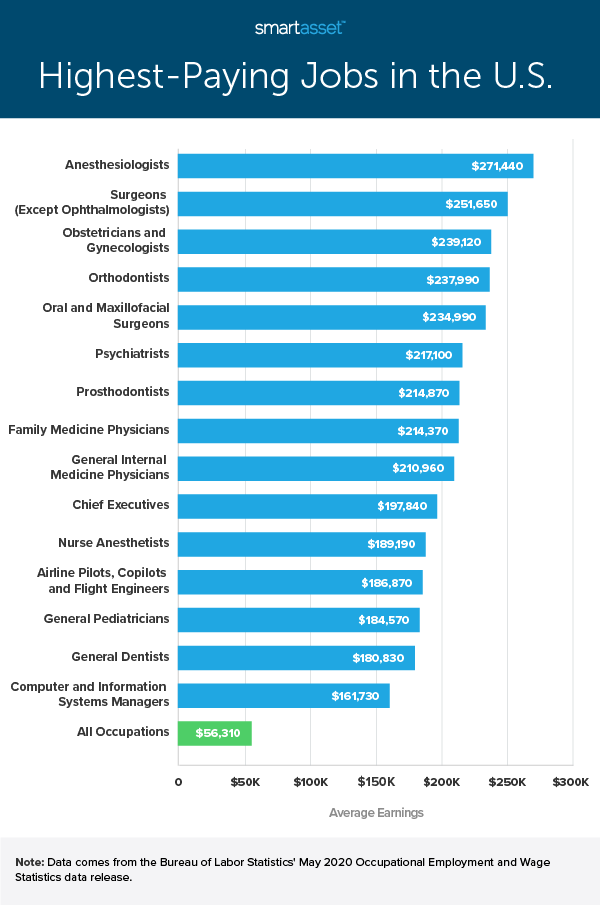

Data from the Bureau of Labor Statistics (BLS) shows that the highest-paying job in the U.S. is that of anesthesiologist. In 2020, average earnings for anesthesiologists were $271,440. Surgeons (excluding ophthalmologists) follow closely behind with average earnings of almost $251,700 in 2020. Earnings for both occupations are more than four times higher than average earnings for all workers ($56,310).

Average earnings exceed $200,000 for seven additional healthcare roles:

- Obstetricians & gynecologists

- Orthodontists

- Oral & maxillofacial surgeons

- Psychiatrists

- Prosthodontists

- Family medicine physicians

- General internal medicine physicians.

Of those, the largest occupation is that of family medicine physician. BLS data shows that there are about 98,600 family medicine physicians nationally, while there are less than 600 prosthodontists.

Other highest-paying jobs in the U.S. include:

- Chief executives ($197,840)

- Airline pilots, copilots & flight engineers ($186,870)

- Computer & information systems managers ($161,730)

The occupation of computer & information systems manager employs the most workers (457,290), while that of airline pilot, copilot & flight engineer is the smallest of the three (employing less than 83,600 workers in 2020). The chart below compares the 15 highest-paying jobs in the U.S. to average earnings for all workers.

Highest-Paying Jobs in the 15 Largest Metro Areas

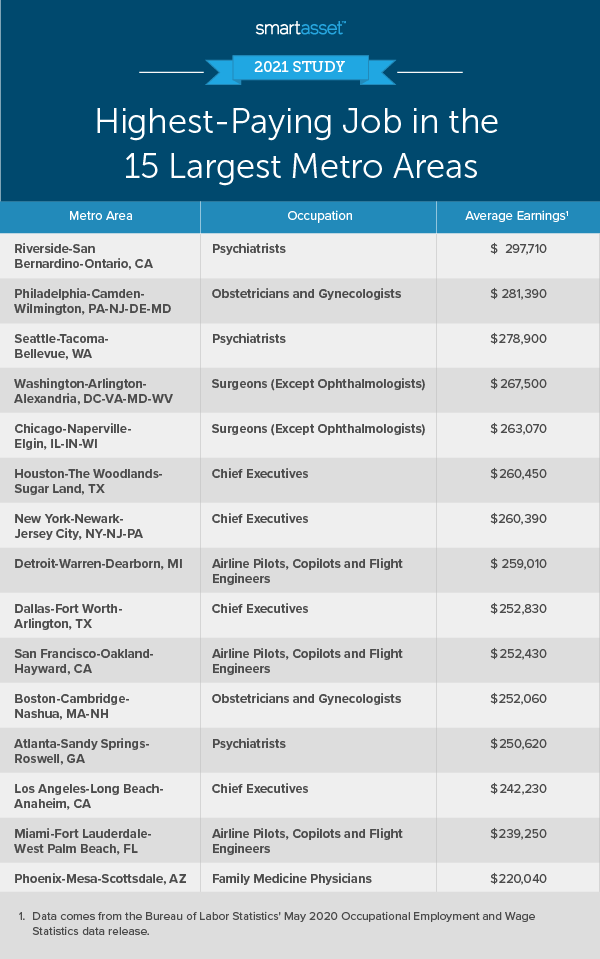

While specialty healthcare jobs rank at the top of the list nationally, data shows regional differences in some of the 15 largest metro areas where other occupations are the best paid.

This is the case with chief executives. Nationally, they have the 10th-highest paying job. But as we referenced earlier, this occupation ranks at the top in four of the 15 largest metro areas. Average earnings for chief executives exceed $242,000 in the following metro areas: New York, Los Angeles, Dallas and Houston. Chief executives in the Houston-The Woodlands-Sugar Land, Texas metro area earn the most on average ($260,450), but they are the most prevalent in Los Angeles-Long Beach-Anaheim, California, with roughly 9,830 employees in the field (amounting to almost 169 per every 100,000 workers).

The airline pilot, copilot & flight engineer job similarly ranks as the 12th-highest-paying job nationally, but is the top paid job in three metro areas:

- Detroit-Warren-Dearborn, Michigan

- San Francisco-Oakland-Hayward, California

- Miami-Fort Lauderdale-West Palm Beach, Florida

In all three of those areas, average earnings for airline pilots, copilots & flight engineers are at least 29% higher than the national average for these workers ($186,870). In fact, average earnings for airline pilots, copilots & flight engineers in the Detroit metro area are 38.60% higher than the national average for those in this occupation.

The table below shows the highest-paying job in all 15 largest metro areas; metro areas are ranked according to average earnings figures.

Data and Methodology

Data for this report comes from the IRS and the Bureau of Labor Statistics’ May 2020 Occupational Employment and Wage Statistics data release. To find the highest-paying jobs in the U.S. and the 15 largest metro areas, we compared average (or mean) earnings across all occupations. We filtered out any occupation with “other” or “miscellaneous” in the title to maintain occupation specificity.

Note: We looked at mean earnings rather than median earnings, as median earnings data is not available for many occupations.

Tips for Maximizing Your Savings

- Invest early. Many high-paid workers may be able to have an early retirement. To do this, it is important to take advantage of compound interest by investing early. Take a look at our investment calculator to see how your investment in a savings account can grow over time.

- Contribute to a 401(k). A 401(k) is an employer-sponsored defined contribution plan in which you divert pre-tax portions of your monthly paycheck into a retirement account. Some employers will also match your 401(k) contributions up to a certain percentage of your salary, meaning that if you chose not to contribute, you are essentially leaving money on the table. Our 401(k) calculator can help you determine what you saved for retirement so far and how much more you may need.

- Consider professional help. A financial advisor may be able to help you create a financial plan for your needs and goals. SmartAsset’s free tool matches you with financial advisors in five minutes. If you’re ready to be matched with advisors, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/Andrey Shevchuk