Did you start side hustle last year? You’re self-employed. Even if you only made $0.01 and didn’t get a 1099.

Financial advisors and tax professionals alike are here to help but there is growing confusion about who counts as self-employed and how that impacts taxes. The idea that you only have to report income if you receive a 1099 a misconception, one that could end up costing you in penalties pending an IRS investigation. Let’s look at the facts and what’s influencing the confusion.

Understanding the SE Income Tax System

Self-employed (SE) taxes work differently than your traditional income taxes. If you work for an employer as a W-2 employee then your employer covers a portion of your taxes. However, being self-employed means you cover all of your taxes. See the breakdown below:

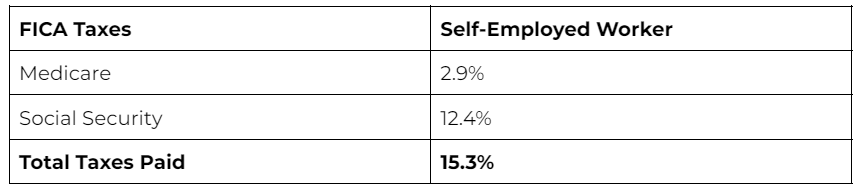

Self-Employed Worker:

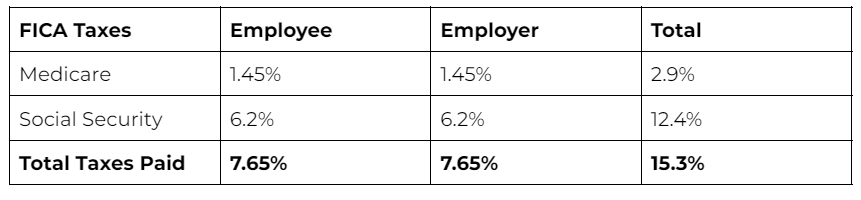

W-2 Employees:

FICA taxes are the combination of Medicare and Social Security taxes. They total to make up 15.3% in taxes. If you’re self-employed you’re responsible for the entire 15.3% tax. If you’re a W-2 employee, you’re only responsible for your half and your employer covers theirs.

A Warning to Self-Employed Workers

The IRS has been lenient over the past few years with self-employed workers not claiming their income, but that is coming to an end. Back in 2021, The American Rescue Plan Act was introduced and lowered the requirements for who receives a 1099. Prior to the new act, only merchants who sold $20,000 worth of products, or who completed at least 200 transactions were receiving a 1099. Today that max has been cut down to $600.

What this means for SE workers is you will now be receiving a 1099 if you make $600 or more on any marketplace (Etsy, Shopify, etc.) or any gig economy site (Uber, Lyft, etc.).

What if I didn’t make $600 from any one source?

Technically the IRS states that you only need to report self-employment earnings if your net earnings were $400 or more in total. However, if you worked multiple side hustles, that can be an arduous tally.

To be safe, if you earned any income through these avenues, it is counted as self-employed income and you still need to report it. Those with low earnings have gotten into a bad habit of “asking forgiveness rather than permission” if they do get audited. But this is a dangerous game to play.

How to Report Self-Employment Income

The IRS has set up an entire page dedicated to gig economy workers and self-employed workers, to answer the questions of who counts, who’s exempt, and how to report your earnings. But here’s the generalized version that will apply to most of the SE population.

- Collect your earnings from any avenue counted as self-employment income. This includes:

- Ridesharing services

- Delivery services

- Crafts and handmade item marketplaces

- On-demand labor and repair services

- Property and space rentals

2. When you file Form 1040 for your taxes you will also need to prepare a Schedule C and Schedule SE. This is just a detailed layout of what you earned and where plus a calculation of what taxes are owed.

3. Attach both schedules to your Form 1040 and file prior to the April 15th tax deadline.

The Bottom Line

The ins and outs of SE income tax filings are complex and are subject to change annually. While we have covered some of the basics from who owes SE income taxes and forms you need there are pages of exemptions, deductions, and special circumstances that you may be eligible for.

Contacting a tax professional is highly recommended especially if you’re new to self-employment. Depending on your earnings you may be required to pay quarterly taxes as opposed to an annual filing as you’ve done in the past.

Tips for Understanding Your Taxes

- From how much you owe, to payments, deductions and timelines, if you’re new to self-employment taxes, a professional can help you. Gaining clarity on the areas where you’re uncertain can go deeper than a quick online search.

- Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo Credit: https://www.istockphoto.com/syahrir maulana, SDI Productions, hapabapa