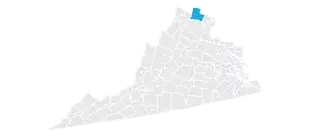

Overview of Loudoun County, VA Taxes

Loudoun County is one of the largest counties in the state of Virginia, with more than 440,000 residents. Taxpayers in the county are subject to some of the highest property taxes in the state, as the median annual property tax bill is $6,243. That's more than twice as high as the statewide median.

| Enter Your Location Dismiss | Assessed Home Value Dismiss |

| Average County Tax Rate 0.0% | Property Taxes $0 (Annual) |

| of Assessed Home Value | |

| of Assessed Home Value | |

| National | of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

Loudoun County Property Tax Rates

Loudoun County property tax rates rise higher than both national and state averages. The county has an average effective tax rate of 0.79%.

While property tax rates themselves aren’t particularly high, median home values in Loudoun County are a different story. The county’s overall median home value is $790,400, which is higher than the state median of $403,500. And it's almost twice as high as the national median of $360,600.

Because of these high home values, county homeowners pay much higher tax payments than many other counties within the state. In fact, the median annual property tax payment in Loudoun County is $6,243.

A financial advisor can help you understand how homeownership fits into your overall financial goals. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Paying Your Loudoun County Property Taxes

Loudoun County mails real estate assessment notices every February. But it’s important to note that these notices are not tax bills. Instead, they reflect property value as of January 1 of that year based on market activity in the previous year. Both this value and the upcoming April’s tax rate combine as the base determining a property’s new annual tax bill.

Under state law, the Treasurer has to mail your property tax bill with at least two weeks’ notice before your tax bill is due. Annual tax bills in Loudoun County are typically mailed out in late April and then again in late October.

As is common with residential property in many areas, tax payments might be covered through your home’s escrow account. Loudoun County relies on mortgage companies to request information rather than automatically sending it. It’s a good idea to check in with your mortgage company if you’re unsure of whether or not these taxes will be paid automatically.

Loudoun County collects property taxes through two installments each year. Due dates are spaced out during the year with the first payment due June 5 and the second on December 5. Any amount not paid by these due dates is subject to a 10% penalty. And you’ll be responsible for paying monthly interest on any overdue balances as well.

As the property owner, you have several options for paying your property taxes each year. You can pay online through the Loudoun County website. You can choose between paying with your credit or debit card and paying by electronic check. You can also pay in person at the Treasurer’s Office in Leesburg or the Treasurer’s Office in Sterling. Both of these offices have drop boxes for you convenience. If you’d prefer to mail your tax payment, you can find the mailing address listed on the county website.

How Your Loudoun County Property Tax Works

Value assessment is the first part of the annual property tax cycle in Loudoun County. Assessors typically measure property values every two to four years. Under Virginia state law, cities need to do a new value assessment every two years. At the county level, Loudoun County assessors are required to update values every four years.

What exactly is reassessment? Reassessment measures a property’s fair market value. This is the price that the home would hypothetically sell for in a normal fair market. But fair market value isn’t necessarily the amount paid for a property. The home’s fair market value combines with its property tax rate to determine the property’s tax bill for the year.

When assessors set market value, they look at a range of information. This often includes sales information from previous years that can vary by property. Assessors might measure factors like the home’s age, size, condition and location within Loudoun County. Assessors then create a ratio of assessed values compared with selling prices.

Real estate assessment notices go beyond assessed value information following state law changes in recent years. They now include the amount of taxes due in past years for reference.

It’s common for your home’s assessed value to change from year to year. There are several different factors that can lead to changes in assessed value. Common situations that could lead to value changes are excess damage and home construction. For example, placing an addition on the home could lead to a value increase while severe damage or destruction could cause your home’s value to plummet from the previous year.

Places Receiving the Most Value for Their Property Taxes

SmartAsset’s interactive map highlights the places across the country where property tax dollars are being spent most effectively. Zoom between states and the national map to see the counties getting the biggest bang for their property tax buck.

Methodology

Our study aims to find the places in the United States where people are getting the most value for their property tax dollars. To do this, we looked at property taxes paid, school rankings and the change in property values over a five-year period.

First, we used the number of households, median home value and average property tax rate to calculate a per capita property tax collected for each county.

As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. We created an average score for each district by looking at the scores for every school in that district, weighting it to account for the number of students in each school. Within each state, we assigned every county a score between 1 and 10 (with 10 being the best) based on the average scores of the districts in each county.

Then, we calculated the change in property tax value in each county over a five-year period. Places where property values rose by the greatest amount indicated where consumers were motivated to buy homes, and a positive return on investment for homeowners in the community.

Finally, we calculated a property tax index, based on the criteria above. Counties with the highest scores were those where property tax dollars are going the furthest.

Sources: US Census Bureau 2018 American Community Survey, Department of Education