Overview of Wake County, NC Taxes

If you own a home in Wake County, North Carolina, paying property taxes isn’t something you can avoid. Fortunately, North Carolina’s property taxes are generally fairly low. Residents of Wake County have an effective property tax rate of 0.68%, while the median annual property tax payment is $3,533.

| Enter Your Location Dismiss | Assessed Home Value Dismiss |

| Average County Tax Rate 0.0% | Property Taxes $0 (Annual) |

| of Assessed Home Value | |

| of Assessed Home Value | |

| National | of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

Wake County Property Tax Rates

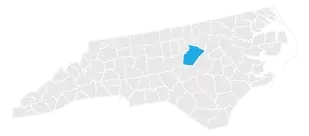

Wake County is located in northern North Carolina. It’s made up of 12 municipalities including Raleigh, the state’s capital and the county seat. The median home value in Wake County is $521,600, with a median property tax payment of $3,533. That makes the county's effective property tax rate 0.68%.

Wake County property tax dollars are used to cover the cost of various expenses. A portion of the property tax revenue goes to public schools and colleges such as the Wake Tech Community College. The rest pays for things like sanitation services, public safety, environmental services and local police services.

Certain kinds of properties in North Carolina aren’t subject to taxation. For example, your real estate or personal property may be exempt if it’s used for educational purposes, religious reasons or charity. In some cases, disabled veterans don’t have to pay taxes for having motor vehicles. And if you’re a member of the military who’s on active duty, some of your personal property may be exempt from taxation, even if you own a home in a different state.

In order to be exempt from taxation, you’ll need to call the Wake County Department of Tax Administration. Applications are due by January 31. But you may be able to submit your application after the deadline if you have a legitimate reason for turning it in late (like military deployment or a death in the family).

A financial advisor can help you understand how homeownership fits into your overall financial goals. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Wake County Property Tax Breaks

If your property tax bill is higher than you’d like it to be, it’s a good idea to apply for one of the tax relief programs that the state of North Carolina offers. Wake County residents may qualify for the Elderly or Disabled Exclusion, the Disabled Veteran Exclusion or the Circuit Breaker Tax Deferment Program.

The Elderly or Disabled Exclusion shields 50% or $25,000 (whichever is greater) of the value of a permanent place of residence from taxation. To qualify for this tax break, you and your spouse cannot earn more than a combined $38,800 per year. You also must be either permanently disabled or at least 65 years old. Once you find out that you’re eligible for the exclusion, you won’t have apply for it again unless your annual income is higher than the income cap, you decide to move or your spouse dies.

The Circuit Breaker Tax Deferment Program allows homeowners to postpone the payment of a certain percentage of their property taxes until a disqualifying event takes place. At that point, you’ll have to pay any taxes you deferred in the last three years, plus interest. Examples of disqualifying events include the decision to choose a different permanent residence and the death of the original property owner.

To be eligible for the Circuit Breaker Tax Deferment Program, you must:

- be at least 65 years old or be permanently and totally disabled

- have a total income between you and your spouse of below $58,200

- have owned and occupied a home in Wake County for at least five years

You’ll also have to reapply for tax deferment every year. You won’t, however, have to reapply for the disabled veteran exclusion, which allows qualifying individuals to shield up to the first $45,000 of their home’s appraised value from taxation.

Can’t decide which tax relief program to apply for? You can visit wakegov.com for a side-by-side comparison of the program benefits based on your home value and income level. There are also tax deferment programs for certain landowners, such as Wake County taxpayers who use their land for wildlife conservation purposes or farming. Property taxes can be deferred on forest land and historical sites as well.

If you have questions about how property taxes can affect your overall financial plans, a financial advisor in Raleigh can help you out.

Paying Your Wake County Property Taxes

Wake County property owners typically receive their tax bills each year in July. If your property taxes are being paid through an escrow account, you won’t get a bill in the mail. Instead, you’ll have to go online and print your statement.

Property tax payments in Wake County are due on January 5. If you miss this payment deadline, you’ll get hit with a 2% interest charge in January. For every additional month that your tax payment is late, you’ll incur a 0.75% interest charge.

Tax bills are based on calculations for the period that falls between July 1 and June 30. In other words, the property tax bill you receive in July 2026 would represent your property tax burden for the period between July 1, 2026 and June 30, 2027.

When you’re ready to pay your property taxes, you can submit your payment in person by visiting one of the revenue department offices listed on wakegov.com. You can also pay through your online bill pay service or have your tax payment withdrawn directly from your checking account. If you’re paying with a debit or credit card, you may be charged a processing fee.

Want to pay your property taxes as soon as possible? You can prepay the amount you owe anytime between January 1 and June 30. If you’d rather pay your property tax bill in installments rather than all at once, you can do so without notifying the Wake County Revenue Department.

If you’re worried that you can’t pay your property tax bill in full or through installment payments, you can contact the revenue department and find out whether you can be placed on a temporary payment plan.

Places Receiving the Most Value for Their Property Taxes

SmartAsset’s interactive map highlights the places across the country where property tax dollars are being spent most effectively. Zoom between states and the national map to see the counties getting the biggest bang for their property tax buck.

Methodology

Our study aims to find the places in the United States where people are getting the most value for their property tax dollars. To do this, we looked at property taxes paid, school rankings and the change in property values over a five-year period.

First, we used the number of households, median home value and average property tax rate to calculate a per capita property tax collected for each county.

As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. We created an average score for each district by looking at the scores for every school in that district, weighting it to account for the number of students in each school. Within each state, we assigned every county a score between 1 and 10 (with 10 being the best) based on the average scores of the districts in each county.

Then, we calculated the change in property tax value in each county over a five-year period. Places where property values rose by the greatest amount indicated where consumers were motivated to buy homes, and a positive return on investment for homeowners in the community.

Finally, we calculated a property tax index, based on the criteria above. Counties with the highest scores were those where property tax dollars are going the furthest.

Sources: US Census Bureau 2018 American Community Survey, Department of Education