Morningstar recently compared the numbers on different scenarios for investors who may be thinking of pausing their 401(k) contributions. The result was not favorable for those who opted to stop contributing to their retirement plans, and the data showed that it rarely ever is.

After comparing those who continued investing to others who withheld and tried out the “wait and see” approach, the end return was quite drastic in terms of dollars earned and dollars lost. Let’s look at their results and see an example of what you could stand to lose should you choose to pause your retirement investing.

Investors needing guidance on creating a resistant retirement plan can find assistance through a financial advisor. You can connect with a financial advisor for free in just five minutes.

Should Investors Ever Pause 401(k) Contributions?

Investors should avoid pausing their 401(k) contributions during a bear market, recession or market downturn. The loss in compounding earnings typically outweighs any potential for savings you think you’re getting by keeping the cash out of your retirement savings.

The Morningstar Comparison: Continued Contributions vs. Paused Investing

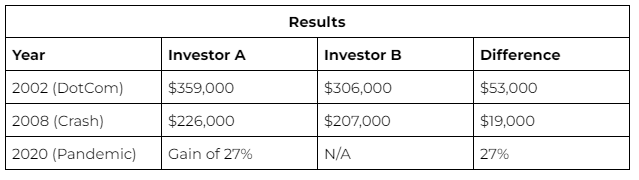

Morningstar ran the numbers from the previous three major market upsets; 2002, 2008 and 2020. It created a simple comparison to determine who ended up ahead — (A) an investor who continued making $500 monthly contributions or (B) a conservative investor who paused all retirement savings.

The results held firm throughout each scenario — the continued contributor always came out on top. Why? Mainly from the compounding effect that takes place. The initial $500 investment wasn’t substantial, but the compounding interest over the years took off.

Should Investors Cash Out During A Bear Market?

Investors should never cash out their 401(k) for the sole purpose of avoiding loss during a bear market. After all, the consequences are steep. The only way to guarantee a loss during a bear market is to withdraw your investments from their vehicles. Technically, the market trends up far more than it trends down. Even in the “down times,” the market tends to recoup its losses in time.

By removing your savings or “cashing out” prematurely, you eliminate the possibility of recouping any losses you may have incurred during the downturn. The best option is to hang tight and ride the wave; the loss is only real if you remove your investments. Until then, your portfolio typically holds a 75% chance of retaining a positive return in the long run.

Protecting Your Retirement Savings During A Recession

The surprising answer to protecting your retirement savings is to not panic. Reject the urge to let a downturn influence your decision-making. Retirement savings is a long-term play, one that has time on its side.

Some other ways to protect your investments include

- Portfolio diversification: How you allocate your assets can mitigate risks and bolster your portfolio returns.

- Portfolio rebalancing: Bringing your portfolio back into its original form can also assist with exposure to unwanted risk levels and maximize returns.

- Continue Contributing: While pausing 401(k) contributions aren’t as bad as cashing out, it has its own negative consequences. Even a short pause can mean thousands in missed funds.

The Bottom Line

Time is the great equalizer when it comes to retirement savings, stocks will continue to be volatile, fluctuate and test your patience but those that can stick to a plan see the best outcomes. If all else fails, it’s best to stay on your current 401(k) investment path. Make sure to connect with a financial advisor to help you plan accordingly.

Tips for Protecting Your 401(k)

- Consider talking to a financial advisor about investment strategies and protecting your 401(k). Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- A target-date fund will automatically rebalance over time. This will ensure you remain primarily invested in stocks early in your career. Then, as you near retirement, it’ll shift to safer, more conservative investments.

Photo credit: ©iStock.com/Sezeryadigar, Photo credit: ©iStock.com/ AndreyPopov