Financial planning positions offer an opportunity to do work that you enjoy while potentially earning a highly competitive salary. If you’re fresh out of college or making a transition to financial services from another field, you might be wondering how to find openings that look promising. There are several possibilities for finding available financial advisor positions, as well as jobs specifically in the field of financial planning.

Add new clients and AUM at your desired pace with SmartAsset’s Advisor Marketing Platform. Sign up for a free demo today.

Financial Planner Job Outlook

Is a career in financial planning worth considering? According to the Bureau of Labor Statistics, the answer appears to be yes.

Job growth for personal financial advisors is set to increase by 13% through 2033, which is significantly faster than the average pace. The median pay for financial advisors in 2023 was $99,580 per year with some advisors making substantially more, according to the most recent BLS Occupational Employment and Wage Statistics survey

A quick search for “financial planning jobs” turns up plenty of results, suggesting that there are plenty of roles to be had. The key is finding the right job in financial planning based on your education, expertise and other qualifications.

Client Acquisition Simplified: For RIAs

- Ideal for RIAs looking to scale.

- Validated referrals to help build your pipeline efficiently.

- Save time + optimize your close rate with high-touch, pre-built campaigns.

CFP®, CEO

Joe Anderson

Pure Financial Advisors

We have seen a remarkable return on investment and comparatively low client acquisition costs even as we’ve multiplied our spend over the years.

Pure Financial Advisors reports $1B in new AUM from SmartAsset investor referrals.

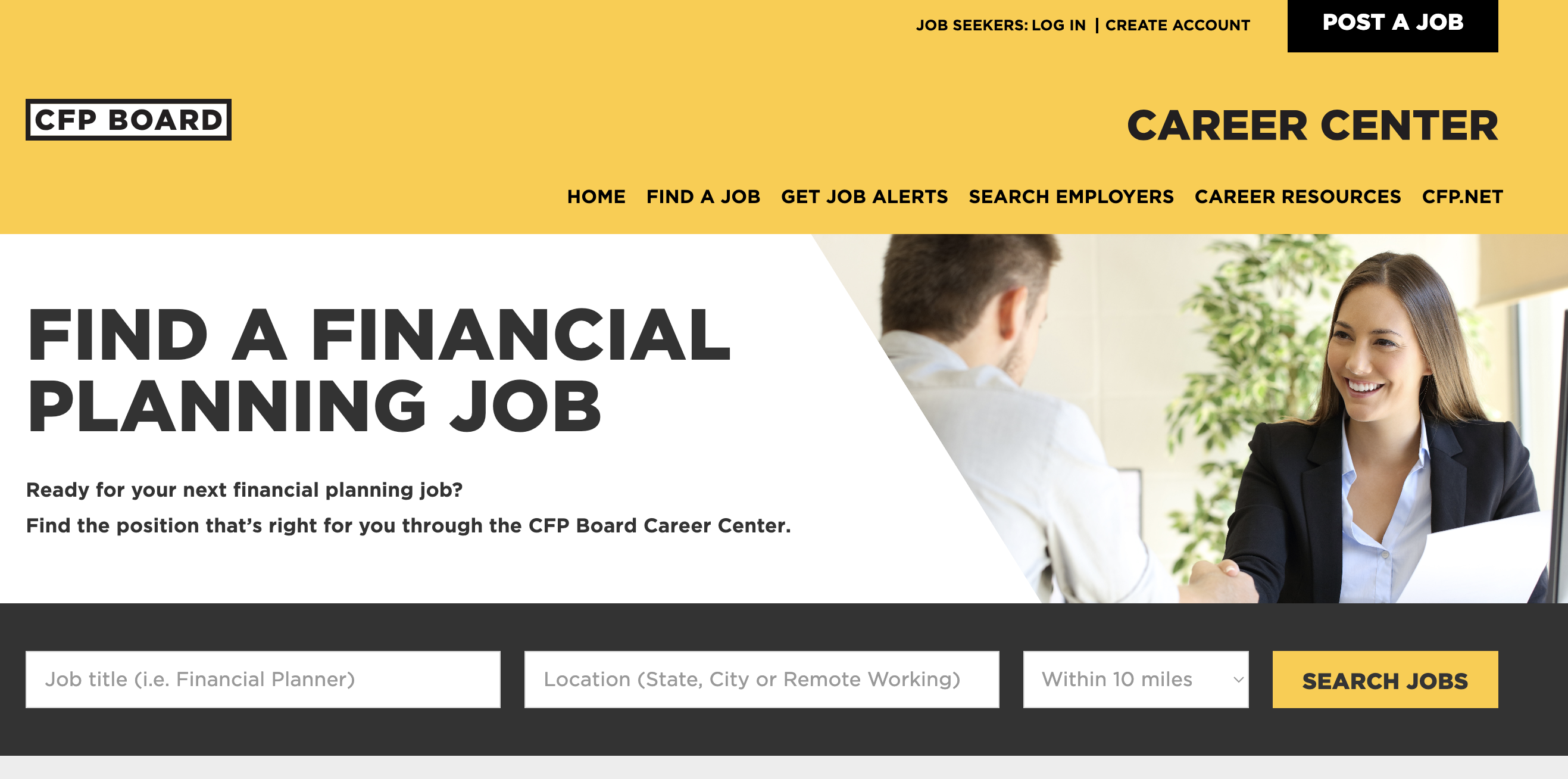

CFP Board Career Center

The CFP Board is a non-profit organization that sets and enforces the standards for the Certified Financial Planner™ (CFP®). To earn this credential, you must meet education requirements, obtain the necessary professional experience and successfully complete the CFP® exam.

The CFP Board offers numerous tools and resources to help you reach your career goals, including access to the online Career Center. When you create an account, you can upload your resume so that hiring professionals and recruiters can see it, browse job listings and sign up for alerts when new jobs are posted.

Become a Top Financial Advisor

Referrals and market gains aren't enough. Grow with the all-in-one advisor marketing platform.

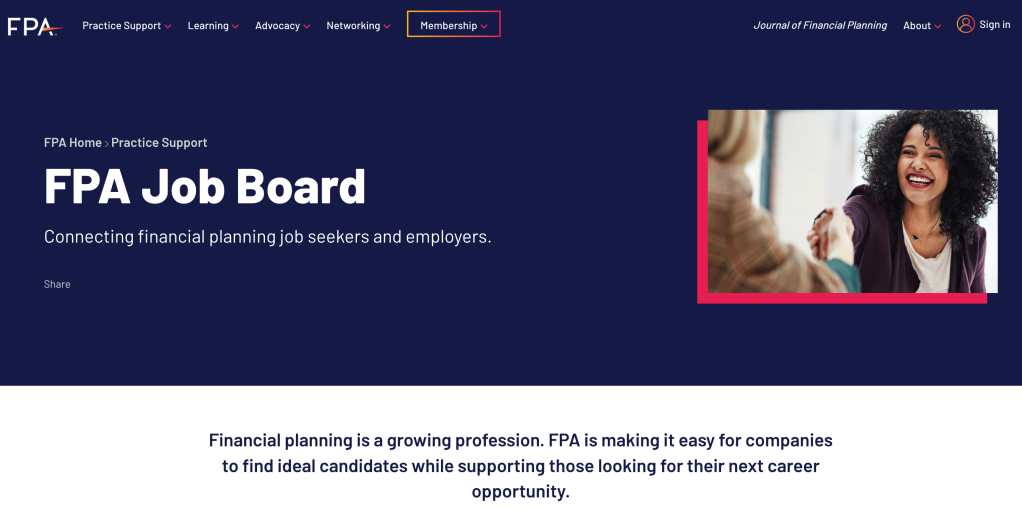

Financial Planning Association Job Board

The Financial Planning Association is a membership organization for CFP® professionals. You can access practice support tools, learning resources, networking opportunities and the association’s job board online.

When you create an account, you can post your resume to the job board and review job listings. You can also sign up for alerts, get help with your resume and check to see what your references are saying about you to prospective employers.

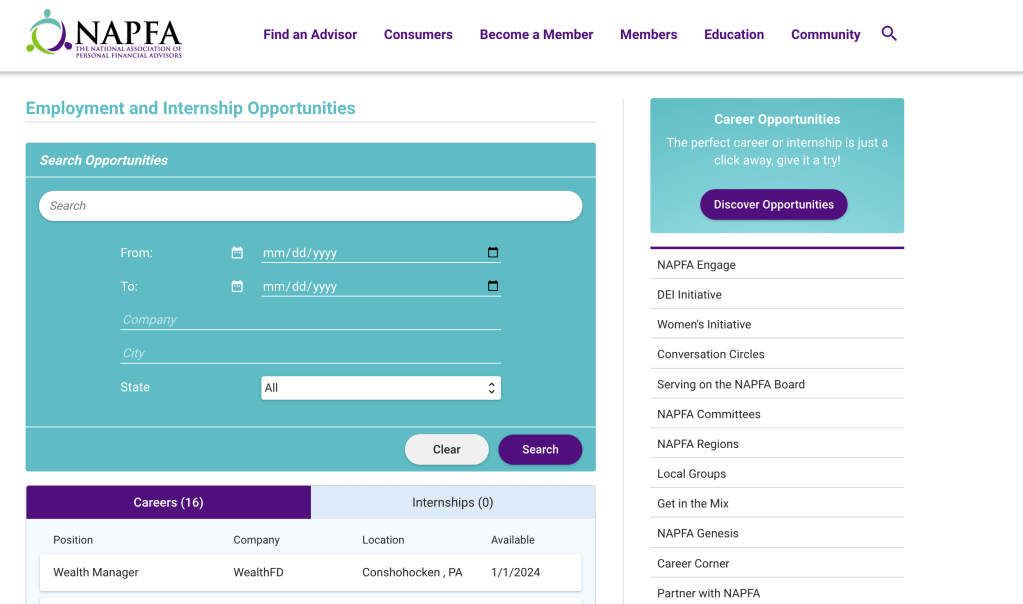

National Association of Personal Financial Advisors (NAPFA) Job Board

The National Association of Personal Financial Advisors is a professional association for fee-only financial advisors. One of the many tools NAPFA offers to advisors is access to an online jobs board.

In terms of the types of jobs posted here, there’s quite a bit of variety. For instance, you can find postings for financial planner jobs alongside listings for wealth management associates, client services coordinators and client relationship specialists.

Simply Paraplanner

Simply Paraplanner features listings for virtual finance jobs, including financial planning roles. You can filter jobs by location, specialty area and full-time or part-time status. You can also see which roles have been filled.

In addition to searching for financial planner jobs, you can post your resume for review for a fee. One-on-one career consulting is also available, again, in exchange for a fee.

Other Ways to Find Financial Planning Jobs

Job boards that exclusively feature openings in the financial services industry may be the best place to start when looking for your first or next role. You can then branch out your search to include other job search resources.

For example, you might consider any of the following:

General Job Boards

General job board sites like Indeed.com or Monster.com can yield plenty of search results for financial planning jobs. Selecting specific keywords can help you narrow down your searches to jobs that align with your needs, preferences and experience. LinkedIn also has a jobs section where available financial advisor positions are listed, including financial planning jobs.

Internships and Entry-Level Programs

For those new to the industry, internships and trainee programs provide an entry point into financial planning. Many firms offer structured programs where candidates can learn about financial advising while gaining hands-on experience. Programs like Vanguard’s Advisor Development Program or Charles Schwab’s Financial Consultant Academy can help new advisors build the skills needed to transition into a full-time role.

Your School’s Career Planning Office

If you’re still working toward a degree, you might visit your school’s career planning office to discuss the possibility of getting help with job placement after graduation. Your career counselor may also be able to direct you toward internship opportunities that could lead to a full-time job offer.

Financial Planning Firm Websites

Many financial planning firms list job openings on their websites. If there’s a specific firm that you’re interested in working for, you can look for a “Careers” page on their website to explore opportunities. For example, the Pure Financial Advisors careers section lists a variety jobs currently available throughout the country.

Headhunters and Recruiters

Specialized recruiters help financial advisors find positions that match their experience and career goals. Firms like Selby Jennings, Alpha Apex Group and Somers Partnership specialize in placing professionals within wealth management and financial advisory roles. Working with a recruiter can provide access to exclusive job listings and help streamline the application process.

Your Network

Who you know really can make a difference when it comes to finding a job in the financial services industry or any other field. If you have people who are already working as financial planners or advisors in your network, you may ask them if they’re aware of any job openings that you might be a good fit for. At the very least, they may be willing to pass your info along should something come up.

How to Avoid a Financial Planning Job Scam

While the financial planning job boards mentioned above are legitimate, general job boards often attract scammers and you don’t want to get ensnared by one. These tips can help you avoid scams while searching for financial planning jobs.

Do Your Research

Before applying to a listing on an online job board listing, check the details. Can you verify that the company is legitimate? Does the person listed as the hiring manager or recruiter have a profile on the company’s website, LinkedIn or social media? Is the company established or did it just incorporate last month? Asking these kinds of questions can help you spot potential scams.

Double-Check the Firm’s Career Page

Companies may list job openings on their websites and on third-party job boards. If you find a financial planning job opening on a general job board, go back to the company’s site to see if it’s listed there also.

Know How to Spot Red Flags

Certain things should be an automatic tipoff that a job posting is not legitimate. For example, if a hiring manager asks for your bank account information before you’ve signed a contract or expects you to pay an upfront fee to have your application processed, those are big red flags.

Request an In-Person Meeting

Hiring managers and recruiters may communicate via phone call, text, email or instant message but ultimately, you’ll want to meet them face-to-face. If you’re asking for an in-person interview and getting pushback, that could be a sign that the job posting is fake. If you do get a meeting, confirm that the company has premises at the location you’re being directed to go to.

Ask Before Handing Over Your Social Security Number

Employers will need your Social Security number to complete your onboarding paperwork. You may also need to share it so an employer can complete a background check or credit check. If you’re asked for your Social Security number, verify what it’s for first and ask to see a copy of any written policies that explain who will have access to it.

If you’re scammed by a fake financial planning job ad you can file a police report. You’ll want to give law enforcement as much detail as possible about the scammer. You can also report the scam to the Federal Trade Commission (FTC) and your state attorney general’s office.

Bottom Line

Searching for financial planning jobs becomes easier when you know where to look for opportunities. Keep in mind that in a competitive job market, it may take time to find the right role. Working with a recruiter, headhunter or career consultant could make it easier to connect with companies that are interested in what you have to offer.

Tips for Growing Your Advisory Business

- SmartAsset AMP (Advisor Marketing Platform) is a holistic marketing service financial advisors can use for client lead generation and automated marketing. Sign up for a free demo to explore how SmartAsset AMP can help you expand your practice’s marketing operation. Get started today.

- Obtaining one or more professional credentials could give you a competitive edge in the job market. Depending on your career plans, that might include obtaining a CFP certification, becoming a registered investment advisor (RIA) or something entirely different. If you’re interested in professional financial designations, researching the requirements for each one and what they’re designed to allow you to do can help you decide which one(s) might be right for you.

Photo credit: ©iStock.com/PixelsEffect, ©iStock.com/CFP Board Career Center, ©iStock.com/Financial Planning Association Job Board, ©iStock.com/National Association of Personal Financial Advisors (NAPFA) Job Board, ©iStock.com/ , ©iStock.com/Prostock-Studio