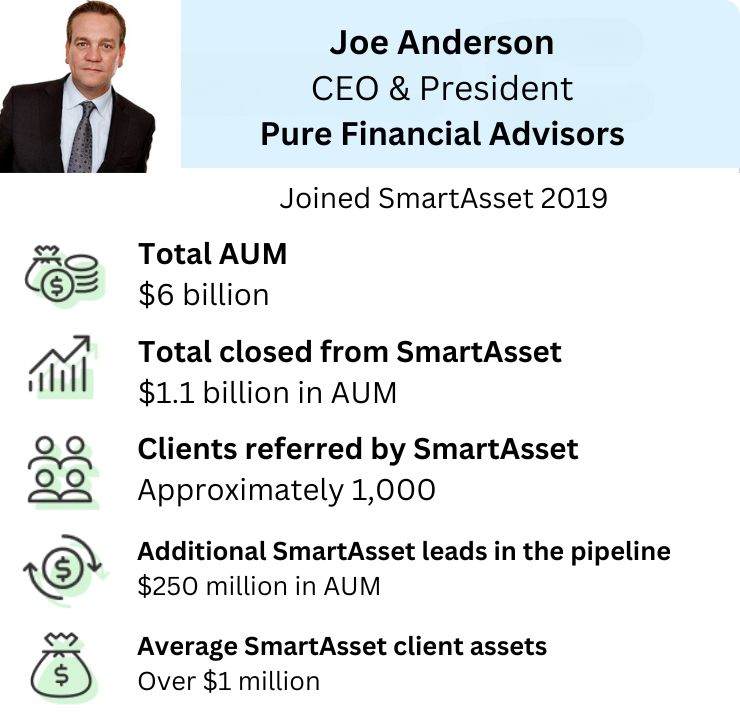

Partnering with SmartAsset, Pure Financial Advisors reports recently crossing a major milestone in raising over $1 billion in new assets under management through the platform. The success Pure has had with lead generation through SmartAsset has helped the business expand organically beyond its California headquarters and into other states.

“Our team is proud to celebrate this achievement with SmartAsset,” said Joe Anderson, CEO & President of Pure*. “We have seen a remarkable return on investment and comparatively low client acquisition costs even as we’ve multiplied our spend over the years.”

But Anderson and team are not treating the celebration as an opportunity to rest. SmartAsset leads continue to add fuel to the fire, with another several hundred million dollars already in Pure’s pipeline. Pure is one of SmartAsset’s fastest-growing partners, thanks in part to the team’s diligence on the platform and beyond.

“Generating over $1 billion in new AUM – approximately 1,000 new clients – is a clear indication of the quality of Pure’s value proposition and also our ability to drive and scale organic growth for our wealth management partners,” said Michael Carvin, founder and CEO of SmartAsset. “Pure’s performance demonstrates that aggressive, double-digit organic growth rates are achievable in wealth management with dramatically better capital efficiency than M&A. Last year, our partner firms closed an estimated $34 billion in new AUM.** Wealth management firms with a good consumer offering, ready to commit to best practice, can exceed their growth ambitions.”

Anderson, in turn, plans to continue expanding Pure’s business with SmartAsset’s help. “We are notably more confident in our expansion plans in adding new advisors and entering new markets, as we’ve done in Seattle, Chicago and Sacramento, knowing we have a reliable partner like SmartAsset to support such growth efforts.”

Those plans include continuing to accelerate growth with SmartAsset’s new Advisor Marketing Platform (AMP), which helps RIAs further grow their AUM via validated investor referrals paired with automated nurture tools.

Designed to target a specific number of new clients per year, AMP is available in three tiers, Discover, Accelerate, and Scale. For larger firms, custom packages are available. By providing advisors with the leads and tools to accelerate growth and scale, SmartAsset aims to continue pushing firms to reach the $1 billion mark and beyond.

Watch or read the full interview between Michael Carvin, SmartAsset CEO and Joe Anderson, CEO and President of Pure Financial.

*Pure Financial Advisors, LLC is an actual SmartAsset client since 2019. Statements are individual experiences reflecting the real-life experiences of those who have used our services. The testimonials are not 100% representative of all of those who use our products and/or services, and we make no admissions of such. Additionally, they have not been paid for their insights.

**The estimated AUM closed by advisors from SmartAsset referrals is based on the number of matches made between validated investors reporting over $25K in investible assets and advisors in 2023. Further, the calculation assumes: a 4% close rate (based on data collected from partners and industry benchmarks) and an average amount of assets per household of $996K, that was calculated from self-reported asset ranges in the advisor matching survey. The Calculation is: Valid*Matches*Average Assets Per Household*4% Conversion Rate.