A financial plan template helps advisors organize their clients’ financial goals, assets and strategies on a single page, making complex planning more accessible. By summarizing a client’s income, net worth, asset allocation and other elements of a financial plan, a one-page format provides a structured yet flexible approach to managing finances. It can also serve as a reference for ongoing financial decisions, allowing clients to adjust their plans as circumstances change. Whether used independently or as part of a broader advisory process, a well-structured financial plan template offers a clear snapshot of a client’s financial position and long-term objectives.

Are you looking to expand the marketing of your financial advisor practice? Try SmartAsset AMP, a holistic client prospecting and marketing automation platform.

Components of a One-Page Financial Plan Template

Financial planning templates are a helpful tool, as you can simply swap out the information from one client to the next. If you’re interested in putting together a one-page financial plan template for use in your practice, here are some of the most important sections you may want to include:

1. Client Values

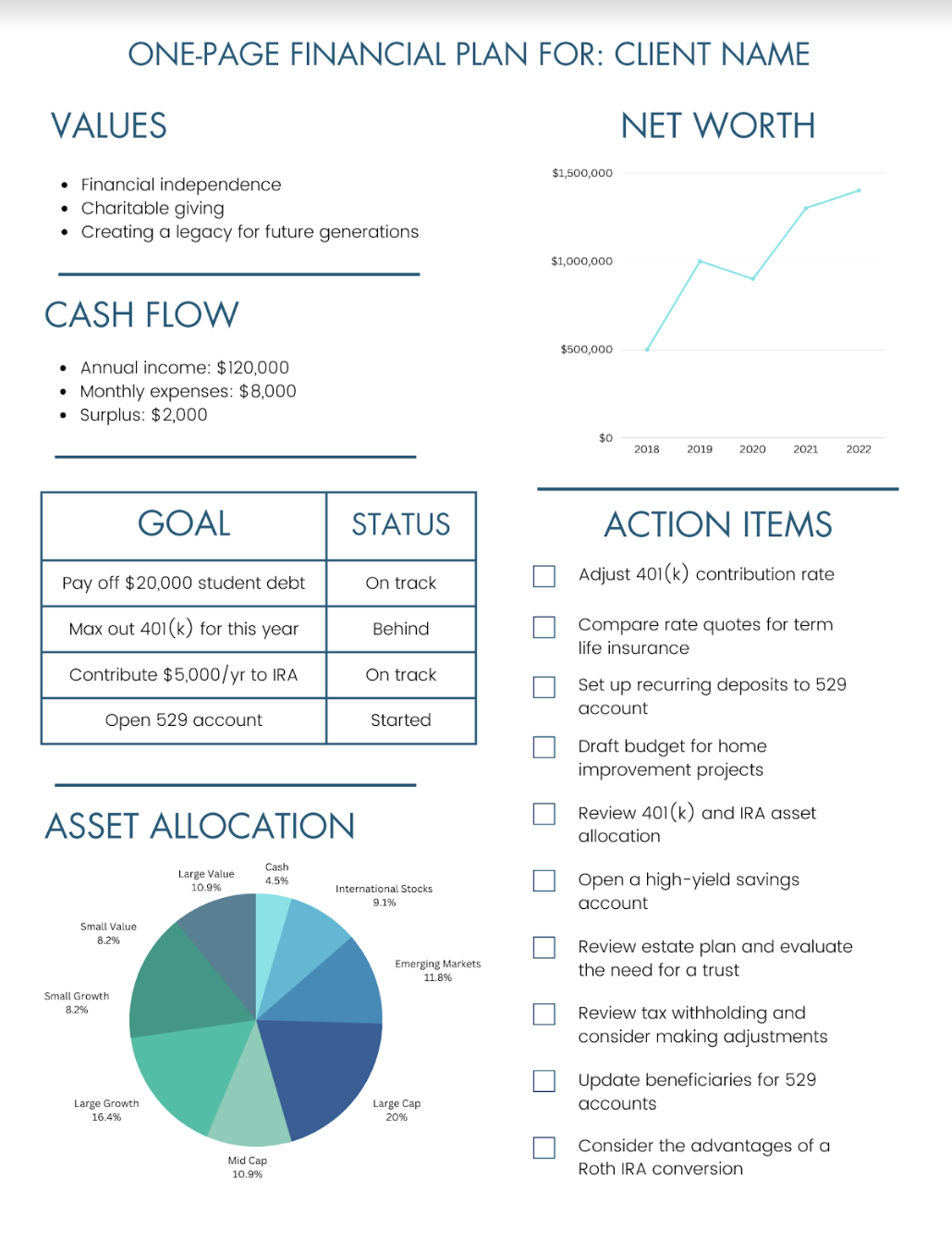

This is optional, but it may be helpful to include a section at the top of your template specifying your client’s top three most important values. Understanding what your client values most can be instrumental in shaping a financial plan that prioritizes what’s most important to them.

2. Net Worth

Including a graph or chart that shows how your client’s net worth is trending over time is a simple way to indicate to them how they’re doing financially. Depending on how often you update your clients’ financial plans, you may track net worth data monthly, quarterly or annually.

3. Current Cash Flow

Here, you can offer a brief overview of your client’s current cash flow. For example, you might include a bulleted list or pie chart showing their annual income, monthly income and monthly expenses. You could also include a line showing how much they have in surplus funds each month and where that money is allocated.

4. Goals

This section should briefly list your client’s main goals and where they are in terms of reaching them. You don’t need to get too detailed here; you can simply specify whether they’re on track or behind, or whether that goal has been started or completed.

5. Action Items

This section should be the most detailed, in terms of specific next steps your client should be taking to execute their financial plan. You can add this as one long list of items or separate them into current tasks that need to be completed in the short term and tasks that can or will be finalized at a future date.

6. Asset Allocation

In this section, you can use a chart to show a visual breakdown of how your client’s assets are allocated. You may also add a separate section illustrating where those assets are held. For example, that might include a 401(k), a traditional IRA and a taxable brokerage account.

While one-page financial plans can be valuable tools for serving existing clients, increasing your firm’s assets under management requires finding new clients. For that, you may want to find an online lead generation service.

SmartAsset Advisor Marketing Platform (AMP) is a subscription-based service that helps advisors automate their lead generation and marketing efforts. With AMP, you receive client referrals, CRM integrations, account management and the ability to create automated marketing campaigns.

The service even allows you to make live connections with validated leads through conversations facilitated by a SmartAsset representative. During these phone conversations, you can pitch the idea of streamlined financial management and outline your approach to financial planning.

Client Acquisition Simplified: For RIAs

- Ideal for RIAs looking to scale.

- Validated referrals to help build your pipeline efficiently.

- Save time + optimize your close rate with high-touch, pre-built campaigns.

CFP®, CEO

Joe Anderson

Pure Financial Advisors

We have seen a remarkable return on investment and comparatively low client acquisition costs even as we’ve multiplied our spend over the years.

Pure Financial Advisors reports $1B in new AUM from SmartAsset investor referrals.

Tools for Creating One-Page Financial Templates

Financial advisors have access to various software tools that streamline the creation of one-page financial plans, helping clients visualize their financial goals efficiently.

- RightCapital: This software provides a customizable financial plan template that integrates cash flow projections, tax planning and risk assessments. It offers a snapshot of key financial metrics while allowing advisors to tailor recommendations to client needs.

- eMoney Advisor: Known for its robust planning features, eMoney allows advisors to generate simplified financial summaries alongside in-depth analysis. Its interactive client portal enhances engagement, making financial plans more dynamic.

- MoneyGuidePro: This goal-based planning software enables advisors to create concise, client-friendly financial roadmaps. Advisors can use the plan summary feature to show clients what it will take to put their financial plan into action, as well as identify any potential gaps that exist in it.

- PreciseFP: Focused on streamlining data collection, PreciseFP offers templates that advisors can modify to build personalized one-page financial plans. It integrates with major CRM systems, ensuring seamless client management.

- Asset-Map: With a strong emphasis on visualization, Asset-Map produces intuitive, high-level financial summaries. Advisors can present financial plans as easy-to-read diagrams, making it simple for clients to grasp complex information.

Exceed Client Expectations

Attract HNW clients that fit your firm. Get the all-in-one advisor marketing platform.

Tips for Creating a One-Page Financial Plan

If you’ve already created a comprehensive financial plan for your clients, then filling out a template may simply be a matter of plugging in the necessary information. But there’s some additional work you may need to do beforehand to ensure that the plan you’re creating accurately reflects your clients’ needs. As you create a one-page financial plan template, here are some best practices to keep in mind.

1. Think Like Your Client

The best financial plans, one page or otherwise, are tailored to the needs and values of each client. Understanding what your clients value and what they hope to accomplish can help you narrow down what kind of actionable items to include on a one-page financial plan.

2. Keep it Simple

The one-page financial plan is not the place to use a lot of industry jargon or technical terms. Remember, this document is meant to provide clients with an at-a-glance look at their overall financial health. Here’s a simple rule to follow: If anything that you’ve included in your one-page financial plan template would take more than five minutes to explain, you’re probably overcomplicating it.

3. Incorporate Graphics

Since you’re working with a one-page document, space is at a premium. You can make your financial plan template more visually appealing by adding charts, graphs, tables or bulleted lists where appropriate. That can make it easier for clients to consume the information you’re providing while ensuring that you’re working on the most important points.

4. Review and Update as Needed

Just as your clients’ needs and goals may change, their financial plans will need to be updated as well. Creating a one-page financial plan isn’t something you can or should do just once. Reviewing plans annually can allow clients to track their progress while giving you an opportunity to make adjustments as needed to ensure that you’re still aligned with their values.

Background on One-Page Financial Plans

The one-page financial plan is a concept that was developed by New York Times contributor Carl Richards. In his 2016 book, “The One-Page Financial Plan,” Richards argues that financial planners can better serve their clients by summarizing key information into a one-page breakdown, rather than inundating them with unnecessary jargon or overly detailed reports.

A one-page financial plan is meant to provide clients with a snapshot of their goals and the steps they’ll take to reach them. If you’ve created a more in-depth financial plan for your clients, you could think of the one-page plan as the Cliff Notes version.

Creating a one-page financial plan can benefit both you and your clients in different ways. On the client side, a one-page plan may be less overwhelming to read through compared to a multi-page report. They can see all of the most important aspects of their plan on a single page, and which action steps they’ll need to take next.

Frequently Asked Questions (FAQs)

How is a one-page financial plan different from a traditional financial plan?

A one-page financial plan summarizes key information such as goals, net worth, cash flow and action items in a concise format, while a traditional financial plan typically includes more detailed projections, analyses and supporting documentation. Many advisors use the one-page version as a high-level overview that complements a more comprehensive plan.

How often should a one-page financial plan be updated?

Most advisors review and update one-page financial plans at least annually, or whenever a client experiences a significant life or financial change. Regular updates help keep goals, priorities and action items aligned with current circumstances.

Can a one-page financial plan replace full financial planning software?

A one-page financial plan is best viewed as a communication and organization tool rather than a replacement for full planning software. Comprehensive platforms are still useful for detailed modeling and analysis, while the one-page format provides a clear snapshot clients can easily understand and reference.

Bottom Line

The one-page financial plan strategy might appeal to you and your clients if you’re hoping to simplify the way you deliver advice. Having the right information as a guide can help you create an effective one-page financial plan template for your clients. This can be a game-changing step to take in order to fully prepare for your clients’ needs.

Tips for Growing Your Advisory Business

- SmartAsset AMP (Advisor Marketing Platform) is a holistic marketing service financial advisors can use for client lead generation and automated marketing. Sign up for a free demo to explore how SmartAsset AMP can help you expand your practice’s marketing operation. Get started today.

- Are you struggling with how to effectively market your business? Creating social media content that gets attention is key to a successful digital marketing strategy. Researching where your target client base tends to spend time online and the kinds of techniques your competitors are utilizing can help you develop a marketing plan that gets attention.

Photo credit: ©iStock.com/Pekic, ©Rebecca Lake, ©iStock.com/Jacob Wackerhausen, ©iStock.com/Jacob Wackerhausen