Social media is one of the most powerful marketing tools, and allows financial advisors to connect with their target audience, build a loyal following and get prospects into their sales funnel. A good social media strategy revolves around creating compelling content and engaging with your audience consistently. That’s where a social media calendar for financial advisors comes in.

Ready to grow your client base? SmartAsset AMP helps you connect with leads.

Why Financial Advisors Need a Social Media Calendar

When you’re trying to gain a foothold with social media marketing, a haphazard approach just doesn’t cut it. Creating a content calendar can help you to:

- Post consistently and get your followers in the habit of anticipating your updates

- Determine the best times of day to post content to various social media platforms

- Plan content ahead to account for holidays and special dates that are likely to be of interest to your followers, such as tax filing deadlines or the annual FAFSA deadline (if your client base includes the parents of college-bound children)

- Build buzz surrounding special events, such as a seminar you’re leading or a workshop you’re participating in

- Keep track of what you’re posting or reposting across different social media platforms and how much engagement that content receives

In short, a social media calendar is an organizational tool that’s fairly simple to create. But it can have a substantial impact on your marketing efforts.

Client Acquisition Simplified: For RIAs

- Ideal for RIAs looking to scale.

- Validated referrals to help build your pipeline efficiently.

- Save time + optimize your close rate with high-touch, pre-built campaigns.

CFP®, CEO

Joe Anderson

Pure Financial Advisors

We have seen a remarkable return on investment and comparatively low client acquisition costs even as we’ve multiplied our spend over the years.

Pure Financial Advisors reports $1B in new AUM from SmartAsset investor referrals.

What to Include in a Social Media Calendar for Financial Advisors

You should customize your social media calendar to your firm’s needs. But generally speaking, your calendar should tell you at a glance:

- Type of content being posted (e.g., photos, videos, etc.)

- Content topic

- Which platform or platforms it’s posted on

- The date and time the post will go out

- Hashtags or descriptors

You can create a weekly or monthly calendar, depending on how far out you want to track social media posts.

There are several ways to create a social media calendar for your advisory business. The options include:

- Creating your schedule with a regular paper calendar or datebook

- Using a spreadsheet to track your social media content

- Creating a digital calendar using a tool like Canva or Goodnotes

- Utilizing a social media calendar app or tool

When choosing a method, consider how accessible you need your calendar to be. If you have multiple team members who need to be able to view the calendar, then it could make more sense to use a collaborative digital tool versus a physical paper calendar.

Outsource Your RIA Marketing

Automate your marketing with a proven system. Automated outreach, nurture campaigns and more.

Social Media Calendar for Financial Advisors Template

Having a template to use as a guide can help you shape your social media content calendar in less time. If you’re using a digital template, you can easily duplicate the template to update it for each new week or month.

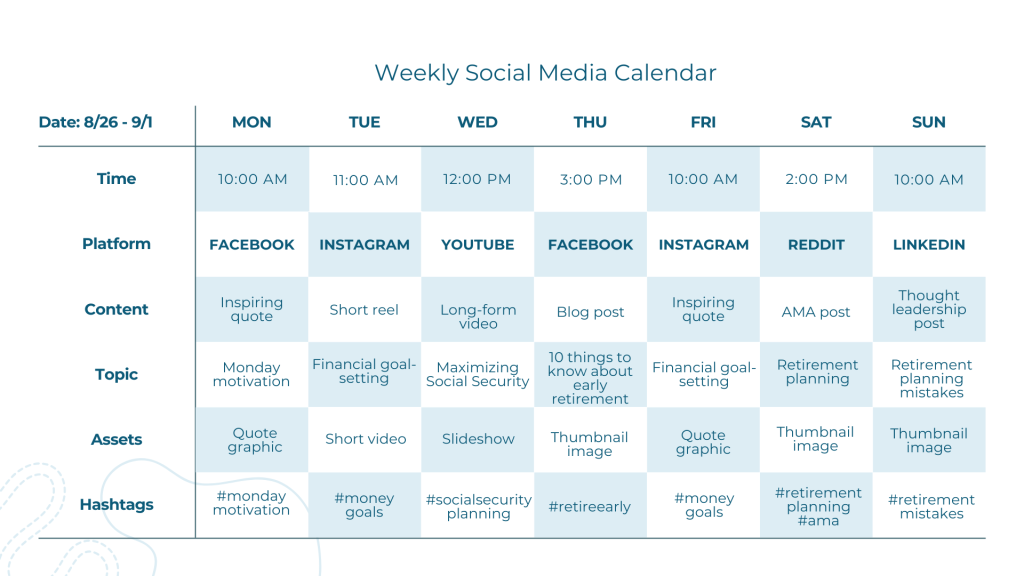

Here’s an example of one way you could visualize your social media calendar using a weekly posting format:

As you can see, there’s room to record your social media content for the week, including the time you’ll post, where the content is going, what type of content you’re sharing and any relevant details.

Again, this doesn’t have to be complicated. The goal is to simply create an easy-to-follow format for tracking your social media content.

Social Media Content Ideas for Financial Advisors

Creating a social media calendar can go a long way in helping you get organized, but you need something to put on it. If you’re stuck for ideas on how to promote your advisory business, here are some types of social media content you can consider:

- Share your favorite personal finance tip and why you think it’s something your followers should know.

- Tell a personal story of a money mistake you once made and how you help your clients to ensure they don’t fall into the same trap.

- Share an inspiring or motivational money quote to get your followers excited about their financial situation.

- Highlight a client success story or case study that demonstrates how you helped them reach their goals.

- Share your thoughts on a trending finance topic and what you think your clients should know about it. For example, you might dive into what’s happening with interest rates or break down TikTok money trends like underconsumption core.

- Start a Q&A or AMA (ask me anything) thread and invite your followers to ask you questions about a specific topic or financial planning in general.

- Share a news article that you found helpful or interesting and ask your followers to share their thoughts in the comments.

- Provide followers with timely updates that can impact them directly, such as changes to the tax code or rate hikes/cuts.

- Boost engagement by posting a poll or survey and asking followers to share their responses.

- Share content on the same topic in different formats across platforms. For example, you might share a blog post on Facebook, make a reel about it for Instagram, and create a longer form video for YouTube.

- Share a list of your favorite personal finance books, blogs or podcasts, and ask your followers what’s on their reading, watching and listening lists.

- Take time to shine a spotlight on one of your employees and the valuable contributions they make in serving clients.

Those are just a few ideas you could use to connect with your followers. The best social media content strategy focuses on creating content that’s relevant to your audience and that’s designed to engage or inspire them in some way.

And don’t forget to include a call to action in your posts so your followers know what to do next. For example, if you’re trying to grow your email list, you might share a blurb about your lead magnet and a CTA that tells your readers how and where to download it.

Frequently Asked Questions (FAQs)

Do Financial Advisors Need a Social Media Calendar?

Financial advisors don’t need a social media calendar, but there are some benefits to having one. A calendar makes it easier to track social media content, including when and where it’s posted, and the topic covered. If you tend to repurpose or repost content, a calendar can help you ensure that you’re spacing out posts appropriately.

What’s the Best Social Media Calendar Tool for Financial Advisors?

There’s no one social media calendar tool that’s better than another. Some advisors may prefer an old-school pen and paper method, while others look to digital calendar tools to do the job. It’s more important to choose a method for tracking social media content that works for you.

What Do Financial Advisors Need to Know About Social Media Compliance?

Compliance is an important consideration for financial advisors. The SEC’s marketing rule restricts the kinds of statements advisors can make when marketing their firms. There are also rules regarding the use of client testimonials to promote your firm. Familiarizing yourself with compliance requirements for social media can help you avoid potential violations of SEC guidelines.

Bottom Line

A good marketing plan includes social media, and a calendar can help you stay on top of your content. The template included here is just one example of how you might create a social media calendar to track your firm’s posts.

Tips for Growing Your Advisory Business

- Marketing is essential for growth. After all, you can’t rely on word of mouth and referrals alone. If you’re struggling to be consistent or want to streamline your efforts, you may consider partnering with an advisor marketing platform. SmartAsset AMP uses a holistic approach to help you match with leads. Schedule a demo to learn how it can help you grow your business.

- Which social media channels make the most sense for marketing? The answer can depend largely on how well you know your target client base. Facebook, YouTube, Instagram and TikTok are some of the most popular social media channels. However, some are more heavily favored among certain demographics than others. Understanding who your ideal client is and where they spend time online can help you pinpoint which channels it makes the most sense to be active on.

Photo credit: ©iStock/VioletaStoimenova, ©Rebecca Lake, ©iStock/David Gyung, ©iStock/VioletaStoimenova