In 2018, the median monthly rent for a studio was $891 while the median rent for a one-bedroom rental was $911. This means that the average renter living alone in America spends upwards of $10,600 every year on rent, even when living in a studio. While that annual rent is high and unaffordable for many individuals, rent prices and cost of living are lower in some cities than others, making living alone a more attainable reality.

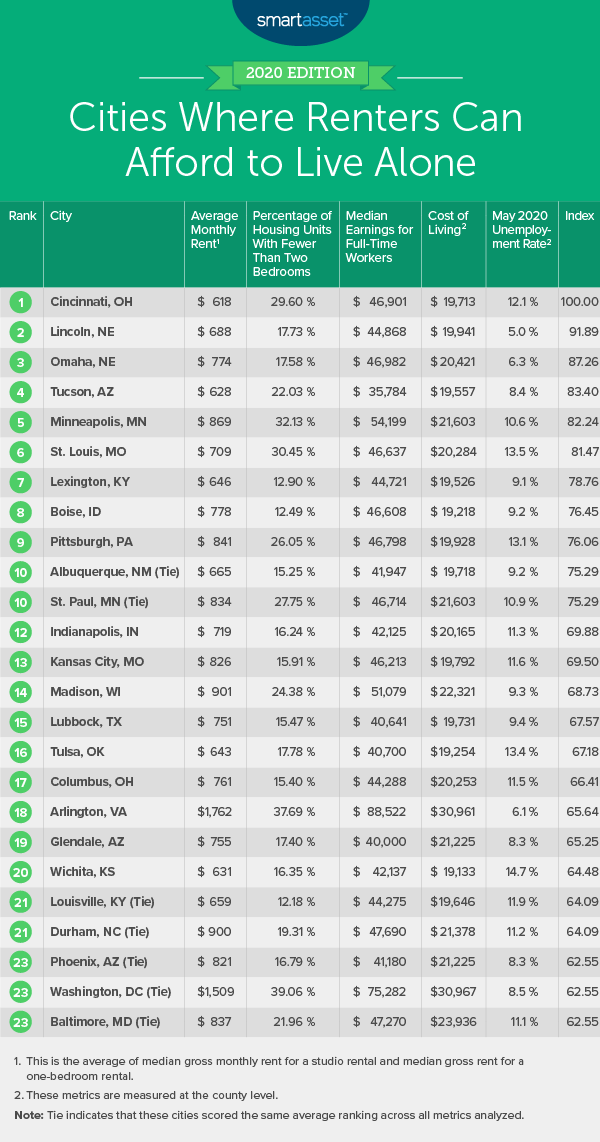

In this study, SmartAsset looked at the cities where renters can most easily afford to live alone. We compared the 100 largest U.S. cities across five metrics: average rent for a unit with fewer than two bedrooms, percentage of housing units with fewer than two bedrooms, median earnings for full-time workers, cost of living and unemployment rate. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s third annual study on the cities where renters can afford to live alone. Check out the 2019 version here.

Key Findings

- Cincinnati, Ohio takes the top spot for the third year in a row. Cincinnati, Ohio has ranked as the best city where renters can afford to live alone for all three years SmartAsset has produced this study. Though the average monthly rent for a unit with fewer than two bedrooms increased slightly (about $50) between last year and this year, the city still ranks within the best fifth of cities for that metric and two others – percentage of housing units with fewer than two bedrooms (29.60%) and cost of living ($19,713).

- Renting an apartment alone in California may be difficult. Six of the 10 cities where it is most difficult for renters to live alone are located in the Golden State. They are Santa Ana, Chula Vista, Riverside, Anaheim, Fremont and Los Angeles. San Francisco – one of the state’s five largest cities – ranks towards the middle of our study (at No. 45) due to its high percentage of housing units with fewer than two bedrooms (39.24%) and high median earnings for full-time workers ($90,030).

1. Cincinnati, OH

Many affordable studios and one-bedroom housing units are available in Cincinnati, Ohio. Census Bureau data from 2018 shows that close to 30% of occupied housing units in Cincinnati are studios or one-bedrooms. Additionally, the average rent for a unit with fewer than two bedrooms is $618, the sixth-lowest in our study.

Cincinnati also offers renters living alone low living costs and favorable employment conditions. The estimated annual cost of living is about $19,700, the 13th-lowest in our study. Meanwhile, the city has the 36th-highest median earnings for full-time workers ($46,901) and the 40th-lowest May 2020 unemployment rate (12.1%).

2. Lincoln, NE

Unemployment has spiked during COVID-19, but jobs in Lincoln, Nebraska seem to be more protected than those in other areas. In Lancaster County, of which Lincoln is the county seat, the May 2020 unemployment rate was 5.0% – the lowest in our study. Lincoln also ranks well in terms of the two metrics measuring affordability: average rent for a unit with fewer than two bedrooms and cost of living. More specifically, we found that the average rent for a studio or one-bedroom is less than $700 and a single adult with no children spends about $19,900 annually.

3. Omaha, NE

Lincoln’s neighboring city, Omaha, Nebraska, also has a low May 2020 unemployment rate, at 6.3%. By contrast, the average national unemployment rate during that month was more than 13%. Across the other four metrics we examined, Omaha ranks particularly well for its low average rent for a housing unit with fewer than two bedrooms ($774) and low estimated cost of living ($20,421).

4. Tucson, AZ

Holding the No. 4 spot, Tucson, Arizona ranks in the best 10 of all 100 cities in our study for three metrics: average rent for a unit with fewer than two bedrooms ($628), annual cost of living (roughly $19,600) and May 2020 unemployment rate (8.4%). Tucson falls the farthest behind our top three cities where renters can afford to live alone in terms of median earnings for full-time workers. Census Bureau data shows that the average Tucson worker earned less than $35,800 in 2018.

5. Minneapolis, MN

Minneapolis, Minnesota ranks in the top fourth of the study for three of the five metrics we considered. It has the 11th-highest percentage of housing units with less than two bedrooms (32.13%), 21st-highest median earnings for full-time workers ($54,199) and 20th-lowest May 2020 unemployment rate (10.6%).

Renters living alone in Minneapolis may need to be more wary of additional living costs besides housing. The estimated annual cost of living in Minneapolis is more than $21,600. Check out our cost of living calculator to see how other cities compares.

6. St. Louis, MO

Many small housing units for renters hoping to live alone are available in St. Louis, Missouri. In 2018, more than 30% of occupied units were either studios or one-bedrooms. Additionally, the average rent on those units is relatively low, at $709 per month.

If you live in St. Louis already but are hoping for help managing your finances, check out our list of the top 10 financial advisors in the area.

7. Lexington, KY

Lexington, Kentucky ranks in the top fifth of all 100 cities in the study for three of the five metrics we considered. It has the 12th-lowest average rent for a unit with fewer than two bedrooms (less than $650 per month), ninth-lowest cost of living (about $19,500) and 13th-lowest May 2020 unemployment rate (9.1%).

8. Boise, ID

Boise, Idaho has the lowest estimated cost of living of any city in our top 11 and the fifth-lowest overall. According to data from the MIT Living Wage Calculator, the average adult in Boise only spends about $19,200 annually on food, housing, transportation, medical and other expenses. Beyond being able to enjoy low cost of living, an individual in Boise may be able to afford rent alone since earnings are relatively high. Census Bureau data from 2018 shows that the average full-time worker makes more than $46,600, a top-40 rate.

9. Pittsburgh, PA

High earnings for full-time workers and a low cost of living in Pittsburgh, Pennsylvania indicate that the city may be a great place for renters to live alone. In 2018, the median earnings for full-time workers in Pittsburgh was almost $46,800. With the estimated annual cost of living for an adult around $19,900, a resident living alone could expect to save a large portion of earnings for other financial goals, such as saving for a house or retirement.

10. Albuquerque, NM (Tie)

Albuquerque, New Mexico ties for the 10th-best city where the average renter can afford to live alone. Albuquerque has the 16th-lowest average rent for a unit with fewer than two bedrooms as well as the 14th-lowest cost of living in the study. Additionally, the May 2020 unemployment figure in Bernalillo County was 9.2%, the 14th-lowest in our study.

10. St. Paul, MN (Tie)

St. Paul, Minnesota ranks in the best fourth of all 100 cities in the study for two metrics – percentage of housing units with fewer than two bedrooms (27.75%) and May 2020 unemployment rate (10.9%). The city also ranks within the top half of the study for two of the remaining three metrics. It falls the farthest behind in terms of the area’s cost of living. Annual living costs amount to more than $21,600 for the average adult with no children, which is the 44th-highest of all 100 cities.

Data and Methodology

To find the cities where renters can afford to live alone, SmartAsset looked at data on the 100 largest U.S. cities. We compared them across five metrics:

- Average rent for a unit with fewer than two bedrooms. This is the average of median gross monthly rent for a studio and median gross rent for a one-bedroom rental. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Percentage of housing units with fewer than two bedrooms. This is the percentage of occupied housing units that are either studio or one-bedroom apartments or homes. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Median earnings for full-time workers. Data comes from the Census Bureau’s 2018 1-year American Community Survey.

- Cost of living. Data comes from the MIT Living Wage Calculator and is from February 2020. This metric is measured at the county level.

- May 2020 unemployment rate. Data comes from the Bureau of Labor Statistics and is measured at the county level.

We ranked each city in every metric and found each city’s average ranking, with each metric receiving an equal weight. Using this average ranking, we created our final score. The city with the best average ranking received a score of 100 while the city with the worst average ranking received a score of 0.

Tips for Maximizing Your Savings

- To rent or to buy? Understand whether continuing to rent is the right choice for you using SmartAsset’s rent vs. buy calculator. No matter your homeownership status, it might be useful to learn about the ways that the recent Coronavirus Aid, Relief and Economic Stability (CARES) Act passed by the government directly and indirectly protects homeowners and renters.

- Consulting an expert could save you time and money in the long run. If you are looking for guidance and are able to do so, it might be useful to seek the advice of an expert advisor. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/StefaNikolic