Before 2020, you could adjust the number of allowances on your W-4 to change how much federal income tax was withheld from each paycheck. The right number of allowances depended on your situation, but since allowances were removed from the W-4, the form is now simpler to complete.

A financial advisor can help you optimize a tax strategy that fits your budget.

What You Should Know About Tax Withholding

Whenever you get paid, your employer removes, or withholds, a certain amount of money from your paycheck. This withholding covers your taxes so that instead of paying one lump sum during tax season, you pay them gradually throughout the year. Employers in every state must withhold money for federal income taxes. Some states, cities, and other municipal governments also require income tax withholding.

Pay-as-you-go taxes also apply to pension income and other earnings such as gambling winnings, bonuses or commissions. If you’re a business owner, independent contractor or otherwise self-employed, you’ll need to set aside money for taxes yourself and generally make quarterly estimated tax payments to cover what you owe.

Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works, or if you have multiple jobs. You can also list deductions and other withholdings.

When you fill out your W-4, you are telling your employer how much to withhold from your pay. That’s why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child.

What Were Tax Allowances?

A withholding allowance was like an exemption from having a certain amount of income tax kept back from your pay. So if you claimed an allowance, you would essentially be telling your employer (and the government) that you qualified to have less taxes withheld.. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible.

If you didn’t claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If you claimed too many allowances, you probably ended up owing the IRS money.

How Did You Determine How Many Allowances You Should Claim?

Allowances are no longer in effect on the current W-4 form, but when they were, the allowances were completely subjective. Many people would take an allowance for every single person that they were responsible for financially. So if you had yourself, a spouse and two children, you may claim four allowances.

Ultimately, the number of allowances depended on your tax strategy and whether you needed to take more tax out of your check or you needed more monthly income. It was a very personal choice with no exact answer.

How Do I Affect Withholding Now?

In 2020, the IRS redesigned the W-4 and removed the allowance system. Although the change was intended to simplify the form, many filers find the new version more complex, and it now relies on different inputs to determine how much tax is withheld from each paycheck.

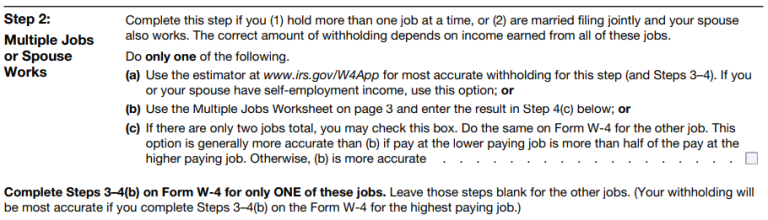

First, it’s important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 to properly estimate your annual household income.

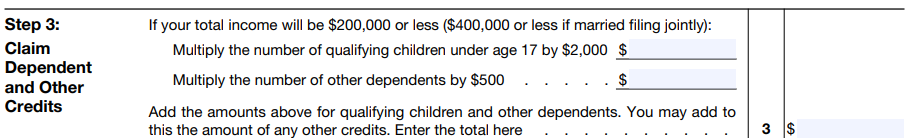

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

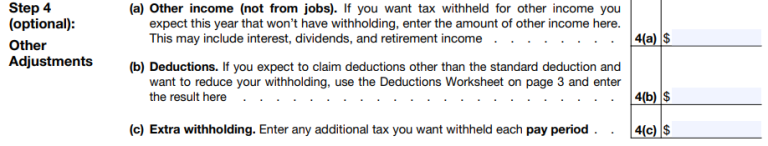

Finally, Section 4 of the W-4 is a bit more indefinite. Here you’ll be able to state other income and list your deductions, which can help reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your expected deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax planning.

Claiming an Exemption From Withholding

If the IRS refunded you last year for all of the federal income tax that was withheld, and if you expect that to happen again this year, you can claim an exemption from withholding. Generally, you can claim exemption from federal tax withholdings if both of the following are true:

- You had no tax liability in the previous tax year

- You expect to have no tax liability in the current tax year

Keep in mind that this exemption only applies to federal income tax. You still need to pay the FICA taxes for Social Security and Medicare.

Fine-Tuning Your Withholdings

You can claim deductions and extra withholding as you so desire. Taking an estimated or inaccurate amount would mean you overpay or underpay your taxes, but you can do it. You may want to claim different amounts to change the size of your paychecks. This is a personal choice that helps you plan your budget throughout the year.

At the same time, you can submit a new W-4 at any time during the year. So if you decide that you want larger or smaller paychecks, you can submit a new W-4 to your employer with a different number of deductions or withholdings.

When to Update Your W-4

Filing a W-4 isn’t a one-time event. Certain life changes and financial decisions can significantly impact your tax liability and paycheck. To keep your withholding accurate, consider updating your W-4 when any of the following events occur:

- Marriage or divorce

- Having or adopting a child

- A spouse starting or leaving a job

- Starting a second job or side income

- A significant change in income or bonuses

Buying a home and becoming eligible for itemized deductions - No longer being eligible to claim a dependent

Updating your W-4 after any of these changes can help avoid under- or over-withholding. This can reduce the risk of owing money to the IRS. You can submit a new W-4 to your employer at any time, and it usually takes effect within a few pay periods.

How Tax Law Changes Affect Withholding in 2026

Federal tax law changes that begin in 2025 can affect how much tax your employer withholds from your paycheck. Withholding is tied to your expected taxable income, so updates to tax brackets, deductions, and credits can change the amount withheld, even if your income does not change.

Several provisions in the One Big Beautiful Bill Act begin in 2025 and can reduce taxable income. These include the new senior bonus deduction of up to $6,000 per filer age 65 or older with income below $75,000 for single filers or $150,000 for joint filers. The deduction applies from 2025 through 2028 and can be claimed whether you itemize or take the standard deduction. If you qualify for this deduction and do not update your W-4, your employer may withhold more tax than needed.

Standard deductions also increase in 2025 under the act. For example, the standard deduction rises to $16,100 for single filers, $32,200 for married couples filing jointly and $24,150 for heads of household. In addition, the TCJA brackets of 10%, 12%, 22%, 24%, 32%, 35% and 37% remain in place for 2026 and future years, with thresholds adjusted for inflation. These updates can change your withholding once they take effect.

Because withholding now reflects dependents, multiple jobs and expected deductions rather than allowances, reviewing your W-4 after the 2025 and 2026 rule changes can help keep your paycheck and tax bill aligned. The IRS withholding estimator or a tax professional can help you calculate the amount to withhold if your situation becomes more complex.

Bottom Line

Tax allowances were an important part of helping people manage their personal finances. While they don’t exist on the W-4 anymore, claiming additional withholding or deductions can still help provide a bigger paycheck. If you’re concerned about the amount your employer withholds, you can also refer to the withholding calculator provided by the IRS or update your W-4 at any time.

Tax Filing Tips

- Some financial advisors are tax experts and can help you understand how taxes impact your financial plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- You’ll save time if you gather and organize all the supporting documents required to file your taxes. This means your W-2 or 1099s, student loan interest information, and a slew of other documents, depending on your financial situation. You might also use our tax calculator to get an estimate of what you’ll pay in income taxes.

Photo credit: ©iStock.com/vgajic, ©iStock.com/nandyphotos, IRS W-4 screenshots, ©iStock.com/Steve Debenport