The best way to prepare for retirement is to get a head start by saving early and often, letting your 401(k) accrue interest as you head toward your golden years. But even the best-laid plans may go awry, and sometimes it’s difficult to save for retirement. This can leave seniors relying on Social Security to make ends meet during their retirement.

In order to find the places where retirees rely on Social Security the most, we looked at data for 100 cities across two metrics. We looked at data on average household retirement income for senior households (households aged 65 or over) and average Social Security income for senior households.

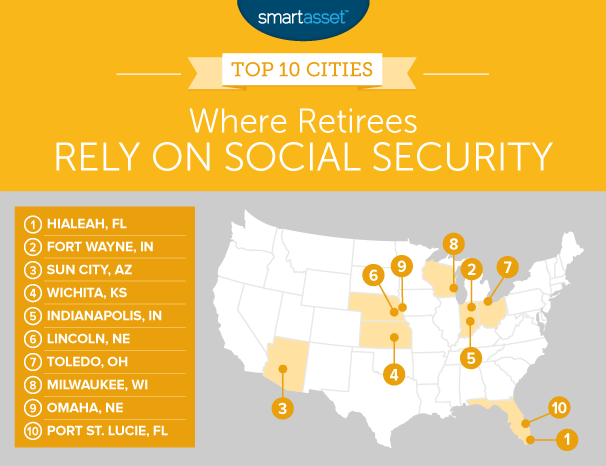

Key Findings

- Midwest cities at the top – Seven of our top 10 cities where retirees are most reliant on Social Security are in the Midwest. One benefit for seniors living in the Midwest is the relatively low cost of living.

- Expensive cities at the bottom – One pattern that emerges from our data is that retirees who live in cities with high costs of living tend to have larger retirement incomes. For example the seniors who rely the least on Social Security live in cities like Washington, D.C, San Diego and Boston, which rank 100th, 91st and 90th respectively.

- Small differences – Reliance on Social Security among the cities in our top 10 runs from 54% of retirement income to 48%. From the top-ranking city, Hialeah, to no. 99, Sacramento, the difference is only 21 percentage points.

1. Hialeah, Florida

Hialeah has 46,000 residents aged 65 or over, the 53rd-most in the country. In general, these residents tend to rely on Social Security payments to make ends meet.

According to data from the Census, the average retirement income in Hialeah is only $11,311 for senior households. At the same time the average senior household takes in $13,300 in Social Security. That means Social Security makes up 54% of combined retirement and Social Security income, the most in our study.

2. Fort Wayne, Indiana

Fort Wayne is a college town with about 34,100 seniors. Census data shows that the average senior household here does not have a ton of retirement income, only $18,400 on average. And the average over-65 household takes in $20,800 in Social Security. This leaves Social Security making up a majority of the retiree budget in Fort Wayne.

3. Sun City, Arizona

Sun City is “an entire community dedicated to leisure and recreation for active, retired adult”, according to the city’s website. Our data suggests that in order to have fun in Sun City, seniors tend to rely on their Social Security income.

According to our data, the average Sun City senior household has about $41,500 in total retirement income, split evenly between Social Security and independent retirement income.

4. Wichita, Kansas

Wichita takes fourth. This is the first city in this list where independent retirement income is greater than Social Security income. The average 65-or-over household has about $20,400 in retirement income and $20,300 in Social Security income.

The good news for residents is that the cost of living in Wichita is relatively low. Census data shows that only 28% of seniors in Wichita are housing cost-burdened.

5. Indianapolis, Indiana

Indiana’s capital takes fifth. There are about 94,000 seniors in Circle City, giving it the 13th-most seniors in the country. Combining retirement income and Social Security income, Census Bureau data shows that the average senior household in Indy has about $39,000 in total retirement income. Social Security makes up $19,400 of that total or 49.85%.

6. Lincoln, Nebraska

The first of two Nebraska cities in this top 10 is Lincoln, Nebraska’s capital. Seniors in this city have the second-most total retirement income in our top 10 at $42,500. A large chunk of that retirement income, however, comes from Social Security. The average Lincoln senior household takes in $21,000 in Social Security.

7. Toledo, Ohio

There are 37,700 seniors in Toledo, a large portion of whom rely on Social Security. According to our data, the average senior household takes in just under $36,000 per year, 49% of which comes from Social Security.

The good news is that cost of living in Toledo is low and seniors don’t seem to struggle too much paying for housing. Only 32% of seniors are housing cost-burdened, a better-than-average rate.

8. Milwaukee, Wisconsin

There is not much separating Milwaukee from other cities in this top 10. Our data shows that Social Security income makes up 48.9% of total retirement income for the average senior household in Milwaukee, less than 1% below the cities ranked above it. In total Census Bureau data shows the average senior household has a combined retirement income of $36,500, $17,800 of which comes from Social Security.

9. Omaha, Nebraska

Omaha takes ninth. The average senior household in this city takes in a combined $41,900 in total retirement income. Social Security makes up $20,400 of that, or 48.7%.

One promising statistic for Omaha retirees is their homeownership rate. Data from the Census Bureau shows that 75% of over-65 households own their home and only 34% of those households are housing cost-burdened.

10. Port St. Lucie, Florida

On average, Port St. Lucie seniors take in a combined $43,200 in total retirement income, the most in our top 10. Of that income, $22,400 comes from independent means like IRAs. That leaves about $20,800 coming from Social Security.

One good sign for senior prosperity in the region is that only 33% of senior households spend over 30% or more of their income on housing. That is the 33rd-lowest rate in our study.

Data and Methodology

In order to find the places where seniors are most dependent on Social Security, we looked at data for the 100 cities with the largest population of residents aged 65 or over. Specifically, we looked at the following two metrics:

- Average retirement income for senior households. This is all income which comes from pension plans, periodic income from annuities or insurance and income from IRA plans. Data is for households where the head of household is 65 or over and comes from the U.S. Census Bureau’s 2016 1-year American Community Survey.

- Average Social Security income for senior households. This includes Social Security pensions and survivors benefits and permanent disability insurance payments made by the Social Security Administration. Data is for households where the head of household is 65 or over and comes from the U.S. Census Bureau’s 2016 1-year American Community Survey.

We combined the two income metrics to create one overall retirement income metric. Then we divided average Social Security income by overall retirement income. This showed what percent of total retirement income was coming from Social Security. We then ranked the cities from highest to lowest.

Tips for Saving for Retirement

In order to be prepared for retirement it is a good idea to start saving early. After saving up for an emergency fund you should start putting most of your savings toward retirement. Putting money into your 401(k) or IRA is a great way to save for retirement. Using these retirement tools helps you save for retirement while also lowering your tax bill.

If you are nearing retirement age and don’t have much saved, it might a good idea to consider moving to a lower cost of living area. Living in a cheaper area will make every retirement dollar stretch further.

Another option to maximize retirement income is to delay taking Social Security benefits. By waiting until age 70, you can max out your monthly Social Security check. However, waiting to take Social Security typically makes more sense for those in good health. You would need to live past the age of 80 to make up for not taking Social Security at 62. If you are in poor health or do have enough funds to support yourself until 70, taking Social Security benefits earlier may make more sense.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/monkeybusinessimages