Nicole Lapin is a financial expert and successful entrepreneur who learned everything the hard way. She never studied finance or business. Instead she worked hard and tried to learn as much about money as she could. Now she shares the financial lessons she has learned so that others can take control of their finances. If you’re looking for some help reaching financial stability, Nicole Lapin’s advice could be the right place to start.

Find a financial advisor to help you maximize your retirement savings.

Top Financial Advice From Nicole Lapin

Throughout our lives, many of us have developed some bad financial habits. Changing those habits is hard. But as Lapin explains in her book, “Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together… Finally,” you don’t have to change your financial habits all at once. Instead she proposes that people change in small steps. Do more than one thing at a time and you’re likely to get overwhelmed and quit. Lapin tries to handle all of her finances in a step-wise fashion and it has worked for her. (This is why she always presents the advice in her books as steps.)

To illustrate her step approach, Lapin likes the example of the first time she filed taxes. When she filed her taxes the first time, she didn’t know what she was doing. She had to learn everything as she went along. If she had just decided to dedicate one entire day to her taxes (as in sit down and not leave her desk until she was done), she knew she’d fail. She’d panic and give up. So Lapin gave herself a full month and she divided the task into a number of smaller steps. Day one was just getting all her receipts together in one place. As long as she did that, it was a successful day. That’s a small step but by doing just one thing at a time, she kept herself motivated and completed her goal (paying her taxes on time).

Another tip from Lapin is to negotiate everything. That means going beyond just negotiating your salary. She also negotiates things people don’t usually think of, and it has made a real difference in her life. As she wrote in an article for Redbook Magazine, it doesn’t matter how official-looking your bill is. It isn’t set in stone. For example, she has found success negotiating down her internet and phone bills. Missed a credit card payment? Call customer service and ask them to forgive you by citing your loyalty and how you normally pay your bills on time. Just got a high medical bill? You can even negotiate that. Lapin admits that you might have to be persistent sometimes, but the worst that could happen is you have to pay the same price you already expected to pay.

Lapin believes that one of the most important financial moves you can make is to create an emergency fund. An emergency fund will work as a security blanket in case you face an unexpected financial challenge, like a big car repair. Ideally, Lapin suggests a fund that covers at least six months of expenses. Of course, it’s always better if you can create a larger emergency fund that covers, say, nine months.

Lapin knows that six to nine months’ worth of money is a lot. But you don’t have to do it all at once. Remember her advice about doing things in small steps. Just put what you can into an emergency fund and grow it as quickly as you can. If your emergency fund only covers a few months right now, that’s OK.

Once you have a strong emergency fund and some savings, it’s time to think seriously about retirement. Lapin likes to start with a simple question when talking about retirement savings. How do you want to live in your retirement? Some people may want to relax and knit all day. Others may want to have an active retirement where they can cross things off their bucket list. Depending on what you want to do, you will need to plan differently for retirement.

Lapin finds that many people underestimate how much money they’ll need after they retire. People assume their big bills (like student loans and mortgage payments) will be paid off and so they’ll have more free money to spend. Lapin tells people that even if you’re frugal and find senior discounts wherever possible, you should expect your expenses to be at least 60% of what they are now. Most people should probably aim to have enough retirement savings to cover 80% of whatever they currently spend. Try this handy calculator to figure out your retirement needs.

A Brief Bio of Nicole Lapin

Nicole Lapin didn’t learn much about money when she was young. She was raised in a household where they never discussed money. She didn’t have books on finance or access to the financial publications she would read every day later in her career. There were no money or business programs on the TV.

The only thing she knew about money was cash. Her parents lived a cash-only lifestyle. This was inconvenient at times for Lapin (like when she wanted to buy something online). It was also a sound practice from a financial perspective. With cash you can only buy something if you physically have the money to pay for it. That’s a great way to prevent overspending.

Lapin’s passion was journalism and she got her first experience as a TV host in high school when she hosted a news program for a local public-access station. She went on to study journalism at Northwestern University and graduated as valedictorian of her class.

While she was in college, she got her first debit card as a step up from a cash-only lifestyle. She decided to get her first credit card when she moved to Atlanta, Georgia for a job with CNN. However, she quickly found herself in credit card debt. She had some big expenses since she was moving to a new city, so she started charging things on her credit card before she got her first paycheck. She was able to pay off the debt in a couple of years but it served as a good lesson on her financial journey.

As Lapin explains in her book, “Rich Bitch,” another big financial moment came when she broke up with one her boyfriends. His dream was to be a hedge fund manager, but she didn’t know what this was (she thought it had to do with gardening). She tried to follow along with conversations but they eventually broke up because he felt that she didn’t know enough about finance to have conversations with his friends. Lapin was disappointed that she knew so little about such an important topic and decided to learn as much as she could.

This led to journalistic work with finance and she was soon anchoring international business programs. She published her first book in 2015 to help share the financial lessons she had learned. And in the same year she joined Redbook magazine as a money columnist.

Financial Focus and Philosophy

When Nicole Lapin talks about finance, her goal is to be honest. Sometimes her advice can come off as blunt, but she doesn’t sugarcoat things. She wants to actually spur people to act. Lapin also works hard to explain finances in a simple and understandable way. She knows that financial jargon is confusing and intimidating – especially if you’re just starting to think about your money. But she believes the basics of finance are actually pretty simple. So she tries to make personal finance approachable by using plain English.

Underlying all her work is also the belief that anyone can take control of their finances. It doesn’t matter where you’re from or how old you are. It doesn’t matter what your educational background is or how good your math skills are. You can handle your finances. She particularly stresses this point when addressing women.

Where You Can Find Nicole Lapin

Lapin has a website where you’ll find a blog which she calls “Essential Conversations.” Her posts cover anything she finds important for people to know about. For example, there are sections on finance, health, style and other topics. On Lapin’s website you can find downloadable spending plans to help you track your spending and finances. Have a burning financial question for her? She lets people submit their financial questions to her through a form on her website.

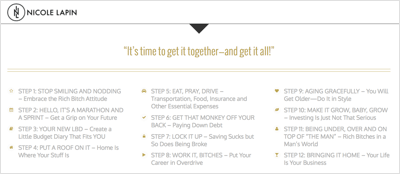

You can find more of Lapin’s advice in her bestselling books. Her first book, “Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together…Finally,” covers her main financial advice and presents 12 small steps to help you think about your finances. Throughout the book there are also a number of funny and insightful asides that talk about her personal journey with money.

Current Projects

Nicole Lapin’s second book, “Boss Bitch: A Simple 12-Step Plan to Take Charge of Your Career,” published in early 2017. It provides advice to help women gain confidence and take control of their careers.

Lapin currently hosts a business competition show, “Hatched,” for the CW Network. Entrepreneurs attempt to pitch their product ideas to both business experts and consumers. You can find episodes of “Hatched” on Lapin’s YouTube channel. The channel also features her other TV appearances and financial tutorials.

The Takeaway

Nicole Lapin is a financial expert who taught herself everything she knows about finance and money. The result is that she knows how hard it is (or at least how hard it seems) to learn about finance if you’re starting from zero. Lapin brings this understanding to all of her work. She strives to create materials – videos, articles and books – that explain things in plain English. There is no sugarcoating and she isn’t afraid to talk about her personal mistakes. Lapin is also a young, successful, female entrepreneur who should inspire other women trying to take control of their finances, careers and lives in general.

Tips for Reaching Financial Stability

- A great way to reach financial stability and stay on track with all of the above is to work with a financial advisor. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Every two weeks, Nicole Lapin likes to gather all her receipts (even the crumpled up ones in the bottom of her purse). From her experience, it only takes about 10 minutes. Then she sorts through them all to make sure she knows how much money she spent and what she spent it on. She likes to keep her receipts just long enough (one or two weeks) so that she can can make sure the charges on her credit card are correct. This is a great strategy to help you stay on top of your spending. And while you’re at it, you may also want to check your credit report a few times each year to make sure the information is correct.

- To make sure she stays on track, Lapin uses a budget. Budgeting scares a lot of people so she likes to call it her LBD (little budget diary). She writes down how much she spends on everything from clothes to rent. She decides how much to spend by dividing her money into three categories. One category covers the essentials. These are things like rent, food, utility bills, transportation and insurance. This makes up a total of 70% of her spending (ideally with less than 35% going toward rent or mortgage). Next she allocates 15% of her money toward the future. This includes retirement and any big savings goals like an emergency fund. The remaining 15% of Lapin’s money goes toward everything else. This includes gym memberships, eating out, clothes and all the other things she wants to spend money on. If you have a hard time staying within Lapin’s spending percentages, you might want to consider the common 50/30/20 budget. Regardless of the exact plan you follow, you should know how much you’re spending and what you’re spending it on.

- When it comes to retirement, Lapin believes that your employer’s 401(k) is a great place to start. This will allow you to save for retirement with money you haven’t paid taxes on yet. If your employer doesn’t offer a 401(k) or equivalent account, then Lupin says you need to open an IRA. An IRA offers many of the same benefits as a 401(k) but you don’t have to contribute through an employer. It’s also a good idea to diversify your retirement savings by putting money in a Roth IRA. With a Roth IRA, you contribute after-tax money and then you don’t have to pay any taxes when you withdraw your funds in retirement.

Photo of Nicole Lapin courtesy of NBG Productions, ©Flickr/Nicole Lapin, NicoleLapin.com