Right now is among the best times ever to get a new job.

That’s the result of the latest wage growth data from the Atlanta Federal Reserve. In it, they find that the last 12 months have been among the strongest ever for people who change jobs, with the wage benefits of changing jobs roughly double the usual rate.

For workers who want to boost their lifetime incomes, not to mention their retirement accounts, the 2023 labor market offers some of the best opportunities in a long time.

Here’s what’s going on.

Talk to a financial advisor today to plan to maximize your income and retirement.

Job-Hopping and Lifetime Income

A well-known feature of the labor market is that it tends to reward people who change jobs.

This has been studied and documented for decades, since researchers first started to notice the trend. In 1992, for example, Harvard’s Quarterly Journal of Economics published a paper finding that changing jobs accounts for at least one-third of a worker’s early-career wage growth. “Job changing is a critical component of workers’ movement toward the stable employment relations of mature careers… it is the principal method by which workers at the present time improve their condition on their own initiative.”

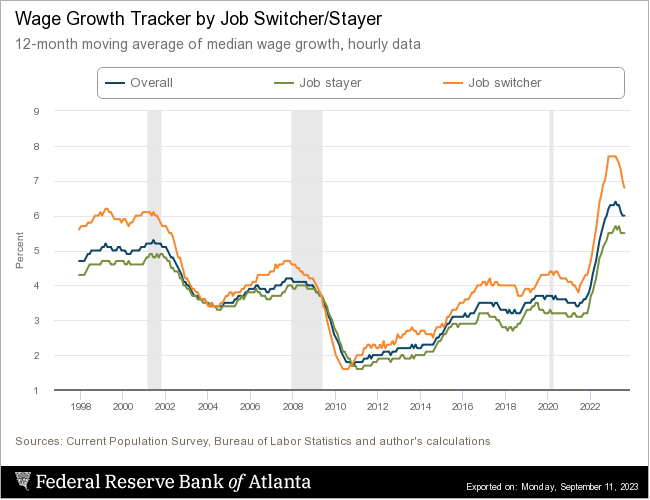

The Atlanta Federal Reserve has been tracking this phenomenon for almost as long, posting monthly wage data since 1998. In almost all months for the past 25 years, their data shows people who switch jobs have higher wage growth than people who stay in the same position. The only significant exceptions have been in the wake of recessions, which tend to create a short-term preference for stability. (This was not true of the historically strong post-Covid recovery.)

And, critically, this wage growth is cumulative.

A worker who changes jobs and receives a 5% raise has increased their earning power. By changing jobs later on, they might receive another 5% raise and another after that, ending up 15.7% ahead of where they started. Each raise compounds the value of the last one. In this way, changing jobs can increase a worker’s lifetime income considerably.

Right Now, Job Switchers Do Better Than Ever

What has changed, according to Federal Reserve data, is the extent of this phenomenon.

Historically, job-switchers have tended to gain an advantage of between 0.5 and 1 points over whose who stay put. For example, in January, 2017, job-stayers had an average wage growth of 3.2% compared with wage growth of 4.1% for job switchers.

In the past two years, and especially the past 12 months, that advantage has doubled. In June, 2023, wages grew by an average 5.5% for workers who stayed put. Those who switched jobs averaged a 7.3% raise. In April, 2023 those numbers were 5.6% and 7.6%, respectively, and 5.5% for job-stayers vs. 7.7% for job switchers in January, 2023.

This trend has been broadly true since early 2022. In 2020 and 2021, job switchers maintained their advantage of approximately 1 point over job stayers. Then, about two years ago, changing jobs began to build real momentum, to the current significant advantage.

A financial advisor can you project the outcome of different income scenarios.

What You Do Matters

That said, there are some details in the data. Specifically, the less you earn the less this works.

The current labor market has rewarded some of the traditionally forgotten sectors of the economy. In the post-pandemic recovery low-wage workers have seen some of the highest income gains of any group. The causes of this remain debated, with theories that include pandemic-related disruptions, the Trump and Biden Administrations’ stimulus bills, and the Biden Administration’s economic plans.

But historically that has not been true.

The practice of changing jobs to increase lifetime income is known as a “job ladder.” In the metaphor of economics, workers climb the rungs to achieve cumulative gains as they go. As the St. Louis Federal Reserve found when they studied the impact of job switching for male workers, ordinarily this doesn’t apply to low-earners.

While low-income workers are more likely to switch jobs, they wrote, that rarely translates to wage growth and momentum. Instead, it’s often the result of extended unemployment, which tends to depress lifetime earnings. Across most income levels, they found, “[a]verage annual earnings growth for job stayers is surprisingly similar… whereas for job switchers, it rises almost linearly from 0% for the bottom earners to around 3% for those in the 65th percentile.”

For the bottom 40% of earners, switching jobs tends to harm their wage growth compared with stability. After that, the more someone earns the more they tend to gain from switching jobs. That’s particularly true of salaried workers, who tend to gain about three times the boost of wage earners when they change jobs.

This finding echoes that of research published by McKinsey & Company, in which they found that job switchers see the most wage gains in the context of skill development. “[J]ob moves involving salary increases required a greater stretch in skills on average than other moves. Incremental moves with largely overlapping skill requirements don’t pack the same punch. Going to another company to perform largely the same tasks may yield a pay bump in the short term but not real growth over the longer term.”

Switching Jobs To Boost Your Retirement

So, what does all of this say about your retirement?

Long-term, the takeaway is this: One of the very best ways to boost your retirement savings is to keep up the momentum in your career. Each time you change jobs, you have the opportunity to negotiate for more money, creating a cumulative effect that helps grow your income again and again.

This will give you ever-more flexibility to contribute to your retirement account. With more lifetime earnings, you can dedicate more money to a 401(k), IRA or other self-funded accounts. Higher earnings also mean higher employer contributions, since those are based on a percentage of your income. Future raises will also be based on your income, creating a compounding effect that boosts your ability to save for retirement over the long run.

But it’s also important to remember that this is not just about volatility. The income gains of a new job are generally pegged to growing your skills and climbing the job ladder. To boost your income and savings, focus on generating new skills and think in terms of a career rather than a job. Workers who tend to move laterally between one similarly-situated positions tend not to capture much, if any, of the job-switching gains.

Or, as McKinsey put it, “[w]hen someone has learned all they can from one employer, they should not only go; they should boldly go in search of learning opportunities elsewhere.”

Income Boosting Tips

- Just like it’s good to think about your job in terms of a career, it’s helpful to think about your income in terms of net worth. And you can do a lot to increase your net worth.

- A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock/PonyWang