You’ve worked hard for decades of your life, putting in hours of work and paying taxes like the upstanding citizen you are. You’re ready for retirement – who isn’t? You can’t wait to sit back and relax and never worry about taxes ever again. Except sadly, that’s not how it works. True, you don’t have to pay taxes on every bit of money you have in retirement. But you will need to pay taxes on some of that income.

Is Retirement Income Taxable?

Unfortunately, while you may want to just relax in retirement, you can’t fully escape taxes. Even though most retirees aren’t receiving the same kind of income, you still have to pay taxes on the money that is coming in.

However, you don’t have to pay full taxes on everything. There are some sources, like IRAs and 401(k)s, that will mostly be taxed. But even then, there are limitations and exceptions. You may also have some accounts that can only be taxed partially, ensuring the accounts aren’t depleted. Let’s take a look at what sources of retirement income are taxable, starting with those that can see full taxation.

Taxable Income on Retirement Accounts

Any withdrawals you make from your retirement accounts like IRAs and 401(k)s are subject to taxes. Other accounts include 403(b)s, Simplified Employee Pension Plans (SEPs) and Savings Incentive Match Plans for Employees (SIMPLEs). This is because you funded those accounts with pre-tax money. So when that money comes back out, it can get taxed. The exact amount you’ll pay in taxes will depend on your total income, total deductions and your tax bracket in that retirement year.

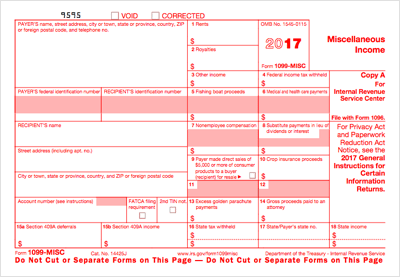

The IRS can also tax your pension income in retirement. If you made any after-tax contributions to your pension, those contributions cannot be taxed. You should receive a 1099 form from your pension provider that shows just how much is taxable. If you have a military or disability pension, though, you can see a full or partial reprieve from taxation. Additionally, pension income taxes will vary between states. So you’ll want to check your own state’s tax laws to get a better look at what your tax hit might be.

Sometimes, the IRS cannot tax the entirety of a retirement income source. The top example is your Social Security benefits. Up to 85% can be taxed, which is a lot to be sure. But to see any taxation on your benefits, your other sources of income have to add up way past IRS limits.

Other Taxable Retirement Income

You will have to pay taxes on annuity withdrawals when you saw an investment gain. The gain is then taxed as normal income. However, if you make an annuity withdrawal from your principal, you can avoid the tax. The company who distributes your annuity should inform you of your taxable amount.

Another bit of income that you’ll have to pay taxes on is any gains you earn from investments. Just as you do now, when you sell investments, you have to report that capital loss or gain on your tax forms. You will receive a 1099 form that will show you what amount is taxable. Generally, if you’ve had an investment more more than a year, it will be taxed more favorably as a long-term gain. You could potentially get a reprieve, if your other forms of income don’t reach too high.

You could also end up paying taxes in retirement if you sell your home. If you’ve lived in the house for at least two years, you should be fine. However, if your profit from the sale exceeds $250,000 (if you’re single), then you can still pay taxes on that gain.

Cashing in some of your cash value life insurance policy can also trigger a tax bill. If what you get from cashing in exceeds what you paid in premiums, that’s considered a gain. It’s the gain that becomes taxable.

Tax-Free Retirement Income

Luckily, the IRS can’t leave you entirely high and dry in retirement. There are a few sources of income that it cannot touch through taxes. First off, it’s important to remember that Roth IRAs are treated differently than a traditional IRA. Their main difference has to do with the way their funds are taxed. Since a Roth IRA carries after-tax funds, it does not get taxed when you make your withdrawals.

Other forms of income that can’t be taxed are municipal bonds interest, life insurance policy loans and reverse mortgages.

Bottom Line

Once you reach retirement, it’s mostly time to relax. But it’s important that you don’t forget you’ll still be held responsible for paying certain taxes. While your Roth IRA may be safe, your 401(k) and pension aren’t entirely tax-free. Keep an eye out for 1099 forms that may come in.

Tips for Saving for Retirement

- First things first: it is never too early to start saving for retirement. Too many people realize too late that they have to survive off of their savings in retirement if they hope to stop working. Luckily, we have a retirement calculator to help you figure out how much you will need to save.

- If your employer offers a 401(k), take advantage of it. Put a solid amount of your paycheck into the account every pay period. If you fill your 401(k) with investments, make sure it’s the most optimized mix of investments, which you can do with the help of a financial advisor if not on your own. That way, your 401(k) savings will be a solid source of income in retirement.

- Work with a financial advisor. According to industry experts, people who work with a financial advisor are twice as likely to be on track to meet their retirement goals. A matching tool like SmartAsset’s SmartAdvisor can help you find a person to work with to meet your needs. First you’ll answer a series of questions about your situation and goals. Then the program will narrow down your options from thousands of advisors to three registered investment advisors who suit your needs. You can then read their profiles to learn more about them, interview them on the phone or in person and choose who to work with in the future. This allows you to find a good fit while the program does much of the hard work for you.

Photo credits: ©iStock.com/PeopleImages, ©iStock.com/monkeybusinessimages, ©iStock.com/bowdenimages