Many renters don’t enjoy living with roommates, but in order to live alone you need to find an affordable home. This can be challenging, especially with rents on the rise across the country. However, there are some cities where living alone is within reach for a large number of workers. Below we look at these and other factors to rank the cities where you can afford to live alone.

In order to rank the most affordable cities for renters to live alone, we looked at data on five metrics. We looked at median rents, the number of studio and one-bedroom apartments as a percent of all homes, median earnings for full-time workers, overall cost of living and unemployment rate.

Key Findings

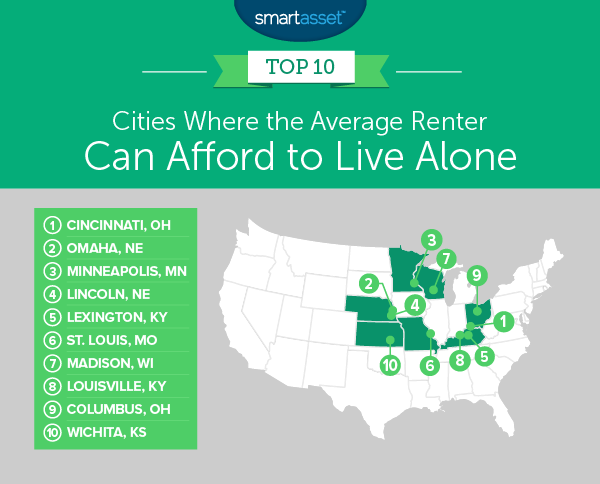

- Live alone in the Midwest – Eight of the top 10 most affordable cities to live alone are in the Midwest. The only non-Midwestern cities in our top 10 are Lexington and Louisville in Kentucky.

- California and Virginia at the bottom – Midsize cities in Virginia and California rank low. In cities like Virginia Beach and Chesapeake in Virginia, renters hoping to live alone will face two challenges: high rents and there a limited number of suitable places to live alone. California cities like Riverside and Fresno also rank poorly.

- Big cities are a mixed bag – While big cities tend to come with high rents, they also tend to come with plenty of studio and one-bedroom places. In San Francisco, for example, nearly 39% of homes are studios or one bedrooms. In Boston that figure is 31.5% and in Oakland it is 32.3%. The city with the largest supply of studios or one-bedroom homes is Washington, D.C. In that city, over 41% of homes have less than two bedrooms.

1. Cincinnati, Ohio

When it comes to affordably living alone, no cities scores better than Cincinnati. The average person living in a studio or one-bedroom apartment in this city pays only $575 on rent and the overall cost of living is over 3% less than the national average. With those low rents and costs of living, renters here can get started on saving to make the switch from renting to buying.

The only major black mark on Cincinnati’s record is its unemployment rate. This city has a 4.2% unemployment rate which around the national average.

2. Omaha, Nebraska

Omaha, Nebraska takes second. Overall the cost of living in Omaha is a bit higher than it is in Cincinnati. The average renter in a studio or one-bedroom apartment spends over $650 per month on rent and the cost of living in Omaha is on par with the national average.

What puts Omaha in second is its economic climate. Jobs are relatively plentiful here. In total only 3.2% of workers in Omaha are out of work, a score beaten by only 14 other cities in this study.

3. Minneapolis, Minnesota

If you want to rent an apartment to live alone, it’s important that you can find one. In Minneapolis over 34% of all homes are studios or have one bedroom, meaning there is no shortage of realistic option for renting alone.

When it comes to price Minneapolis is on the pricey side, however. According to data from the Census Bureau, the average studio or one-bedroom apartment costs nearly $800 per month. Fortunately those high costs are somewhat balanced by high local earnings. The average full-time worker in Minneapolis earns nearly $49,000 per year.

4. Lincoln, Nebraska

Nebraska’s capital comes in fourth. This is one of the most affordable cities in our study. According to our data the average person renting a studio or one-bedroom pays an average of just under $600 per month. At the same time the overall cost of living is a few percent below the national average.

With those two statistics in mind, it makes sense that Lincoln is one of the most affordable places to live alone. In fact with the cost of living so low it may be a great place for a single person to buy a home.

5. Lexington, Kentucky

Lexington scores well thanks to affordability and access to economic opportunity. This city ranks 14th in rent, with the average studio or one-bedroom apartment costing $608 per month. In terms of cost of living, this city costs about as much as the national average, which is great for a relatively large city. Jobs are readily available too.

The biggest hurdle to living alone in Lexington? Supply of studios and one-bedroom apartments. According to our data, less than 14% of housing units in this city are studios or one-bedrooms.

6. St. Louis, Missouri

St. Louis takes the sixth spot. Residents who are looking to live alone shouldn’t have to look too hard to find a studio or one-bedroom apartment. Over 31% of all housing stock in St. Louis are studios or one-bedroom apartments. That means you should have no trouble finding an apartment that suits your living-alone needs.

The city is hurt in this ranking by high unemployment levels and low earnings. In each of those metrics, St. Louis ranks below average.

St. Louis residents who want help managing their money, including rent, should check out SmartAsset’s top financial advisors in the city.

7. Madison, Wisconsin

Residents in Madison have access to some promising economic prospects. This city has an unemployment rate of 2.2%, second-lowest in our study, and the highest median earnings for full-time workers in our top 10. With high incomes and great job prospects, renters in Madison can afford to splurge on living alone.

However the costs of living stop Madison from climbing any higher on the list. The city has the highest rent costs in our top 10 and the overall cost of living is 10% higher than the national average.

8. Louisville, Kentucky

Another Kentucky city comes in eighth, this time its Louisville. Louisville scores well thanks to affordable rents and low costs of living. The average person in a studio or one-bedroom apartment in this city pays less than $600 per month. And the cost of living is similar to the national average.

The biggest concern for someone trying to live alone in this city might be finding a suitable apartment. According to our data, less than 16% of the housing stock in this city are studios or one-bedroom apartments.

9. Columbus, Ohio

In ninth is Columbus, Ohio. This is a college town with low costs of living. Overall this city ranks 11th out of all the cities we analyzed for cost of living. Renting a home alone is also pretty affordable. This city ranks 26th for median rental costs.

Where residents may struggle is earnings and finding an apartment. In both of those metrics, Columbus ranks around average.

10. Wichita, Kansas

Our list ends in one of the most affordable cities in our study. The average person living in a one-bedroom apartment or a studio in Kansas pays just over $550 per month. That means in order to afford living alone comfortably the average worker would need to earn about $1,650 per month. The good news for residents here is that average pay for outpaces that number. The average full-time worker earns about $3,440 per month.

Data and Methodology

In order to rank the most affordable places to live alone, we looked at data on 100 cities. Specifically we compared them across the following five categories:

- Average rent for a rental with fewer than two bedrooms. This is the average of median gross rent for a studio rental and a one-bedroom rental. Data comes from the Census Bureau’s 2016 1-year American Community Survey.

- Percent of housing stock with fewer than two bedrooms. This is the percent of all occupied homes which have fewer than two bedrooms. Data comes from the Census Bureau’s 2016 1-year American Community Survey.

- Average earning for full-time workers. This is the median annual earnings for full-time workers. Data comes from the Census Bureau’s 2016 1-year American Community Survey.

- Cost of living. This is the cost of living relative to the national average. Data comes from the MIT living wage calculator.

- Unemployment rate. This is the unemployment rate from January 2018. Data comes from the Bureau of Labor Statistics.

First, we ranked each city in each metric. Then we found each city’s average ranking, giving equal weighting to each metric. Using this average ranking, we created our final score. The city with the best average ranking received a 100. The city with the worst average ranking received a 0.

Tips for Moving From Renting to Buying

- Start saving – One reason people become renters is because it is more affordable in the short run. You don’t need a down payment saved or any extra funds to pay for closing costs. But if you do want to become a homeowner, you will need to start saving. In some cities this can take multiple years, so it makes sense to start saving for a down payment before you are ready to buy a home.

- You’re paying for more than just a mortgage – For renters most of the costs of paying for housing are baked into the monthly rent, apart from utilities and other similar bills. For homeowners there are costs other than the monthly mortgage payments to be aware of. For example, homeowners have to pay property taxes, which can be costly depending on which state you live in. Homeowners also need to factor in homeowners insurance.

- Figure out your market – Knowing how much home you can afford is important when you are home shopping. By having a strict number in mind when buying a home, you can avoid making a mistake which will cost you down the line.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/PeopleImages