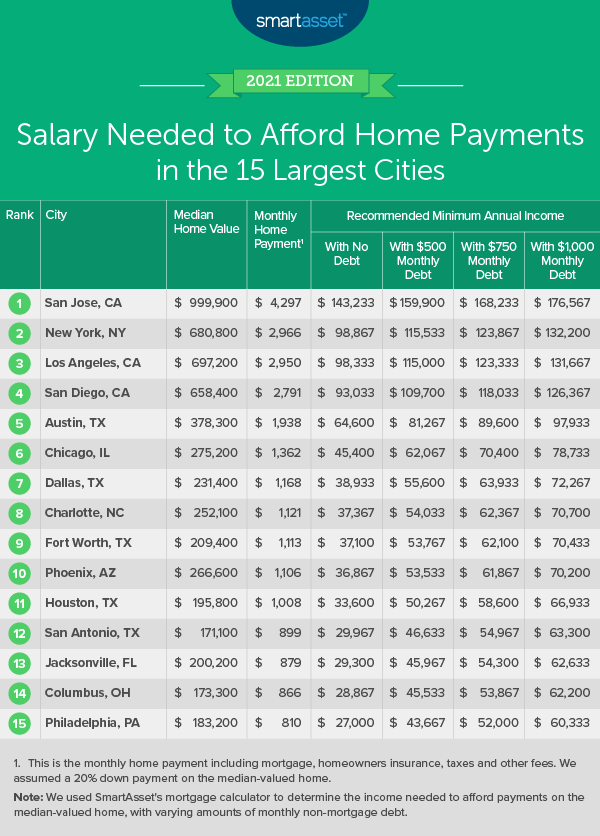

Housing costs eat up more of the average American’s salary each month than any other single expense, reaching about one third of average expenditures in 2019, according to data from the Bureau of Labor Statistics. And while homeownership is coded into the DNA of the American Dream, buying a home isn’t easy for many. Car payments, student loans, credit card bills and other debts can make it difficult to qualify for a home loan and keep up with mortgage payments. That’s why SmartAsset analyzed data from the 15 biggest U.S. cities to estimate how much money you will need to make – and not exceed the recommended 36% debt-to-income ratio – to afford monthly home payments.

Our study compares these cities using the following factors: median home value, property tax rate, down payment, homeowners insurance and other monthly non-mortgage debt payments. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

This is SmartAsset’s fourth study on the salary needed to afford home payments in the 15 largest U.S. cities. Check out the 2020 version of the study here.

Key Findings

- California is expensive. Three California cities – San Jose, Los Angeles and San Diego – are included in the 15 largest U.S. cities, and they all rank within the top four of this study, at first, third and fourth, respectively (with New York City claiming second place). Our findings show that living in California can be very costly if you want to own a home. The average salary (with no additional debt) needed to afford home payments across these three cities is $111,533.

- Home prices vary by more than 5x. Homes in big cities are usually more expensive than homes in suburbs or small towns. But our study reveals that there is also a big difference among the 15 largest U.S. cities. The highest median home value on our list is higher than five times more expensive than the lowest. San Jose, California has a median home value of almost $1 million, while San Antonio, Texas has a median home value of just $171,100.

1. San Jose, CA

Homeowners in San Jose, California need to have the highest income out of all 15 cities to afford their home payments. Our study shows that they have to earn $143,233 (with no debt) to afford a property with a median home value of $999,900. That income goes up to $159,900 when a homeowner has $500 in monthly debt payments, $168,233 if he or she owes $750 a month and $176,657 with $1,000 of additional monthly debt. On a more affordable note, the property tax rate in San Jose is relatively low, at 0.76%.

2. New York, NY

The Big Apple comes in second, but if you want to buy a home in New York City, you will need to earn at least $98,867 with no additional debt to afford house payments. If you owe $1,000 in monthly debt payments, you will need to make $132,200. The median home value in NYC is $680,800, and the median real estate tax bill is $5,633.

3. Los Angeles, CA

Los Angeles’ median home value is slightly higher than New York City’s and the second-highest in the study ($697,200). The property tax rate, however, is the second-lowest overall – at just 0.68%. If you have no debt, you’ll need to earn at least $98,333 to make home payments and keep your debt-to-income ratio less than 36%. But if you owe $500 each month, you’ll need an income of at least $115,000.

4. San Diego, CA

San Diego, California’s median home value is $658,400, fourth-highest in the study. The average property tax rate, however, is third-lowest at 0.69%. If you have monthly debt payments of $1,000 before you take out a mortgage, you’ll need to earn at least $126,367 to afford house payments in San Diego. By comparison, if you have a monthly debt of $750, you will need to make $118,033.

5. Austin, TX

Austin, Texas homeowners without debt must earn a minimum of $64,600 to make their housing payments. Their income requirements rise to $81,267 if they have a monthly debt payment of $500. The median home value in Austin is significantly lower when compared to the top four cities on this list, at just $378,300. But the property tax rate is more than twice as high, at 1.75%.

6. Chicago, IL

The median home value in the Windy City is $275,200. Chicago homeowners have to pay a fairly high property tax rate, at 1.54%. If they do not have any monthly debts, they’ll need to earn at least $45,400 to afford monthly home payments without exceeding the 36% debt-to-income ratio. If they owe $1,000 in debt payments outside of their mortgage, they’ll need to earn $78,733.

7. Dallas, TX

Dallas has the fifth-highest property tax rate in this study, at 1.66%. The median home value in the city is $231,400. Homeowners without a debt must earn at least $38,933. But if they owe $750 in monthly debt, they’ll need to make at least $63,933 to afford a mortgage.

8. Charlotte, NC

Charlotte, North Carolina has a median home value of $252,100 and a property tax rate of 0.94%. Homeowners here must earn $37,367 without any additional debt to afford housing payments. If you owe $500 in monthly debt payments outside of your mortgage, you’ll need to make at least $54,033 for your housing payments.

9. Forth Worth, TX

The property tax rate in Fort Worth is 1.98%, the highest rate across all 15 cities. The median home value is $209,400, and homeowners with additional monthly debt payments of $750 need to make $62,100 to live comfortably in this city. By comparison, if their non-mortgage debt payments are only $500 each month, they will need to earn $53,767.

10. Phoenix, AZ

The property tax rate in Phoenix, Arizona is 0.58%, the lowest in this study. The median home value is $266,600. Homeowners can afford making mortgage payments with an income of $36,867 as long as they have no other debt. But if they have $750 in monthly debt payments, they’ll need earn at least $61,867.

11. Houston, TX

Houston’s property tax rate, like in the other Texan cities in the top 15, is fairly high – third-highest in the study, in fact, at 1.78%. The median home value, though, is much lower on the list, at $195,800. To afford the home payments without breaking the 36% debt-to-income rule, you’ll need to earn at least $50,267 if you have $500 in other monthly debt payments. If you’ve managed to stay debt-free before the mortgage, you’ll only need $33,600 in annual income.

12. San Antonio, TX

The median property tax rate in San Antonio, Texas is 1.91%, the second-highest property tax rate in the study. The median home value is $171,100. To afford payments on the median San Antonio home, you’ll need to earn at least $29,967 and have no additional debt payments. If you owe a monthly debt of $1,000 outside of your mortgage, you’ll need to earn at least $63,300 to afford home payments comfortably.

13. Jacksonville, FL

Jacksonville, Florida’s median home value is $200,200, and the property tax rate is relatively low at 0.87%. This means that you’ll need to make $29,300 to afford an average house payment as long as you have no additional monthly debt. If you are making other debt payments of $500 each month, you’ll need to earn at least $45,967 to afford home payments in Jacksonville comfortably.

14. Columbus, OH

Columbus, Ohio’s property tax rate is 1.60%, and the median home value is $173,300. Homeowners with additional debt payments of $500 each month must earn at least $45,533. Doubling monthly non-mortgage debt payments to $1,000 means that they’ll need a salary of at least $62,200.

15. Philadelphia, PA

The median home value in the city of Brotherly Love is $183,200, and the property tax rate is 0.91%. If you have no other debt, you’ll need a salary of at least $27,000 to make home payments in Philadelphia. If you owe $750 in monthly debt payments outside of your mortgage, you will have to earn a minimum of $52,000 per year.

Data and Methodology

To find the minimum required salary to afford home payments in the 15 largest U.S. cities, we used data from the U.S. Census Bureau. First, we took the median home value in each city and calculated the cost of a 20% down payment. We then used the average real estate taxes paid in each city and the median home value to find the average property tax rate. Using those figures and our mortgage calculator, we found the average monthly home payment in each city assuming a homebuyer would get a 30-year mortgage with a 3% interest rate for 80% of the home value (the balance after paying a 20% down payment). We also factored in an annual homeowners insurance payment of 0.35%.

After finding the average monthly home payment, we calculated the income needed to make those payments while not exceeding a 36% debt-to-income ratio. We also considered the necessary income to make home payments based on prospective homebuyer debt levels, which ranged from no monthly debt payments to debt payments totaling $1,000 per month.

We ranked each city from the highest minimum income (with no additional debt) needed to afford home payments to the lowest minimum income (with no additional debt) needed. Median home values and median household incomes are from the U.S. Census Bureau’s 2019 1-year American Community Survey.

Tips for Homeownership

- Feel at home in your finances with a trusted advisor. Want to buy a house and make sure your finances stay sound? Consider working with a financial advisor. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

- Be realistic. Make sure you know how much house you can afford before you even start looking at homes so you don’t fall in love with a unit that is above your price range.

- Budgeting is key. If you want to start saving for a down payment, make a budget and designate a certain amount to put aside for that each month.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/KenWiedemann