People buy second homes for a variety of reasons. Some people buy a beach home as a place to get away during the winter months, others buy a place next to their favorite mountain to enjoy the slopes. Homebuyers may choose to buy second homes as investments, taking advantage of rising home values. For some that move has paid off. The median home value in the U.S. increased from $194,500 in 2015 to $205,000 in 2016.

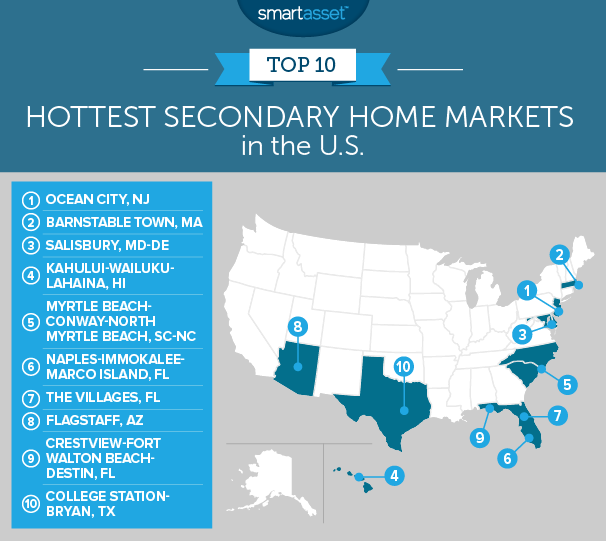

But purchasing a second home is much more popular in some metros than in others. Below we look at home purchase data to find the hottest secondary home markets in the U.S. In order to create this ranking, we looked at data on 402 metro areas. We compared the number of homes purchased as primary residences and compared it to the number of homes purchased as secondary residences. Check out our data and methodology below to see where we got our data and how we put it together to create our rankings.

Key Findings

- Vacation spots – Metro areas with access to beaches dominated this top 10 list. In total seven of the 10 hottest secondary-home markets are near a beach.

- Big cities score well – One statistic which sticks out is the popularity of big cities as places to buy a secondary home. The New York, Los Angeles and San Francisco metro areas all rank in the top third.

- Difference in incomes – While it’s not surprising that people buying secondary homes have higher incomes than those buying primary dwellings, the size of the difference is substantial. The average homebuyer purchasing a secondary home has an income of $197,400, while those buying a primary residence have an average income of $74,100. That means the average household purchasing a secondary home has an income equal to 2.6 times the average income of a household purchasing a primary residence.

1. Ocean City, New Jersey

Ocean City lies on the famous Jersey Shore. In total almost 72% of all homes purchased in this metro area were purchased as non-primary dwellings, the highest rate in our study.

Secondary homebuyers in Ocean City are wealthier than residents who live there full time. On average a homebuyer buying a secondary home in Ocean City had an income 2.8 times that of a homebuyer buying a primary residence in Ocean City.

2. Barnstable Town, Massachusetts

Located within the Barnstable Town metro area is Massachusetts’ favorite vacation spot, Cape Cod. About 4,650 homes were bought here in 2016 and roughly 44% of those were to people purchasing secondary homes.

On average secondary homebuyers in this metro area took out a mortgage worth 1.39 times their income to purchase their house. For buyers purchasing a primary residence, the average mortgage-to-income ratio was 2.5.

3. Salisbury, Maryland-Delaware

About 43% of the 7,548 homes purchased in Salisbury in 2016 were purchased by people acquiring a second home. On average, people buying second homes had an income worth 2.6 times what people purchasing a primary dwelling had.

4. Kahului-Wailuku-Lahaina, Hawaii

Who wouldn’t want to own a home in Maui? Around 36% of all homes bought in this slice of paradise were purchased by secondary homebuyers.

The housing market in this metro area is on the expensive side. Secondary homebuyers took out an average home loan of $561,150 and primary homebuyers took out an average mortgage of $468,596. One plus to owning a home here is Hawaii’s low property tax rates.

5. Myrtle Beach-Conway-North Myrtle Beach, South Carolina-North Carolina

One of the most historic beach locales in America takes our fifth spot. According to data from the Consumer Financial Protection Bureau, about 65% of homes purchased here in 2016 were by primary residence homebuyers. That leaves 35% of homes going to people buying secondary homes.

Homebuyers buying a primary residence in this metro had the lowest average mortgage in our top 10.

6. Naples-Immokalee-Marco Island, Florida

Located in Southwest Florida, Naples-Immokalee-Marco Island is another popular spot for secondary homebuyers. Of the roughly 6,800 homes bought here in 2016, 2,360 were purchased by people in the market for a secondary home. On average people purchasing secondary homes in this metro had an income of $330,000 and took out a mortgage of about $397,000.

7. The Villages, Florida

The Villages, a retirement community in Florida, is an attractive place to buy for people in the market for a second home. Properties here are much more affordable on average than they are in Naples-Immokalee-Marco Island. The average homebuyer buying a secondary home here took out a mortgage of only $195,000. That same figure for people buying a primary residence is $204,000.

That makes The Villages one of three places in our top 10 where homebuyers purchasing primary residences took out larger mortgages than people buying secondary homes. Overall 33.5% of home purchases were made by people buying a secondary home.

8. Flagstaff, Arizona

Around 2,030 homes were purchased here in 2016. Of that number 628 went to people buying second homes. That equals roughly 30.9% of all homes. Homebuyers in Flagstaff who were purchasing primary residences took out a home loan worth about 2.8 times their income on average. When purchasing a home it’s important to factor in long-term costs like property taxes. Arizona’s average effective property tax rate is 0.84%, well below the national average.

9. Crestview-Fort Walton Beach-Destin, Florida

This metro area is part of Florida’s northwest corridor, between the Pensacola metro area and the Panama City metro area. In the past we’ve found that Fort Walton is a good option for those hoping to purchase an affordable beach town.

The data seems to suggest plenty of people are buying secondary homes here. In total 1,902 – or 29.4% – of the 6,467 home purchases went to homebuyers purchasing secondary homes.

10. College Station-Bryan, Texas

Our list ends in College Station-Bryan, the 10th-hottest secondary home market. According to our data, 29.3% of all home purchases in this metro were made by people looking for a secondary home.

Secondary home purchasers also seemed to have found themselves some good deals. According to our data, the average home buyer purchasing a non-primary residence took out a mortgage worth 82% of their income. That’s a mortgage-to-income ratio of 0.84. Only six cities in our top 25 had mortgage-to-income ratios less than 1.

Data and Methodology

In order to find the places with the hottest secondary home markets in the U.S., we looked at data for 402 metro areas. We compared them across the following two metrics:

- Number of homes purchased as non-primary residences.

- Total number of homes purchased.

We divided the number of homes purchased as non-primary residences by the total number of home purchases for each metro area. The metro area with a highest percent of non-primary residence purchases as a percent of all purchases ranked first. The place with the lowest percent ranked last.

Data for both metrics comes from the Consumer Financial Protection Bureau’s Home Mortgage Disclosure Act Database and is from 2016.

Tips for Buying a Second Home

- Pay attention to your mortgage rate. If you are taking out a mortgage to buy your second home, you may pay a higher mortgage rate than on your first home. Second mortgage rates tend to be about a quarter of a point to half of a point higher than interest rates on first mortgages. It’s important to make sure you’re purchasing a home you can afford.

- Don’t forget the other costs of owning a home. While you may be able to afford the mortgage on your second home, to see how much it truly costs you need to include all the other costs of homeownership, like closing costs, property taxes and homeowners insurance. This is especially true for residents looking to buy a second home in states like New Jersey or New Hampshire, where the property taxes are some of the highest in the country.

- Rent out your second home. One way to lower the cost of owning a second home is to rent it out when you are not using it. Even if the rental income does not completely cover the cost of owning the home it will make affording it easier. You will have to pay taxes on rental income, however.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/wbritten