The average woman earns 80% of what the average man earns, according to U.S. Census Bureau data. The real-world implications of the pay gap sometimes get lost in the discussion around the issue. Of course, being paid less is bad, but when it comes to things like housing, for example, women may be worse off than the pay gap suggests. What can appear to be a minor pay difference may be the difference between living in affordable housing or not.

Thinking about making the leap from renting to owning? Check out our rent vs. buy calculator.

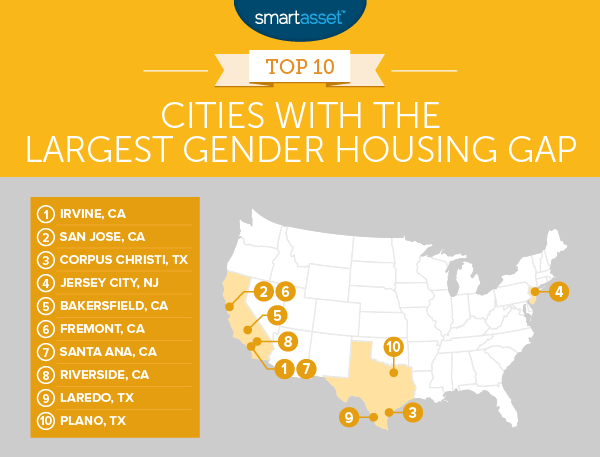

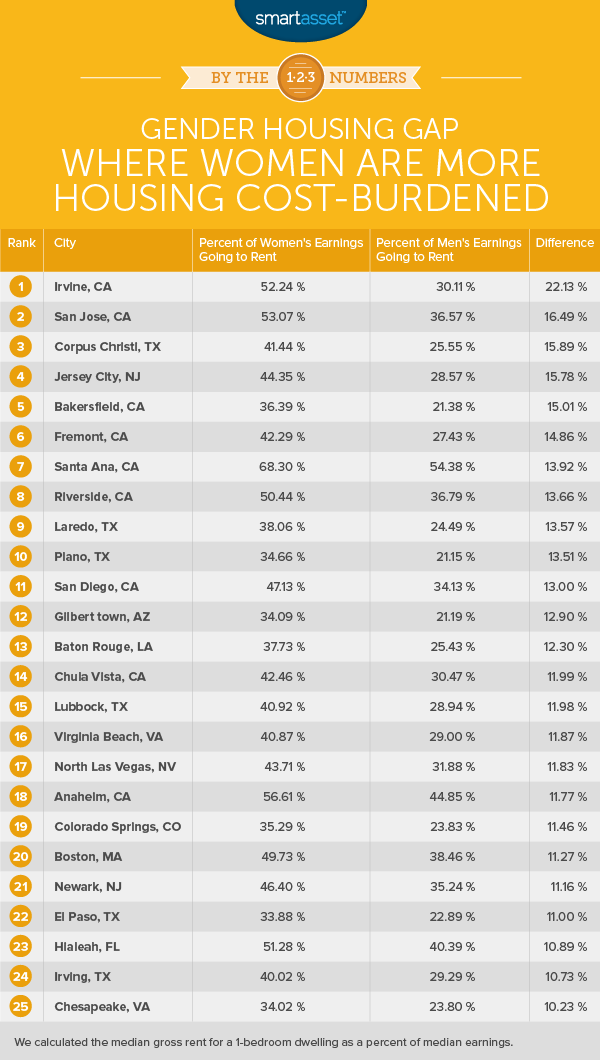

Below we look at the cities with the largest gender housing gap, to see where women are more housing cost-burdened compared to men. In order to find the cities with the largest gender housing gap, we looked at data on men’s earnings, women’s earning and median gross one-bedroom rent costs. We found the percent of income required to pay the rent for each group and found the cities with the largest difference. Check out our data and methodology section below to see where our data come from and how we put it together.

Key Findings

- Housing is expensive in California – It is no surprise to see many California cities top our list. They tend to have high housing costs, making small differences in incomes between men and women more impactful. Overall six of the top 10 cities with the largest gender housing gaps are in California.

- Men have it better – There are only seven cities, out of the 100 we analyzed, where the average woman’s earnings would allow her to be unburdened by housing costs while renting the average one-bedroom apartment. For men there are 63 cities which fulfill that criteria.

- Comparable Colorado – Two of the top 10 cities with the lowest gender housing gap are in Colorado. They are Denver and Aurora. However even in these cities, the average woman can expect to pay around 3% – 4% more of their income on renting a one-bedroom than men.

1. Irvine, California

Our data shows that the average Irvine woman earns around $41,000 per year. Unfortunately for Irvine women, the average one-bedroom costs $1,785 per month. That means an Irvine woman who earns the area’s median salary would have to put 52% of her income toward the average apartment.

The situation for men is quite different. Irvine men earn substantially more: $71,100 per year, on average. So renting the average one-bedroom would cost only about 30% of their income. This puts them right around the Department of Housing and Urban Development’s housing affordability threshold.

2. San Jose, California

Rents in the Bay Area are expensive for everyone, and even more expensive for women earning the median salary. The average woman in San Jose makes about $32,700. She would need to spend 53% of her earnings to pay the rent on the average one-bedroom in the San Jose area.

Men on average make $15,000 more than women in San Jose, meaning they would need to put 36.6% of their income toward the average rent. That’s 16.5 percentage points less than women would need to pay.

3. Corpus Christi, Texas

It would take an arm and a leg for the average woman to rent a one-bedroom in Corpus Christi, Texas. The main issue for women in Corpus Christi is that they are not all that well paid. According to Census Bureau data, the average woman earns just over $22,000 per year. Men in Corpus Christi earn more, just under $36,000, on average, meaning they are much less housing cost-burdened than women.

In fact, while women probably need to find roommates in order to not be housing cost-burdened, the average man should have no problem paying for an apartment alone. It would cost just over 25% of the average man’s income to pay for the average one-bedroom in Corpus Christi. That same figure for women is over 41%.

4. Jersey City, New Jersey

Jersey City is one of the most livable cities in the country. But the large pay gap in the city means it’s a more livable city for men than it is for women. Women in America’s Golden Door earn about 64% of what men earn, making housing less affordable for women. Data from the Census Bureau shows that renting the average one-bedroom apartment in Jersey City will set you back around $1,090 per month.

If the average woman were to pay that, she’d be sacrificing 44% of her income. The same figure for the average man is only 28.6%. That’s a difference of 15.8%.

5. Bakersfield, California

Bakersfield, California is relatively affordable. Of all the cities in our top 10, Bakersfield is actually the second-most affordable for women. It’s also a good city to get out of credit card debt. So why does Bakersfield have the fifth-highest gender housing gap?

The average Bakersfield man, who earns just under $39,000 per year, according to Census Bureau data, need only sacrifice 21.4% of his income to pay the rent on the average one-bedroom apartment. On average, women in Bakersfield earn less: around $23,000 a year. To pay for the same one-bedroom apartment, they’d need to sacrifice 36.4% of their income, making them housing cost-burdened.

6. Fremont, California

In our study of the safest cities in America, Fremont, California ranked second. For this study, we discovered that the average Fremont woman has to spend over 42% of her income to afford the rent on a one-bedroom. That’s squarely on the wrong side of HUD’s housing cost-burden benchmark.

On the other hand, the average man in Fremont takes home $76,000 per year. That means the average man is only sacrificing 27.4% of his income in order to pay for a $1,700 one-bedroom apartment (the median cost).

7. Santa Ana, California

To rent the average one-bedroom abode in Santa Ana, the average woman would need to fork over just under 70% of her income. That’s an alarming statistic. To be fair the situation is only a little better for men. The average man would need to pay around 54% of his income to afford the same apartment. This makes Santa Ana the least affordable city in our top 10 for both men and women when it comes to renting a one-bedroom.

8. Riverside, California

The final California city in our top 10 is Riverside. This city, about 50 miles east of Los Angeles, is home to some underpaid women. Women in Riverside, on average, earn 73% of what men earn. Women earn $22,790 per year, while men earn $31,251 per year, on average.

This puts women in a bind when they are looking to find good deals on a one-bedroom apartment. The average one-bedroom, according to Census Bureau data, costs about $950 per month, which would eat up 50% of the average woman’s income. For men that same figure is 36.8%, for a difference of 13.7 percentage points. It’s worth noting that both those stats are considered housing cost-burdened by HUD.

9. Laredo, Texas

Average rent in Laredo, Texas is lower than many other cities in the top 10. The rent on an average one-bedroom apartment runs about $575 per month. However, the average woman in Laredo earns only $18,130 per year, meaning she’d pay 38% of her salary toward that one-bedroom apartment.

In order to afford the same apartment, men would need to pay, on average, less of than 25% of their income.

10. Plano, Texas

Plano, Texas rounds out our top 10. This is the most affordable city for one-bedroom renters in our top 10. The average man in this city earns about $58,000. He’d have to pay just over 21% of his annual salary to afford the average one-bedroom apartment. On the other hand the average woman in Plano earns just over $35,000. That means she can expect to pay just over 34% of her income on the same apartment.

Data and Methodology

In order to find the cities with the biggest gender housing gaps, we gathered data on the 100 largest cities in the U.S. and looked at the following three factors:

- Men’s median earnings. This is the median annual earnings for men. Data comes from the U.S. Census Bureau’s 2015 1-Year American Community Survey.

- Women’s median earnings. This is the median annual earnings for women. Data comes from the U.S. Census Bureau’s 2015 1-Year American Community Survey.

- Median gross rent for a one-bedroom. Data comes from the U.S. Census Bureau’s 2015 1-Year American Community Survey.

We used these three factors to find what percent of income men and women would need to pay to rent the same one-bedroom apartment in each city. The difference between what percent of their income men and women need to pay for the average one-bedroom is the gender housing gap. We ranked each city from highest gender housing gap to lowest gender housing gap.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/snapphoto