Homeownership rates still have not fully recovered from the 2007 housing crisis, data from the U.S. Census Bureau shows. For some age groups, foregoing homeownership is not a hard decision. It can offer more labor market flexibility and the chance to pursue other investments. For many retirees, however, homeownership may be an important facet of their retirement plan, giving them stability as well as the chance to build equity. Below we look at where the homeownership rates for retirees are rising the fastest.

Find out now: How much house can I afford?

Data and Methodology

In order to rank the cities where the retiree homeownership rate is rising the fastest, SmartAsset looked at data on all U.S. cities where the number of householders is greater than 50,000. Specifically, we gathered data in the following two metrics:

- The 2006 retiree homeownership rate. This is the homeownership rate among households where the head of the household was older than 65 in 2006. Data comes from the U.S. Census Bureau’s 2006 1-Year American Community Survey.

- The 2015 retiree homeownership rate. This is the homeownership rate among households where the head of the household was older than 65 in 2015. Data comes from the U.S. Census Bureau’s 2015 1-Year American Community Survey.

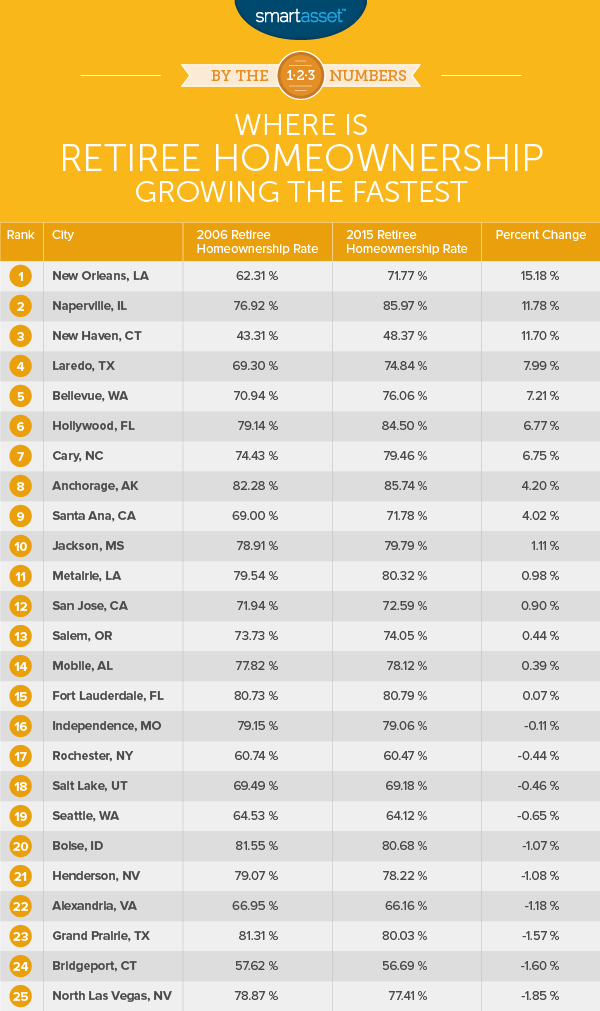

We used those two metrics to find the percent change between the 2006 retiree homeownership rate and the 2015 retiree homeownership rate. We then ranked the cities by biggest change in percent growth to lowest change in percentage growth.

Key Findings

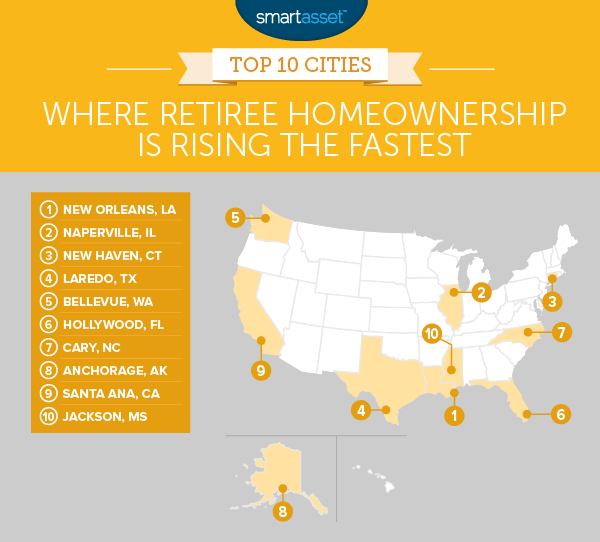

- Hot housing markets – Six of the top 10 cities where retiree homeownership is rising the fastest are located in warm areas.

- All over the map – In previous a study which looked at where retirees are moving, we found that the majority were settling in a few states, like Florida and Arizona. When it comes to the rise in the retiree homeownership rate, the cities with the fastest change are not concentrated in a few areas.

- Glendale decline – The retiree homeownership rate in Glendale, California dropped by 22% over the 10-year period we analyzed. That is the largest decline of any city in our study.

Find out if you are on track for retirement with our retirement calculator.

1. New Orleans, Louisiana

The Big Easy comes in first for cities where retiree homeownership is rising the fastest. The homeownership rate for retirees rose from 62.3% in 2006 to about 71.8% 10 years later. That’s a percent increase of about 15.2%. Those numbers become even more significant when one considers that New Orleans isn’t known for its high homeownership rates. Data from the U.S. Census Bureau shows that the homeownership rate among all households in New Orleans was about 46.4% in 2015.

2. Naperville, Illinois

Naperville has the highest overall homeownership rate in the top 10. Seventy-four percent of all households in Naperville are owner-occupied residences. Similarly, in 2015 just under 86% of retiree households in the city owned the home they live in. That retiree homeownership figure is up 11.8% from the 2006 retiree homeownership rate of 76.9%.

3. New Haven, Connecticut

The overall homeownership rate is low in the Elm City, possibly because it’s a college town. Only 24.8% of households own their homes here. However, that rate doubles when it comes to retirees. The 2015 homeownership rate among retirees in New Haven was 48.37%. That’s up 11% from 2006.

4. Laredo, Texas

Laredo is blessed with the second-most affordable homes in the top 10, so it’s no surprise that the homeownership rate in Laredo is high. Laredo has an overall homeownership rate of 61.8%. And, like many other cities, retirees outperform that mark. In 2006 the homeownership rate for retirees was 69% and in 2015, it was 74.8%. A percentage jump of 7.9%.

5. Bellevue, Washington

The city of Bellevue has seen big population growth in recent years. According to data from the Census, the population in Bellevue has grown 14% from 2010 to 2015. Bellevue also has the most expensive housing market in our top 10. According to Census, the median home value in Bellevue is $562,000. In 2015, Bellevue had an overall homeownership rate of 53% and a retiree homeownership rate of 76%. Retiree homeownership grew 7.2% from 2006 to 2015.

6. Hollywood, Florida

With a population around 70,000, Hollywood is one of the smallest cities to crack our top 10. Originally planned as an East Coast version of Hollywood, California, this city has become a haven for retirees rather than the silver screen. Hollywood, Florida has the third-highest retiree homeownership rate in the top 10 at 84.5%. That’s an increase of 6.7% from the 2006 rate of 79.1%. Homes in Hollywood, Florida are also relatively affordable. The median home value is $181,700, according to the Census.

7. Cary, North Carolina

Close on the heels of Hollywood, Florida is Cary, North Carolina. In a previous study we found that Cary is a city where millennials are buying homes. It’s also a top city where retiree homeownership is rising the fastest. Retiree homeownership jumped up by a rate of 6.75% from 2006 to 2015 in Cary. In 2015, close to 80% of retiree households in Cary owned the homes that they occupied.

8. Anchorage, Alaska

Anchorage ranks eighth for the cities where the retiree homeownership rate is rising the fastest. In 2006, the homeownership rate among retirees in Anchorage was about 82.3%. That was already one of the highest rates in the country, but the rate still increased by 4.2% from 2006 to 2015. The 2015 rate of 85.7% is the second-highest in the top 10.

Related Article: 15 Things to Know Before Moving to Alaska

9. Santa Ana, California

Santa Ana is known for its nice weather. Data from the National Oceanic and Atmospheric Administration shows that the average high temperature in Santa Ana is a balmy 76 degrees and the average low is a mild 55 degrees. This may partially explain why Santa Ana has always had a fairly high homeownership rate among retirees. In the recent past the homeownership rate for retirees in this city picked up, with a 4% increase over the 2006 to 2015 time period. The 2015 retiree homeownership rate sits close to 72%.

10. Jackson, Mississippi

The homeownership rate for retirees in Jackson grew by 1.1% from 2006 to 2015. That may seem like a relatively low rate for a top 10 ranking but it exemplifies how slow the homeownership rate recovery has been in general. In 2006, the retiree homeownership rate was 78.9% and in 2015 it was 79.9%. It’s also worth noting that Jackson has the most affordable housing market in our top 10. The median home value in the city is just $89,200.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/iofoto