In order to save money, it’s important that the necessities of life are already covered. Therefore the best places to save money would likely be where the income is high and the cost of life’s necessities are low. SmartAsset has come up with a list of the places that give renters the best and worst chance to save money.

Find out now: How much should I put down?

Check the potential savings in your (or any) county using this interactive map below. Zoom into your state and scroll your mouse over any county to see how it ranks for savings potential.

Whether renters are working towards a down payment to buy a home, want to be prepared for a move or rental increase, or simply want build a nest egg, it’s a good idea to maximize the amount that you save.

Methodology

Mapping out a savings plan is not a uniform process. Depending on who and where you are, many of life’s necessary costs such as taxes, rent, health care, food, energy and transportation can vary greatly. In an attempt to map out the ability of Americans to save, we compared localized necessary costs with typical household incomes for all U.S. counties. For each of these counties we were able to arrive at the potential savings that someone living on a median household income would have after covering typical costs.

In order to determine the savings potential for residents, we started with the median household income for each county, and then subtracted the basic expenses. These costs included food, healthcare, vehicle insurance, gasoline, electrical energy, income taxes, property taxes and yearly rental payments.

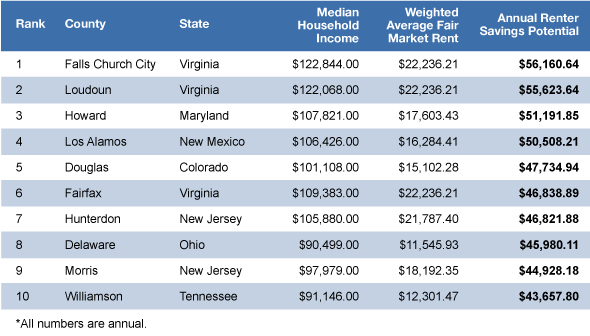

Top 10 Places for Potential Savings

These are the best places to live if you are looking for the maximum ability to save.

1. Falls Church, Virginia

Falls Church, Virginia measured as the top U.S. county for savings potential for renters. It is a city with a total area of just 2.0 square miles in the Washington Metropolitan Area that maintains independent county status. Falls Church residents enjoy a high quality of life and the highest median income of any U.S. county at $122,844. Falls Church renting households typically have a great opportunity to put money away with a savings potential of $56,160.

2. Loudoun County, Virginia

Loudoun County, Virginia was our second highest rated county with a renter savings potential of $55,623. This owes mostly to Loudoun County’s median income, which is the second highest in the country at $122,068.

Historically, Loudon County has been the “value” alternative to Fairfax County and as a result it is the fastest growing county in the DC metro area. Loudoun county is home to several industries including data centers, federal government contracting, aerospace, air cargo, information and communications technology and health services that provide its residents with a healthy take-home that puts them in a great position to save.

3. Howard County, Maryland

Howard County is located in central Maryland and is bounded in the north and northeast by the Patapsco River and in the southwest by the Patuxent River. Howard’s total area of 253.55 square miles makes it the smallest county in Maryland. With schools consistently ranked among the best in the nation, Howard County is a great place to raise a family as well as a great place to save with a savings potential for renters of $51,191.85.

4. Los Alamos County, New Mexico

Los Alamos County is a small, affluent county in northern New Mexico. Thanks to Los Alamos National Laboratory, Los Alamos County has high job stability, and one of the highest numbers of PhDs per capita in the country. In terms of per capita income Los Alamos County has the second lowest poverty rate in the United States. Los Alamos’ high median income allows renters there a savings potential of over $50,000.

5. Douglas County, Colorado

Douglas County, Colorado has the highest median income of any county in Colorado. Despite its high effective income tax payment of $4,681, Douglas’ 100k+ median income ensures there is plenty left for saving. Douglas County enjoys prime positioning for suburban commuters at the midpoint of Colorado’s two largest cities, Denver and Colorado Springs. Douglas’ location has generated a great deal of suburban development by commuters to those two cities that has begun to displace its traditional ranching economy.

6. Fairfax County, Virginia

Located at Virginia’s northern tip, Fairfax County is the most populous jurisdiction in the state. Fairfax County has an economy that revolves around professional services and technology. Many of its residents work directly or in contracted work for the United States government. Fairfax County is highly technologically oriented with a higher concentration of high-tech workers than Silicon Valley. The savings potential for renters is $46,838.89.

7. Hunterdon County New Jersey

Hunterdon County is located in Western New Jersey. Its county seat, Flemington is best known as the site of the Linbergh Kidnapping trial that captivated the nation in 1935. Today Hunterdon is a highly successful county comprised mainly of New York City commuter townships. While Hunterdon has the highest median property taxes in the nation, its relatively low effective state income tax payments of $2,964 make it very attractive to renters looking to save.

8. Delaware County, Ohio

Located directly at the heart of the Buckeye State, Delaware County was formed in 1808. Delaware is split by the Scioto River, the Olentangy River, Alum Creek and Big Walnut Creek waterways, which run north to south through the county. Delaware County is also home to one of the top universities in the state in Ohio Wesleyan University. For a county with a median income of over $90,000, Delaware has extremely affordable rental options with fair market rent averaging out to just $962.

9. Morris County, New Jersey

Despite its recent animal control issues, Morris County, New Jersey is still an incredibly safe place for saving, if not for swimming. The New York City commuter county has a median income of $97,979 and an overall savings potential for renters of $44,928.

10. Williamson County, Tennessee

Located just south of Nashville, Williamson County is Tennessee’s fastest growing county in both population and in job growth. Over half of the Nashville Region’s publicly traded companies including Nissan North America, CLARCOR and Community Health Systems reside in Williamson County. Williamson County is highly successful and educated with 52% of the workforce holding a college degree and a median household income of $91,146. Given the wealth of Williamson households, its fair market rent of $1025 is very affordable, allowing great savings opportunity.

What Neighborhood is the Best Fit For Me?

The Bottom Ten Places for Potential Savings

These are the ten places that, according to our study, give you the worst opportunity to save money.

1. Issaquena County, Mississippi

Issaquena County, Mississippi has the unfortunate distinction of being our worst county for renters looking to save. Located in the Mississippi Delta region of Mississippi, Issaquena rests directly in the land of the blues. Home to famous American musicians like Muddy Waters, Issaquena is rich in culture but has faced hard times recently.

While Issaquena’s median household income is just $24,474, its fair market rent is comparatively high at $1,235 per month. When factoring in taxes and other basic costs, Issaquena renting households have a savings potential of -$9,393. This means that it can be hard for a renter making the median income to even cover basic necessities.

2. Bronx County, New York

The Bronx measured as our second worst county for renters hoping to save as the median household, with an income of $34,300, faces a deficit of $8,194 after accounting for $1,714 per month in fair market rent, taxes and other necessary expenses. Despite its undesirable savings potential, the Bronx has shown many signs of positive growth. Between 2007 and 2012 private sector employment in the Bronx grew by 7.7%.

3. Wolfe County, Kentucky

Wolfe County is a Kentucky County situated squarely upon the Eastern Kentucky Coalfield. Like many counties in this area, Wolfe County has suffered economically in its transition from a focus on its mineral and timber resources to a focus on tourism. Wolfe County residents may find it difficult to save with its median household income of $21,168.

4. Greene County, Alabama

Greene County is a rural county in Western Alabama named after Revolutionary War general, Nathaniel Greene. Greene’s residents are most commonly employed in production, transportation and sales. While Greene historically has been home to strong agriculture in catfish, timber, beef, cotton and soybeans, today just 0.34% of its population is employed in farming, fishing and forestry. At present, Greene County renters are likely having trouble finding extra money to put away with a negative savings potential of $7,238.

5. Jefferson County, Mississippi

Jefferson, Missouri is a county located in eastern Missouri and comprises part of the St Louis Metropolitan Area. The vast majority of Jefferson County residents make a blue-collar living in trade, transportation, warehousing, utilities and manufacturing. While Jefferson has shown positive growth in employment, income and population, its median income sits at just about $20,000 and thus renting in the county is not currently conducive to saving.

6. Owsley County, Kentucky

Owsley is a Kentucky County also located in the Eastern Coalfield region. It is little surprise that saving is so difficult in the county as it has the lowest median income of any U.S. county. While the county has a seemingly affordable fair market rent of $670.49, a median household income of less than $20,000 means that residents likely face an uphill battle towards saving.

7. Taliaferro County, Georgia

With a population of just 1,717, Taliaferro County is the least populous in Georgia and one of the least populous in the country. Taliaferro is named for Benjamin Taliaferro, a colonel during the American Revolution as well as a legislator and a judge. In the 1880s and 1890s thousands of visitors came to the county for the reputed healing powers of the Electric Health Resort where it was said that exposure to bedrock in a subterranean chamber provided electrical healing powers. Today, however the median county household brings home less than $25,000 and must pay a fair market rent close to $1,000 per month.

8. Carter County, Missouri

Carter County is located in Southeast Missouri in the Ozark Foothills Region. Like many counties in the area, Carter County has an economy that formerly depended on timber and mineral resources. As those industries have become obsolete or less profitable or have found new means of production, Carter County has struggled while attempting to redefine itself. While its median income is higher than many of the counties towards the bottom of this list, Carter County residents are significantly hampered in their ability to save by a $5,517 effective state income tax payment.

9. Oregon County, Missouri

Oregon County is a Missouri County that borders Carter County to the southwest. Much like its neighbor, Oregon County has sought to transform its economy from a resource based one to include tourism to Mark Twain National Forest. Interestingly, Oregon County’s median income of $26,209 is less than that in Carter County, but a slightly lower fair market rent and state tax payment give it a small edge in savings potential.

10. Brooks County, Texas

Brooks County is located at Texas’ southern tip. The county’s location has placed it at the forefront of the fight over immigration reform. Unfortunately this position has made Brooks County the location of 37 of the record high 445 migrant deaths recorded last year. Unfortunately, for Brooks renting residents, their savings scarcely provide relief from this strife as the county’s savings potential calculates to -$5,901.81.

What Neighborhood is the Best Fit For Me?

More on the Methodology

To derive our savings potential data we began with median household income for each county from the US Census Bureau’s income survey and sought to subtract the cost of basic necessities. We applied yearly food, gasoline, vehicle insurance, public transportation and healthcare costs from the Bureau of Labor Statistics Consumer Expenditure survey for the appropriate US region. Next we found average monthly costs of electricity from the Energy Information Administration for the state the county is located in.

In order to determine typical yearly rental costs we took an average of one, two, three, and four bedroom fair rental prices from the United States Department of Housing and Urban Development weighted by the proportion of those types of homes across the US. We applied tax foundation data to Census Bureau median household income in order to calculate the proper state and federal income tax payment for the median household in each county. We determined median property tax payment by applying Census Bureau data on property taxes to our own data on median home value.

The savings potential represents the money that would be left to renters after meeting necessities with a median income.

Best and Worst Counties to Save Money (if You’re a Homeowner)

Photo Credit:© iStock.com/andresr, flickr