The straddle is an options trading strategy, so named for the shape it makes on a pricing chart; your position literally “straddles” the price of the underlying asset. With the straddle, you trade on the expectation of volatility. This position profits if prices change in a big way, and it tends to lose money if prices remain relatively stable. The advantage here is that you can profit whether prices rise or fall. The disadvantage is that you need significant volatility for this position to be profitable.

Consider working with a financial advisor as you explore using options and other derivatives.

What Is a Straddle?

A straddle is an options strategy, meaning that this is a position you open by buying or selling multiple options contracts. The goal of an options strategy is to create a position that has the greatest chance of closing profitably. The particular advantage of a straddle position (as with most options) is that it gives you fixed risk with potentially unlimited gains. You can never lose more than you spent on the contract premiums, but your profits can go as high as the market will bear.

To build a straddle, you buy a call option and a put option on the same underlying asset. Both options have the same expiration date and the same strike price, creating two contracts centered on the same point. If the asset’s price rises by the expiration date, you can make money off your call option. If the asset’s price falls by the expiration date, you can make money off your put option. This is called a “neutral” or “nondirectional” position because it profits whether the asset’s price rises or falls.

Remember that the expiration date of an options contract is the date on which you can execute the contract. The strike price of the contract is the price at which you can trade the underlying asset. So, an options contract gives you the right (but not the obligation) to trade a given asset, for a specified price, on a certain date.

Critically, because these are option contracts, you don’t have to execute the contract that closes unprofitably. If the asset’s price falls, you can simply let your call position expire without acting on it. The reverse is true for your put position. While most investors set the strike price of their straddle at or near the current price of its underlying asset, this isn’t necessary. You can set the strike price of the straddle to anything that seems profitable.

How to Create a Straddle

A straddle option strategy is created by simultaneously buying a call option and a put option with the same strike price and expiration date on the same underlying asset. This strategy is typically used when traders expect significant price movement in either direction but are uncertain about the direction of the move.

To implement a long straddle, an investor selects an at-the-money strike price, ensuring that both options have similar premiums. The profit potential is theoretically unlimited on the upside if the stock rises significantly, while the downside profit is capped at the strike price minus the premium paid if the stock falls. The maximum risk is limited to the total premium paid for both options, which occurs if the underlying asset remains near the strike price at expiration, causing both options to lose value due to time decay.

Conversely, a short straddle involves selling both a call and a put at the same strike price, aiming to profit from minimal price movement but carrying unlimited risk if the asset moves significantly. Straddles are best used in volatile markets, around earnings announcements, or major economic events that could cause drastic price swings.

Example of a Straddle

Say you are building a straddle around ABC Co.’s stock. You might open the following position:

- Call option, Strike price: $20, Expiration date July 1

- Put option, Strike price: $20, Expiration date July 1

You now have the right to buy ABC Co. stock on July 1 for $20 per share. You also have the right to sell ABC Co. stock on July 1 for $20 per share. So if the share price goes up past $20, your call option will make money. If it falls past $20 per share, your put option will make money.

How to Use a Straddle

So what’s the catch? Why would you ever trade anything but straddle options? The answer is premium fees. Since an investor doesn’t have to act on unprofitable contracts, the traders who sell options make their money by charging premiums for each contract.

The more likely it is that the contract will close profitably, the higher the premium. These premiums set the limit of your risk with a straddle. When you open your position you pay the contract premiums. From there you can’t lose any more money. This makes straddles, like many options positions, very good for risk management. You know your total exposure going in.

However, these premiums also create a window for profitability. It isn’t enough for the asset’s price to rise or fall. The price must change by enough that the gains of your call or put offset the premium you paid to open this position. This is what makes the straddle an investment in volatility. If the asset’s price changes only a little, you will still make money off one of your contracts but not enough to offset your up-front losses on the contract premiums.

However, if the asset’s price swings significantly, you can make equally significant profits.

A Straddle in Practice

Say that ABC Co. stock is trading at $50 per share. We expect that something is about to happen with this company, but aren’t sure what. So we will open a straddle position around this stock:

- Call option, Strike price $50, Expiration date Sept. 1, Premium $3

- Put option, Strike price $50, Expiration date Sept. 1, Premium $2

From this position, we can see that the market expects that ABC Co.’s price will probably rise (it’s more expensive to open a call contract than a put).

Since a single options contract involves 100 units of the underlying asset (here, shares of stock), we pay the following premiums:

- ($3 x 100) + ($2 x 100) = $500

It costs us $500 to open this position. This is called our “breakeven.” It is both the limit of the risk on this position, but it’s also the amount of money our position needs to earn before it becomes profitable. (For the sake of clarity, we will omit any commissions or broker-specific costs.)

In this case our breakeven is $45/$55. At these prices our put and call options (respectively) will offset the total premiums we paid and begin to make money. Inside the breakeven, the stock’s price has remained too stable and we will lose money.

For example, say that on Sept. 1 ABC Co. has shot up in price. Our contracts close with the stock trading at $60 per share. The put option closes out of the money, so we gain and lose nothing on it. Our final profits are:

- Call option: $60 – $50 = $10

- $10/share x 100 shares = $1,000

- $1,000 gains – $500 costs = $500

- We make $500 from this position

On the other hand, say that on Sept. 1 ABC Co. has dipped slightly. Out contracts close with the stock trading at $48 per share. The call option closes out of the money, so we gain and lose nothing on it. Our final profits are:

- Put option $50 – $48 = $2

- $2/share x 100 shares = $200

- $200 gains – $500 costs = -$300

- We have lost $300 from this position

In the first scenario, ABC Co. jumped by enough to offset our premiums. Our contracts close with the price of the stock price past the breakeven, and we make more money than we spent to open the straddle. In the second scenario, ABC Co. wasn’t volatile enough. Our put position still made money, but not enough to offset our initial costs.

Final Thoughts on the Straddle

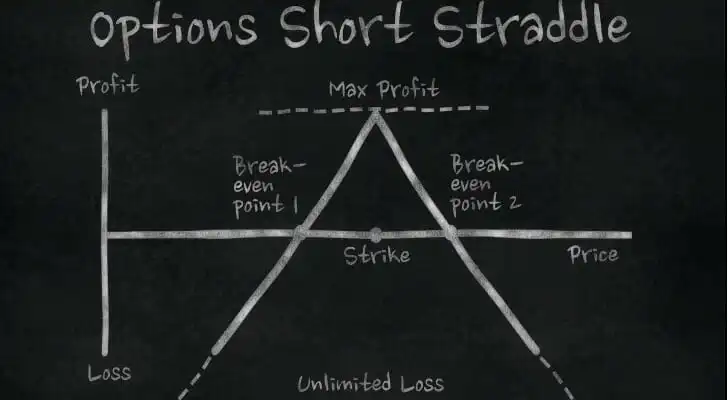

This article describes what is known as the “long straddle.” This means that you have bought contracts and opened the position. You can also create what is known as the “short straddle.” In this position, you sell the put and call contracts behind a long straddle. Just as a long straddle invests in volatility, a short straddle profits from stability.

You collect premiums up front and make money so long as the asset price stays inside the breakevens. However, unlike a long straddle, the short straddle has a fixed upside (the premiums you collect) and potentially unlimited risk. There’s no theoretical limit on how high that call contract can go.

Finally, the straddle is most valuable when you are convinced that something will happen but aren’t sure exactly what. By opening both positions at once you do hedge your bets, but you also double your costs. If you have a sense of which direction the asset will go, you can often make more money by simply buying a single put or call contract.

Bottom Line

A straddle option strategy is a market-neutral position designed to profit from significant price movements in either direction, making it ideal for traders expecting volatility but uncertain about the direction of the move. This strategy involves buying both a call and a put option with the same strike price and expiration date on the same underlying asset. The key advantage of a straddle is that it allows traders to benefit whether the asset’s price rises or falls, as long as the movement is substantial enough to cover the cost of both options (the combined premium paid).

Tips on Investing

- Learning about sophisticated positions like the straddle option is exciting, and any investor would be tempted to jump right in and try these strategies out. Finance, after all, is more rock-and-roll than it gets credit for. Before you jump in consult a financial advisor. Finding a financial advisor doesn’t have to be hard. SmartAsset’s matching tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Are you thinking about selling securities? Consider using our capital gains tax calculator to find out how much your tax bill will be from the sale. Knowing your tax liability can help you make an informed decision about selling.

Photo credit: ©iStock.com/sturti, ©iStock.com/hobo_018, ©iStock.com/Vladimir Zakharov