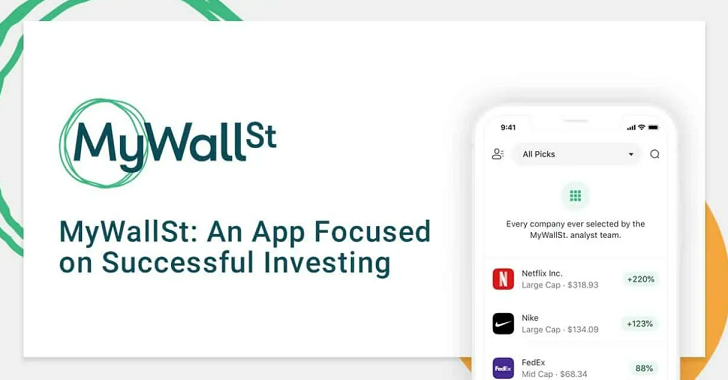

MyWallSt is an online stock-picking service designed to help users build and manage their stock portfolios with expert insights and educational tools. Catering to beginner and intermediate investors, the platform offers stock recommendations, market analysis, and a user-friendly app for tracking investments. With a strong emphasis on financial education, it aims to simplify the investment process while guiding users toward high-quality growth stocks. If you’re looking for more holistic financial advice, consider matching with a financial advisor.

MyWallSt Overview

| Pros | – Highly rated mobile app – Historically great stock picks |

| Cons | – No proprietary trading platform – Limited research tools |

| Best For | – Those who want stock picks – Investors with existing brokerage accounts |

| Drawbacks | – Very simplistic |

Fees Under MyWallSt

While MyWallSt isn’t exactly packed with features, one place where it excels above the competition is when it comes to fees. However, it’s important to remember that its fee schedules will be different than those of a traditional brokerage service. Since MyWallSt doesn’t have a proprietary trading platform, it does not impose fees on trades or transactions associated with your brokerage account.

The only thing you’ll pay for directly when it comes to MyWallSt is stock picks. MyWallSt has four different levels of service – only one of which (Horizon by MyWallSt) is available as a $69 per month subscription. The most basic service, Invest by MyWallSt, costs $99 per year, while the Invest+ also costs $99 per year (reduced from $199 per year). An annual subscription to Horizon by MyWallSt is priced at $699, while MyWallSt’s most premium offering, Nexus II, costs $1,299 per year.

MyWallSt: Services and Features

MyWallSt offers a structured approach to investing, with four service levels catering to different experience levels and investment goals. Each tier provides varying degrees of guidance, stock recommendations and market insights.

- Invest: The entry-level plan provides stock recommendations, educational resources, and a user-friendly app designed to help users build long-term portfolios with ease.

- Invest+: Expands on Invest, offering premium stock analysis, deeper market insights and additional recommendations to help users refine their investment strategies.

- Horizon: Designed for long-term investors, this tier provides exclusive stock picks, in-depth research and strategic guidance for building wealth over time.

- Nexus II: MyWallSt’s top-tier service, featuring advanced stock research, macroeconomic analysis and exclusive insights from financial experts.

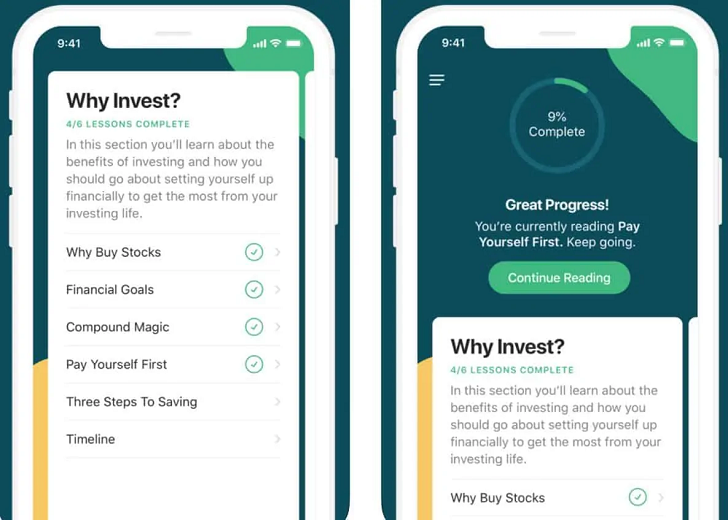

In addition to its tiered services, MyWallSt emphasizes financial education, providing users with investing courses, expert commentary, and a curated selection of high-growth stock ideas. The platform may be particularly useful for those who prefer a buy-and-hold strategy over short-term trading. Whether you’re a beginner or an experienced investor, MyWallSt’s structured approach helps users navigate the stock market with informed decision-making.

If you’re interested in getting more in-depth market research out of your MyWallSt account, consider checking out Learn by MyWallSt. Learn is a separate app that provides more in-depth analysis of markets and stock picks. It gives users access to 40 investing lessons written by the company’s investment team.

MyWallSt: Online and Mobile Experience

MyWallSt is primarily available as a mobile-based experience. The app earns high marks on both the Apple and Google app stores. The app has an average of a 4.1-star rating on the Google Play store and an average rating of 4.6 stars on the Apple app store.

The MyWallSt app is straightforward and easy to use, though partly due to its limited detail and features. Therefore it’s hard to get lost in a barrage of features. It’s easy to see your portfolio as well as buy and trade, if you choose to link your account. It’s also easy to see your watchlist and, of course, see the stock picks provided by MyWallSt that you’re paying for to begin with.

While MyWallSt is mobile-based, you can still access your account, as well as Learn by MyWallSt, on your desktop computer. The user experience is similarly straightforward, and most users likely won’t have much difficulty navigating the platform.

What’s the Catch?

The biggest drawback when it comes to MyWallSt is functionality. While it’s a great option for anyone looking for a paid stock-picking service, you won’t get much more out of it. It’s not a brokerage service, so while you can link an existing brokerage account, the functionality you’re paying for with MyWallSt is simply one stock pick per month, a watchlist, resources from Learn by MyWallSt and a platform to execute trades through your existing brokerage account.

While some may see stock picks as a worthy investment, it’s easy to make the case that your money might be better spent paying for a brokerage service that provides research resources that you can use on your own. Make sure you fully understand the scope of services available through MyWallSt before paying for its services.

How MyWallSt Compares to Other Companies

If you’re comparing MyWallSt to brokerage companies, it doesn’t stack up much at all, mainly given the fact that it isn’t in and of itself a brokerage platform. It’s better to compare MyWallSt with other stock-picking platforms, such as Motley Fool’s Stock Advisor. MyWallSt is cheaper on average, costing $99 for a year-long plan. However, MyWallSt only gives one stock pick per month. Stock Advisor, on the other hand, provides two new picks per month and some additional features, but at a regular annual price of $199 annually. (However, Stock Advisor was being offered at a reduced price of $99 per year for one year, as of February 2025.)

Bottom Line

MyWallSt isn’t packed with features, but it’s a solid option for anyone looking for a stock-picking services that can help them earn long-term returns on their investments. Some of MyWallSt’s stock picks have grown in value by hundreds or even thousands of percentage points. While it’s possible to conduct this stock research on your own, MyWallSt provides it for you while also letting you link an existing brokerage account and trade directly on the app.

Investing Tips

- Investing and picking stocks for your portfolio can be difficult at times, so having a financial advisor in your corner can be helpful. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’re going at your investments by yourself, it pays to be prepared. Check out SmartAsset’s asset allocation calculator to review how your portfolio’s asset allocation compares to a standard setup.

Photo credit: ©iStock.com/mywallst.com, ©iStock.com/tradingreview.net, ©iStock.com/daytradereview.com