As more people start traveling after a two-year pandemic, many investors are looking at a revival in the car rental sector for new investment opportunities. One of the biggest companies in this sector is Hertz. Let’s break down how to buy stock in this car rental company and what to look out for before investing.

A financial advisor could help you create a financial plan for your investment needs and goals.

What Is Hertz Stock?

If you’ve ever rented a car at the airport, chances are you’ve seen the Hertz counter. Hertz Global Holdings, Inc. is a popular car rental and leasing company. It was founded in 1918 and is currently headquartered in Estero, Florida.

The company was originally based in Chicago, where it opened its doors with a fleet of 12 cars. Now, in addition to renting vehicles, the company also sells cars and has locations around the world.

Where Does Hertz Stand?

Hertz has grown considerably over the last century, generating $2.2 billion in total revenues for the third quarter of 2021.

That’s a sharp contrast to its recent bankruptcy filing in 2020. The bankruptcy seemed from pandemic pressures that hit Hertz in two ways. First, the demand for rental cars dropped when travel slowed. Second, the demand for used vehicles temporarily dropped as well. The double hit led to a bankruptcy filing.

After these major financial problems in 2020, some investors believed that Hertz could be poised for recovery with the uptick in travel in a post-pandemic era. But with rising prospects of recession, the return of the travel industry could be a wish that doesn’t come true. Rising gas prices coupled with high inflation might make a rental car a low priority for many would-be travelers. The increased pressure on budgets could lead many to cut discretionary travel out of their budgets.

Finally, the company is facing lawsuits from hundreds of renters who allege that Hertz had them falsely arrested for alleged failure to make payments. If the plaintiffs prevail, the company could end up having to pay hundreds of millions in damages.

How to Buy Hertz Stock in Five Steps

If you’re ready to buy Hertz stock, here are five steps to follow:

- Research the stock: Before jumping into this investment, make sure the value of the stock works for your portfolio goals. While past performance will inform your decision, keep in mind that it isn’t a guarantee for future success.

- Determine the best brokerage platform: If you don’t already have a brokerage account, then it’s time to weigh out all of the options for your needs. The perfect fit will depend on your investment preferences, but it should strike a balance between access to the investments and reasonable fees for handling transactions. SmartAsset breaks down of the best brokerage accounts.

- Open a brokerage account: After weighing your options, you’ll need to provide key personal information and banking details to fund the account that you picked. SmartAsset’s guide walks you through the steps to open a brokerage account.

- Purchase the stock: Once you’ve opened a brokerage account, you can find Hertz stock with the ticker symbol (HTZ). Then, within your account, you can choose the number of shares you want to purchase. In some cases, you can create an order to make the purchase when the stock hits a certain price point. But make sure to factor in fees when making your purchase.

- Monitor your investment: After you add this stock to your portfolio, the journey doesn’t end there. In fact, you might think of this as the beginning. You should monitor the stock to make sure it remains a good fit for your portfolio. If not, don’t hesitate to sell it.

Is Hertz the Right Investment for Your Portfolio?

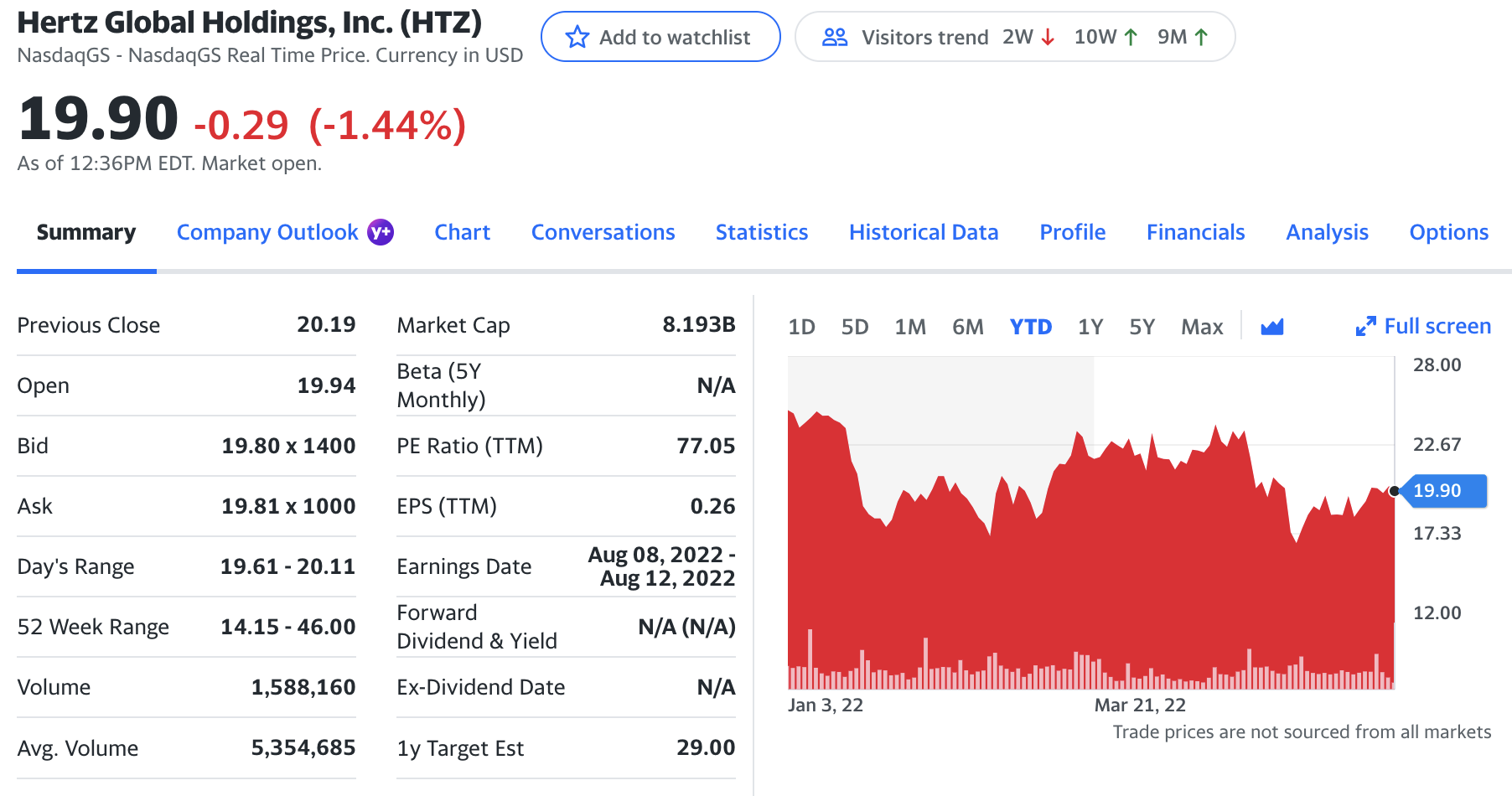

While Hertz shares were valued just under $20 in June 2022, the stock was trading with a 12-month trailing price-to-earnings ratio (PE) in the high 70s. Some investors might find that a bit expensive, especially when compared to the S&P 500’s current levels in the mid to upper teens. It’s also more than 10 times the PE of rival Avis.

Another consideration has to do with your asset allocation. Specifically, it depends on what percentage – if any – of your portfolio you want in mid-cap stocks. With its $8.14 billion market capitalization, the shares fall into the mid-cap range, which is $2 billion to $10 billion.

You may also want to take into account the amount of debt Hertz still holds, something that could be artificially increasing its return on equity. The company is not currently paying a dividend.

Keep in mind, too, that if you’re bullish on the rental car sector, you could invest in a fund that owns shares of several rental car companies rather than investing in a specific one.

Bottom Line

After a two-year pandemic, and with more people traveling, investors are looking for new investment opportunities in a revival of the car rental sector. However, the warning signs of a recession may stall the long hoped-for return of travel. Ultimately, whether or not Hertz is a good fit for your portfolio will depend on your investment needs and goals.

Investment Tips for Beginners

- A financial advisor could help you build out your portfolio. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAsset’s free asset allocation calculator can help you map out your portfolio investments based on your risk tolerance.

Photo credit: ©iStock.com/anouchka, ©iStock.com/tupungato,©iStock.com/Yahoo Finance, ©iStock.com/ollo