If you had to name one company that exemplifies American ingenuity, taste for fun and market domination, many would say it’s the Walt Disney Company. An iconic part of the collective American childhood, the company is more than just Mickey Mouse. The business also owns ABC, ESPN, National Geographic and streaming services, on top of the largest theme parks in the world, as well as themed cruises and prolific movie studios. While Disney stock was hit quite hard during the COVID pandemic, it has rebounded since then.

Talk to a financial advisor today about how to create an investment plan for the future.

How to Buy Disney Stock

Direct Investment

Through a partnership with Computershare, you can buy Disney stock via The Walt Disney Company Investment Plan. Once you open an account, you can buy and sell stock online or over the phone.

As far as specifics go, you can check out the Disney plan prospectus on Computershare’s website. The minimum one-time investment for new shareholders is $250 or a recurring $50 at least five times, while the minimum for existing shareholders is $50 for one-time purchases or recurring ones. There is a $20 initial set-up fee, $7 check fee, $0.02 per share processing fee, $1 fee for one-time investment or recurring investment, $20 fee for batch sales and $25 fee for market order sales. This plan is available only to residents in the U.S., in U.S. territories and in Canada.

Brokerage Account

For those looking for a one-stop-shop for investing in Disney and beyond, a brokerage account could be the way to go. These accounts afford investors direct access to the investment market, including Disney stocks, ETFs, bonds and much more. Brokerages typically offer online trades, broker-assisted trades and over-the-phone trades. The more help you require, the higher the fee you’ll see. But if you feel comfortable trading online, you can avoid paying commissions at many major brokerages.

Once your investment funds are deposited, there are a couple of different trade execution routes you can take. The first, and simplest, option is to complete a market order, which means you’re buying shares at the price when the order is processed. Investors who have a set price in mind, though, can institute a limit order. This will ensure that shares are purchased only at the specified price. Or investors who want to limit any losses can place a stop-loss order, where a stock will be sold or bought when it broaches a specified price level.

Brokerage Comparison

| Brokerage Firm | Trading Fees | Minimum | Best For |

| Robinhood Read Review | $0 | $0 | – Mobile/online traders – Self-sufficient investors |

| TD Ameritrade Read Review | $0 | $0 | – Online traders – Customers who value support |

| Merrill Edge Read Review | $0 | $0 | – Bank of America account holders – Customer support junkies |

Financial Advisor

Investing your hard-earned cash in stocks can be nerve-racking. As you might expect, many financial advisors have experience handling the execution of equity trades. Therefore, investing newbies may feel more comfortable consulting with a financial advisor prior to physically making a purchase. Although this could be a slightly more expensive way of becoming a Disney shareholder, if it helps to ease your mind, it might be worth it.

Overview of Disney

You’ll find Disney’s footprint throughout the global entertainment business. In fact, it owns media networks, amusement parks, retail stores, film studios and more. Aside from Disney’s massive U.S. presence, the company operates in Asia, Europe, the Middle East, Africa and the Pacific. Take a look at some of its most notable holdings:

The Walt Disney Company

| Media | – ABC – ESPN – Disney Channel – FX – National Geographic – Freeform |

| Film Studios | – The Walt Disney Studios – Walt Disney Animation Studios – Pixar Animation Studios – Lucasfilm Ltd. – Marvel Studios – Disney Music Group – 20th Century Studios – Searchlight Pictures |

| Parks and Entertainment | – Walt Disney World – Disneyland – Disney Cruise Line – Hong Kong Disneyland – Disneyland Paris – Shanghai Disney Resort – Tokyo Disney Resort |

| Retail | – Disney Store |

Disney’s Financial Profile

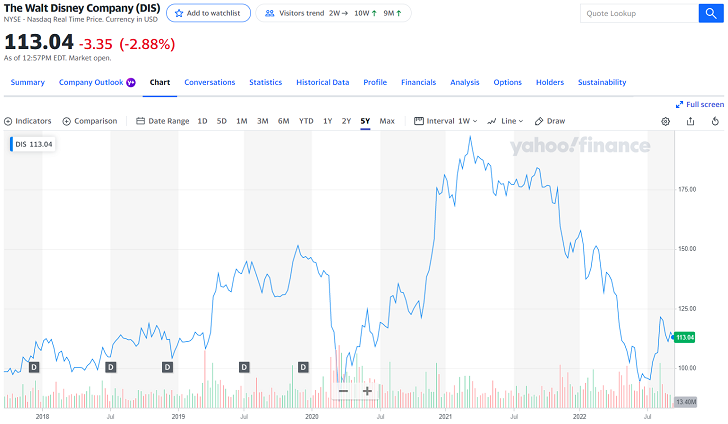

(Past performance does not indicate future results. Chart from Sep. 2022.)

The general consensus across the market is that Disney stock is a blue-chip investment. This title is given to large companies that have performed well financially for some time and show no signs of slowing. Blue-chip stocks are about as reliable an equity investment as there is, but they aren’t immune to dips. So although Disney is a staple in the entertainment sphere, it can still see adverse effects. For reference, other blue-chips include Facebook and Walmart.

According to a report from Howmuch.net, a “$1,000 investment in Disney in 2007 would be worth $2,824” after 10 years. The report further details that this return outpaces that of Coca-Cola, Walmart, Microsoft and McDonald’s during the same time frame.

Should You Buy Disney Stock?

There is always an inherent risk when you buy into an investment, even with a blue-chip stock like Disney. Unlike exchange-traded funds (ETFs) and other index funds that track the overall performance of a collection of securities, the value of an equity is driven by the earnings of a single company. This creates much more volatility, even with the performance of a stock like Disney.

For example, when Disney releases another entry in the Star Wars series, you may see the its stock price jump. On the other hand, when the COVID pandemic forced Disney to close its theme parks, things shifted dramatically in the other direction. In other words, you’ll likely encounter volatility with any stock, so you must decide whether that’s a risk you can stomach.

Tips for Investing

- A financial advisor can help you create an investment and financial plan for the future. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- If you’re not comfortable picking individual stocks, consider buying an exchange-traded fund (ETF) instead. These baskets of stocks have the diversification of a mutual fund, but trade like stocks. You can choose from different sectors and market caps.

Photo credit: ©iStock.com/RinoCdZ, Yahoo Finance, ©iStock.com/danielvfung