Finviz is a browser-based platform offering a free stock screener, market research, financial news and more. Most of its services are free, but it also offers a subscription package with enhanced features like that allow you to test your trading strategies before deploying them in the real world. We’ll explore the benefits of Finviz as well as its drawbacks to help you decide if its the right choice for you. If you want additional hands-on investing guidance, check out SmartAsset’s financial advisor matching tool to find an expert in your area.

Finviz Overview

Finviz is a website that brings together market data, financial news and analytics tools for investors and traders. Most of its features are either free or require registration. The latter simply means you hand over your email address. The upgrades remain free.

But to get everything Finviz has to offer, you must sign up for its Elite version. That subscription currently costs $24.96 a month.

Below, we discuss Finviz features as well as their benefits.

Finviz Features

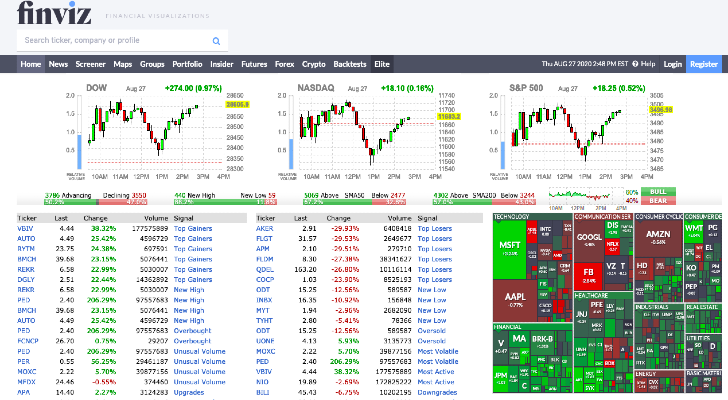

Stock Screener: One of the site’s most popular features is the stock screener. You can use this tool to filter stocks based on specific criteria such as price, market capitalization, dividend yield and more. The website breaks down these criteria into descriptive, fundamental and technical categories. Below are some examples of what you can use to filter the stock market.

- Exchange type

- Industry

- Sector

- Index

- Performance

- Beta

- Average volume

- IPO Date

Maps: This section provides visuals to help you understand how the stock market is performing at different time intervals. Those time frames extend from the past day to the past year. The website breaks down these color-coated maps into three categories: The S&P 500, exchange-traded funds (ETF) and the world market. For each, Finziz provides more layers of customization. For instance, the site breaks down data on S&P 500 stocks by industry and provides quotes. Access to these maps is free, but information is delayed for three to five minutes. Finviz Elite provides data in real time.

Groups: This section displays graphs that break down performance data based on specific categories like economic sector, industry and country. You can filter each of these categories for factors like dividend yield and earnings.

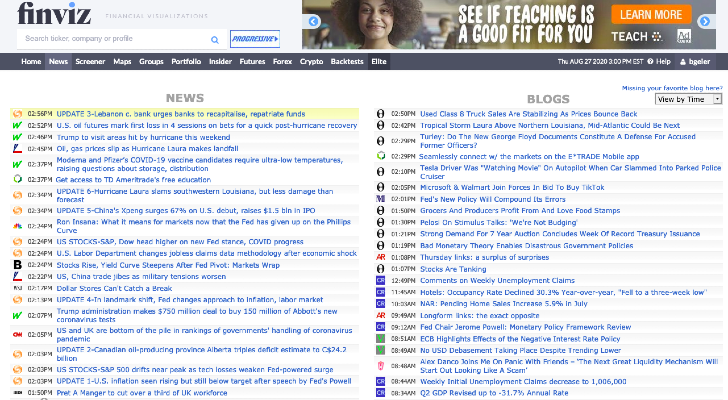

News: The news tab offers the latest financial content and blogs from sources like Reuters, The New York Times and Market Watch.

Portfolio: Access to this service requires registration, but it remains free. You can use this platform to simulate building a portfolio by buying and selling stocks at different prices depending on time period.

Insider: You’d also need to register with Finviz to access to insider platform. This tab offers a glimpse into insider transactions. It provides details like the type of transaction, date, cost, number of shares and more. You can also see the top insider trading for the most recent week.

Futures: This tab gives investors a look at how the futures market is doing. Color-coded charts and quotes help you visualize which are performing well and which aren’t.

Forex: This section gives investors a snapshot of how currencies throughout the globe are performing in real-time. Here too, color-coated charts help you digest data easily and efficiently.

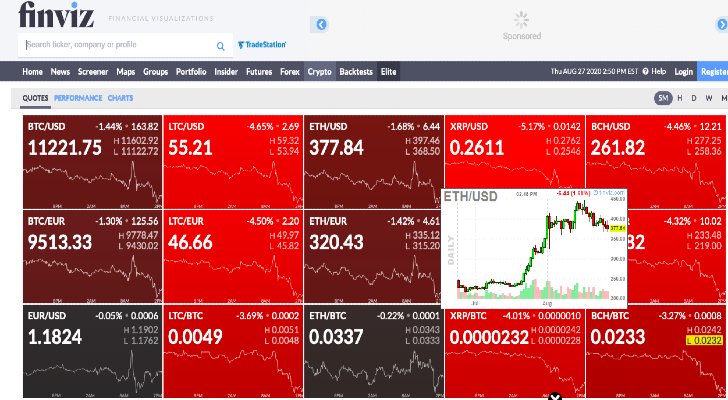

Crypto: This tab is very similar to the futures and forex sections. It simply provides you with quotes and graphics detailing the performance of different crypto currencies.

Backtests: Available to Elite customers, the Backtests platform helps you evaluate and test trading strategies before pursuing them in the real market. It provides more than 100 technical indicators and 16 years of historical data. This is one of several advanced features that come with the Finviz elite package.

Finviz Pricing

Most of the features offered by Finviz are free. Access to its portfolio section, however, requires registration. But you won’t need to fork out any cash at this point. You simply register with Finviz by providing your email address.

Some of its free features are limited, however. Quotes, charts and maps are delayed for three to five minutes. You also can’t export or save anything you gather. For real-time data and exporting capabilities, you’d need a Finviz Elite account.

The Elite service is currently priced at $24.96 per month.

It gives you access to back-testing capabilities and the firm’s proprietary correlation algorithm. You can use it to find stocks that may be correlated or inversely correlated in order to diversify risk.

In addition to bonus features, the Elite version also enhances some of its free components. For example, you get the following:

- Intraday charts

- Drawing tools

- Performance comparison charts

- Overlays and indicators

- Stock screener export capabilities

You can also follow stocks more closely with advanced notification features. Finviz will notify you of any news or changes regarding a particular stock or portfolio.

All of the elite features also come ad-free. With the free version, brief video ads pop up throughout.

Finviz: Who Should Use It?

Beginner investors and traders will find the website’s free features very useful. It can serve as a comprehensive focal point for a lot of the market research you’re going to want to dive into as you test the waters of investing.

Traders, in particular, will find the stock screener especially helpful. You can use it to find stocks that may have a high potential to see sharper-than-usual price moves in the next few days or weeks. Traders can also use Finviz to examine the performance movements of ETFs, futures and options.

But individual investors will find Finviz useful as well. Value investors can use the screener to filter stocks based on price-to-earnings ratios, price-to-book ratios and more. Furthermore, those looking to invest in penny stocks can narrow securities based on market capitalization. They can then evaluate performance. And of course, dividend investors can scan the market easily to find dividend-paying stocks that are doing well.

Overall, the stock screener serves as a great tool to help you analyze the stock market and make wise investing or trading decisions.

In addition, the site’s heat maps can be particularly useful for getting a glimpse into the current state of different sectors, industries and even currencies.

Finviz Cons

When it comes to Finviz, there isn’t much to criticize. While it doesn’t offer the flashiest stock screener around, its tool is surprisingly customizable for a free platform. For a monthly fee, you can get everything Finviz has to offer. But it’s not that much of a stretch from its free services. So, seasoned investors and traders may want to look at more complex platforms when it comes to paid services.

And while the ads on the free version can get annoying, you’re accessing tools that most larger firms charge hefty fees for.

That’s not so say you won’t find better features with other free services. The free stock screener by Zacks, for example, offers some more functionality. With this service, you get to choose exact figures as opposed to predetermined ones from a drop-down menu as is the case with Finviz.

The Takeaway

Finviz storms out the gate with some very useful features you can access free of charge. Any beginner investor and day trader can find the stock screener especially helpful. It also offers interactive maps and a financial news hub to support your market research strategies. While some of this data is delayed for non-paying customers, it’s still very useful. The Elite version clocking in at about $25 a month gives you some more analytical tools that you can use to simulate investing and trading strategies. The website is user-friendly overall, but not your only option. Still, Finviz can serve as one of many tools under your investing belt.

Tips on Boosting Your Investing Game

- As you go about making some shorter term investment decisions, don’t forget to start early to invest for the long term. The sooner you start saving for retirement, the longer you’ll have to reap the rewards of compound interest from your 4o1(k) or IRA.

- The world of investing can be extremely complicated, but you don’t have to jump in alone. A financial advisor can help you make the right decisions based on your personal financial situation and goals. We can help you find the right fit. Our financial advisor matching tool connects you with local financial advisors. The platform also provides you with their profiles, so you can compare qualifications before moving forward.

Photo credit: All courtesy of Finviz