Today we launched SmartAsset. It’s only been a few weeks since our first office hours at YCombinator this summer, where Paul Graham took a long look at our beta designed to provide personalized advice to first time home buyers, furrowed his brow and asked, “So how is this better than a financial calculator?”

Find out now: How much house can I afford?

Our Case

Noting that we thought our new modeling technology was to the financial calculator what the cell phone was to the beeper, our answer was simple: all advice competes on two playing fields, i) quality / accuracy and ii) the ease at which that advice is understood or acted upon. (As a side-note our cell phone / beeper quip was met with a blank stare – as advertised, YC partners are impervious to marketing speak).

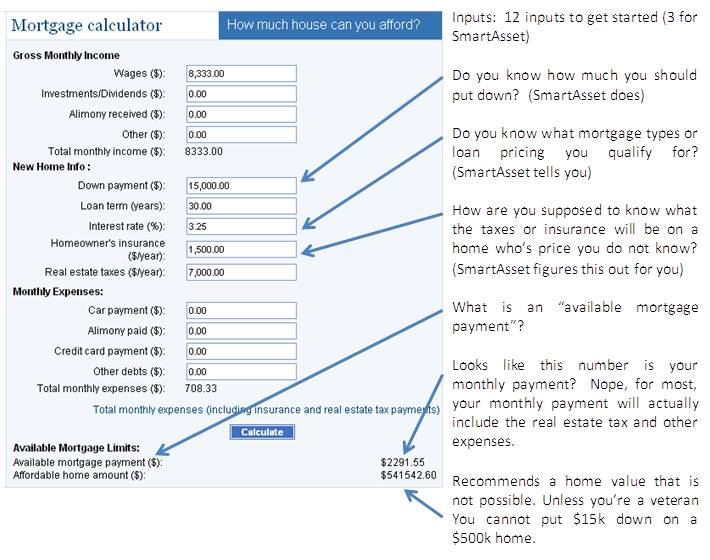

And so we made our case: financial calculators are wildly inaccurate (example below), rely on the user for inputs most will not know (do you know your marginal tax rate?) and, probably most importantly, do not produce very helpful output.

We solve all of those problems: our tech platform models decisions to provide deeply personalized and accurate advice. We house huge amounts of tax, transaction and financial product data so you don’t need to answer questions you don’t know the answer to (that’s our job) and we’ve created a super interactive interface specifically designed to be easily digested.

But PG needed more, “but banks build financial calculators”.

Yes PG, yes they do.

“So how can they be so wrong?”

—

It’s not too hard to demonstrate the weaknesses in financial calculators, and to be clear they are not built exclusively by banks (example below).

More interesting though, is to try and understand why decisions like home–ownership are so complicated in the first place. Why are there so many mortgage alternatives, mortgage insurance alternatives and financial product add-ons, like points? Why when I went to buy a home did I feel like someone was speaking a completely different language (and I worked in finance): sir, you can either get a 5 by 1 ARM, with two points (tax deductible) at an interest rate of 4.175% or an FHA 30 yr fixed with 1.5 points at a rate of 4.375% – but for the FHA you should note that the APR is actually 4.875%, got it?

No, not really.

So I started doing some homework. After some digging I found, not too surprisingly, that many financial services companies embrace complexity. When you’re selling something as fungible as money (mortgages) it turns out that complexity can be a useful tool in differentiating your products and services from a competitor’s while making it look cheaper than it is. The practice is so common it is actually studied by economists, they call it shrouding.

Looking at the weakness of financial calculators, it became clear that there was not much of an incentive for the industry to provide better decision making tools.

We’re not the only people that think so. Speaking after an analysis of a range of financial calculators, The Chief Economist at NMHC, Mark Obrinsky, said, ‘we found that most [financial calculators] are seriously flawed, with a bias toward ownership… The result is that consumers who rely on these tools may make one of the most important decisions of their lives based on misleading data, and the firms who include them on their web sites may be pushing would-be renters into ownership.’

Unfortunately, the willful complexity noted above is not limited to home ownership. We believe it exists in almost all important financial decisions.

So what do we do about it?

Cue SmartAsset.

We believe sunlight is the best disinfectant. Using our financial modeling technology to offer unparalleled transparency, we intend to be your first point of reference for all important financial decisions. One place, where you can answer all of your questions, address all of your concerns and remove the anxiety created by unfamiliar jargon and complex financial consequences.

Example: Financial Calculator:

Just so you know we are not cherry picking this is the highest rank Google return for home affordability. It’s actually one of the better ones.