The majority of Americans find meeting their retirement goals a challenge. After all, the financial world is complicated. Many Americans miss the opportunity to save, which means they miss the chance to invest – whether that’s alone or with the expert guidance of a financial advisor. Without the gains from investing, it is almost impossible to save enough for retirement. Census Bureau data shows that retirement-aged Americans across the country struggle to find affordable housing.

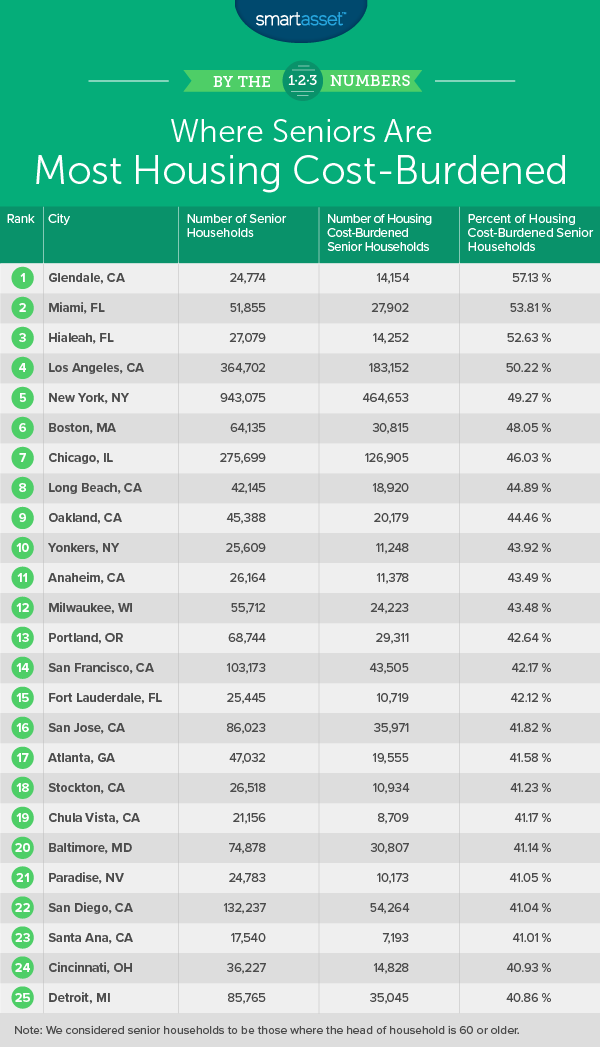

For this study, we looked at data on how much seniors spend on housing. Specifically, we look at the number of senior renters and homeowners who spend at least 30% of their income on housing. According to the Department of Housing and Urban Development, those who spend 30% or more of their income on housing are considered housing cost-burdened. Check out our data and methodology section below, to see where we got our data and how we put it together to create our final ranks.

Key Findings

- Seniors who rent are more likely to be housing cost-burdened – Across the 100 cities we analyzed, seniors who rent were over twice as likely to be housing cost-burdened as senior homeowners.

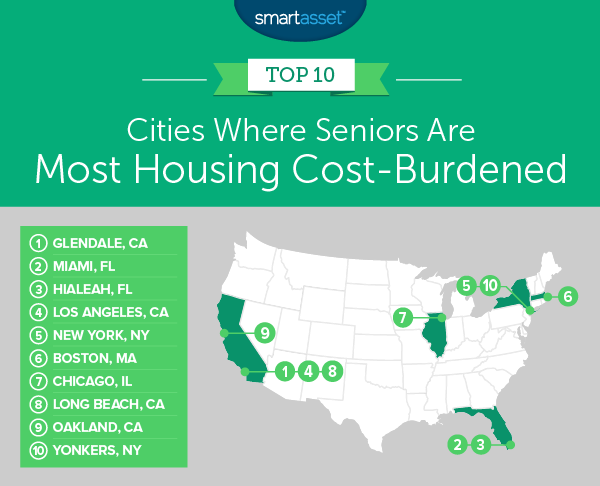

- Seniors in big cities struggle – The top 10 cities with the highest rates of housing cost-burdened seniors have an average of 186,400 senior households. The bottom 10 cities (where seniors are least likely to be housing cost-burdened) have an average of 38,100 senior households.

1. Glendale, California

More seniors in Glendale are housing cost-burdened than in any other city in the study. According to our data, there are around 24,800 senior households in Glendale. Of those, nearly 14,300 spend at least 30% of their income on housing. That means just under 58% of Glendale senior households are housing cost-burdened.

2. Miami, Florida

Miami has the fourth-most senior households in our analysis at 51,855. According to our analysis of Census Bureau data, the majority of those households are housing cost-burdened. Specifically, we estimate that 53.3% of seniors in Miami are housing cost-burdened.

One reason Miami climbed the ranks was the large percentage of seniors in Miami who rent. Our analysis shows that renters in general are more likely to be housing cost-burdened and 56% of seniors in Miami rent.

3. Hialeah, Florida

Another Florida city takes the third spot. In the past we have found that Hialeah residents struggle mightily with housing costs and this city topped our study on severely housing cost-burdened homeowners.

For the most part, seniors here share the same fate as homeowners. We estimate that 53% of all seniors are housing cost-burdened, and 41% of senior homeowners are housing cost-burdened. For percent of senior homeowners who are housing cost-burdened, Hialeah ranks second in the top 10.

4. Los Angeles, California

Just like in other cities in our top 10, seniors in Los Angeles need lots of support when it comes to affording housing. However, L.A. is a unique city in our top 10. Only 64% of seniors who rent in the City of Angels are housing cost-burdened, the third-lowest rate in our top 10.

This city climbs the ranks thanks to the relatively high proportion of senior homeowners who spend at least 30% of their income on rent. We estimate that over 42% of senior homeowners in L.A. are housing cost-burdened, the highest rate in the top 10.

5. New York, New York

New York is one of the most expensive places to live in the country. This puts seniors in a precarious position. There is not a lot of wiggle room when it comes to retiring in the Big Apple so planning is paramount. According to our analysis of Census Bureau data, roughly 49% of New York seniors are housing cost-burdened.

6. Boston, Massachusetts

Boston has 64,100 senior households, the second-most in our top 10. Our analysis of Census Bureau data shows that 45.4% of those households are housing cost-burdened.

The city is split almost evenly between seniors who choose to rent and seniors who are homeowners. Thanks to the high share of renters, you might expect Boston to appear higher on this list. However, Boston seniors who rent do better than average when it comes to finding affordable rentals. According to our data, only 57% of seniors in Boston who rent spend 30% or more of their income on housing.

7. Chicago

Chicago takes the seventh spot. Overall, we estimate 46% of senior households here are housing cost-burdened. For the most part, seniors in Chicago tend to be homeowners, which helps keep the overall senior housing cost-burdened rate lower, but not low enough to keep it out of the top 10.

We estimate that 34% of seniors homeowners are housing cost-burdened. One reason why this number may be so high is the above-average Illinois property taxes which homeowners pay.

8. Long Beach, California

Long Beach is a nice place to live, with access to beaches and good weather. But that livability comes with a high cost of living. The Census Bureau estimates that the median home costs $1,323 per month, while the median rental costs $1,194.

Whether renting or buying, seniors in Long Beach dedicate a significant chunk of their income to housing. All told we estimate 47% of seniors in Long Beach spend at least 30% of their income on housing.

9. Oakland, California

The ninth city on our list is Oakland, California. Oakland has 45,400 senior households, and around 20,100 of those spend at least 30% of their income on housing. Seniors in Oakland are more likely to own than rent. Census Bureau data shows that 57% of senior households are owner-occupied.

Renters and homeowners face relatively similar rates of being cost-burdened in Oakland compared to other cities. Just over 57% of senior renters and 34% of senior homeowners spend at least 30% of their income on housing.

10. Yonkers, New York

Seniors and renters in Yonkers struggle with housing at similar rates. Overall, there is only a 15.4% difference between the percent of senior renters who are housing cost-burdened and the percent of senior homeowners who are housing cost burdened, the lowest figure in our top 10.

A leading reason for this is the high average property taxes in New York. That means even seniors who have paid off their mortgage will be paying a decent chunk on property taxes. In total, we estimate 43.9% of seniors in Yonkers are housing cost-burdened.

Data and Methodology

In order to find the places where seniors are most housing cost-burdened, we looked at data for the 100 cities with the largest number of senior households. Specifically, we looked at the following two metrics to create our final rankings:

- Number of senior households. This is the number of households where the head of the household is age 60 or older.

- Number of housing cost burdened senior households. This is the number of senior households who spend at least 30% of their income on housing costs, including rent and ownership costs.

To create our final ranking, we divided the number of housing cost-burdened senior households by the total number of senior households. This gave us the percent of senior households who are housing cost-burdened. We then ranked all the cities using that number. The city with the highest rate of housing cost-burdened senior households ranked first, while the city with the lowest rate ranked last.

Tips for Hitting Your Retirement Goals

- Working with a financial advisor can help you hit your retirement goals. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Depending on your situation homeownership may not make sense, but if you can manage to pay off your mortgage before you retire, that can help put you on a solid retirement foundation. Without a mortgage, your housing costs will be greatly reduced, lowering the retirement savings you need.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/Wavebreakmedia