Around 30% of workers nationwide do not have access to an employer-sponsored retirement plan, according to Bureau of Labor Statistics data. For these workers, independent retirement accounts like Roth IRAs or SEP IRAs are crucial investment vehicles for building their nest eggs. These accounts also provide tax-advantaged opportunities for workers with employer-sponsored plans to sock away additional money for retirement, which can come in handy as Americans live longer and the cost of healthcare rises. Given the increasing importance of saving for retirement, SmartAsset decided to dig into IRS data to find the places where residents are using independent retirement accounts the most.

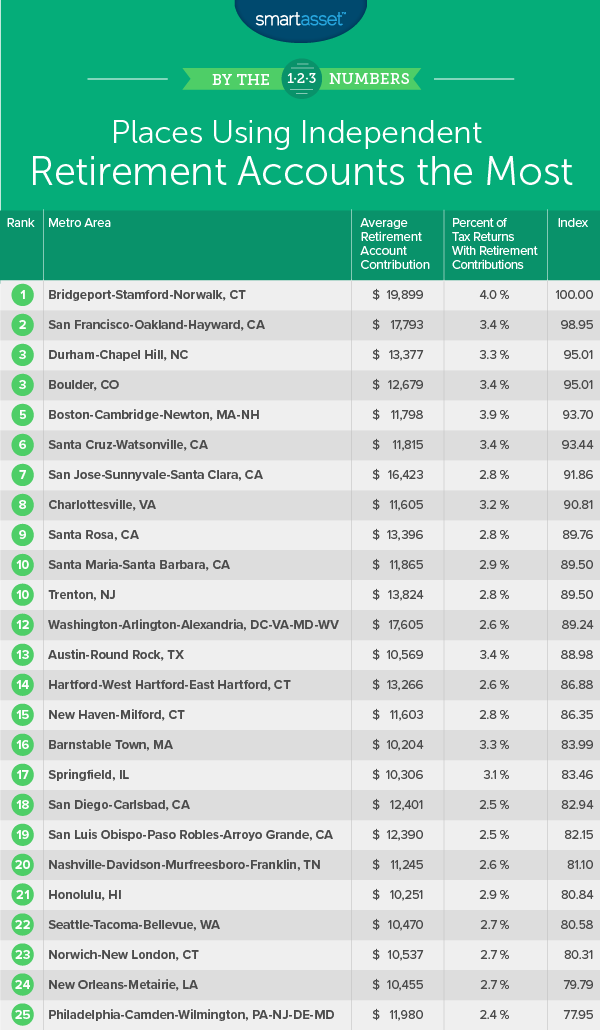

We looked at two factors across 200 cities to determine our rankings. Specifically, we examined the rate at which residents contribute to independent retirement accounts and the amount they contribute to independent retirement accounts. Check out our data and methodology below to see where we got our data and how we put it together to create our final rankings.

Key Findings

- Metros with higher incomes save more with independent retirement accounts – Our research suggests that people in cities where residents have higher incomes tend to utilize independent retirement accounts the most. All the cities in our top 11, for example, are within the top 20% of metro areas with the highest average annual income for workers, according to the BLS.

- Independent retirement accounts are not the most popular way to save – The average utilization rate of independent retirement accounts across all our metro areas is only 2.28%. That means roughly 1 in 50 tax returns with income have independent retirement account contributions. This figure ranges from 0.6% in Fort Smith, Arkansas-Oklahoma to nearly 4% in Bridgeport-Stamford-Norwalk, Connecticut.

1. Bridgeport-Stamford-Norwalk, CT

Coming in as the metro saving the most for retirement using independent retirement accounts is the Bridgeport-Stamford-Norwalk, Connecticut Metro Area. This metro area ranked first in both metrics with an average contribution of nearly $19,900 by people who made contributions to independent retirement accounts. Just under 4% of tax returns that had income also had contributions to independent retirement accounts.

2. San Francisco-Oakland-Hayward, CA

Another wealthy metro area takes second. The average worker here earns just under $70,000 per year, which ranks it among the top in the country. Despite the fact that the high cost of living in San Francisco knocks out a large portion of residents’ income, people here are still able to save. According to our data, the average tax return with independent retirement contributions socks away about $18,000. Around 3.3% of all tax returns make some contribution to independent retirement accounts.

3. (tie) Durham-Chapel Hill, NC

Coming in tied for third is Durham-Chapel Hill, North Carolina. The Research Triangle, as the Durham-Chapel Hill area is known, is full of high-class universities and research institutions. According to our data, the average person contributing to an independent retirement account here saves slightly less than in the metro areas above, but this metro has a large number of savers, boosting it up the rankings. According to our data, 3.3% of tax returns make some contribution to an independent retirement account. On average those contributors save about $13,400.

3. (tie) Boulder, CO

The other metro area tied for third is Boulder. Like Durham-Chapel, Boulder has a reputation as a college town. According to our data, just under 3.4% of tax returns make contributions to an independent retirement account. If you are trying to save here, investing in a retirement account is not your only good option. This area also has one of the most stable housing markets in the country and makes for a great place to park your investments.

5. Boston-Cambridge-Newton, MA-NH

This metro area, stretching up north from Boston into New Hampshire, takes the fifth spot. While people here tend to save less than they do in other metro areas, you are much more likely to see people utilizing independent retirement accounts. This metro area ranks second for percent of tax returns with contributions to independent retirement accounts and 24th for average amount saved per independent retirement contribution.

6. Santa Cruz-Watsonville, CA

California dominates the bottom half of this list, with four of the remaining six cities located in California. Up first is Santa Cruz-Watsonville. This metro area is located along the California coast just south of San Jose. Residents here are not able to save as much as residents elsewhere, perhaps due to those frustratingly high California living costs. Overall, Santa Cruz-Watsonville ranked 23rd for average contribution to an independent retirement account and fourth for percent of tax returns with contributions to independent retirement accounts.

7. San Jose-Sunnyvale-Santa Clara, CA

San Jose-Sunnyvale-Santa Clara comes in seventh. Residents who contribute to their independent retirement accounts here tend to contribute a large amount. It ranks sixth for average contribution to independent retirement accounts. However, this metro area loses ground on its competitors due to its relatively low percent of tax returns with independent retirement contributions. According to our data, only 2.8% of tax returns here have contributions to an independent retirement account.

8. Charlottesville, VA

Breaking up the California party is Charlottesville, Virginia. According to our data, residents here do a good job of saving for their retirement. The average tax return with independent retirement account contributions saves more than $11,600. That is especially high when you consider the median full-time worker earns $52,400. It’s a large amount but not a figure that would rank among the highest in the nation. Also, 3.21% of Charlottesville tax returns have some amount of independent retirement contributions, the 12th-highest rate in our study.

9. Santa Rosa, CA

Coming in ninth in Santa Rosa, California. The average tax return with independent retirement contributions on it saves about $13,400, a top-15 rate. This metro area is slightly down by the number of people who save for retirement using independent retirement accounts. IRS data reveals that roughly 2.9% of tax returns contained independent retirement account contributions. For that metric, Santa Rosa ranked 29th.

10. (tie) Santa Maria-Santa Barbara, CA

Santa Maria-Santa Barbara, California takes one of the final two spots. This metro area comes in right behind Santa Rosa. Specifically this metro area lost out on the ninth spot by just 0.25 points on our index. The good news is that the Santa Maria metro area still claimed a top-11 spot with solid scores. In both the metrics we analyzed, this metro area scored in the top 25.

10. (tie) Trenton, NJ

Finally, a Northeastern city rounds out our top 11. Coming in tie for tenth is the Trenton, New Jersey metro area. The reason this metro area secured a top-11 spot is the high amount of average savings people place into their independent retirement accounts. According to our data, Trenton ranks in the top 10 for average contribution to independent retirement accounts at $13,800.

Data and Methodology

In order to rank the places using independent retirement accounts the most, we looked at data on 200 metro areas. Specifically, we compared them over the following two metrics:

- Average independent retirement account contribution. This is the average independent retirement account contribution made for people who made an independent retirement account contribution. Specifically, we looked at data for self-employment retirement plans and IRAs.

- Percent of tax returns with independent retirement account contributions. This is the total number tax returns with independent retirement account contributions divided by the number of tax returns with income. Specifically, we looked at data on self-employment retirement plans and IRAs.

We then ranked each metro area in each metric. After, we found each metro area’s average ranking, giving equal weight to all metrics. We then used this average ranking to create our final score. The metro area with the best average ranking received a 100. The city with the worst average ranking received a 0.

Tips for Saving for Retirement

- Make sure to start early – When investing, no strategy can beat starting early. No matter your plan for retirement, whether it includes a 401(k), an IRA, stocks, bonds or CDs, your best bet is to save earlier rather than later. Our investment calculator highlights the reasons why. Say you saved up $10,000 dollars at the age of 35 and you are wondering what to do with it. If you invest it right away, leave it untouched and average 6% returns until you retire at age 65, your $10,000 will have turned into $57,400. Doing the same math but assuming you invested five years later and only invested for 25 years, your $10,000 would have turned into just under $43,000.

- Trust the experts – Investing is hard and with so many different investing options out there it is almost impossible to know you are making the right decision. Not only can making the wrong decisions affect your bottom line, but it can also affect your health. Staying up late wondering if the investments you made are going to pan out is not a healthy way to live life. So why not take the stress out of investing and invest with someone you can trust? A financial advisor can make sure your investments are lined up with your priorities. If you are not sure where to find a financial advisor check out SmartAsset’s financial advisor matching tool. It will match you with up to three local financial advisors who fit your specific needs.

Questions about our study? Contact press@smartasset.com.

Photo credit: ©iStock.com/shapecharge