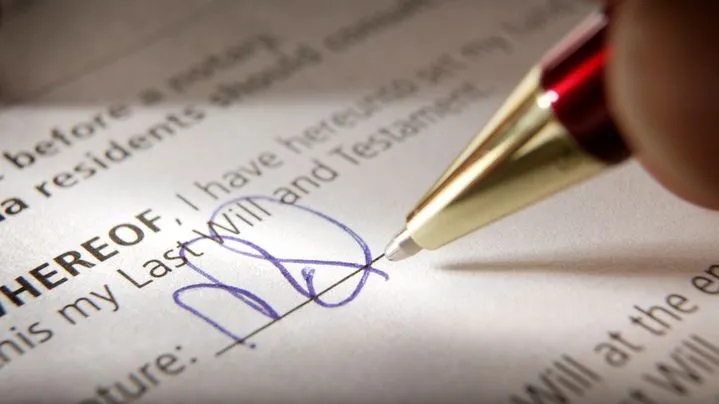

A codicil is a legal document used to make changes or additions to an existing will without rewriting the entire document. It allows the person creating the will, known as the testator, to update specific provisions, such as changing beneficiaries, appointing new executors or adjusting asset distributions. Like a will, a codicil must be signed and witnessed according to state laws to be legally binding. This tool offers flexibility, helping individuals keep their estate plans current while maintaining the original structure of the will.

If you need help organizing and planning your estate, consider working with a financial advisor with estate planning expertise.

Understanding Codicils

A codicil serves as an amendment to a will, offering a way to modify or clarify specific provisions without drafting a new will from scratch. They are commonly used when the adjustments are limited in nature, ensuring the original intent of the will remains intact while adapting to new circumstances like marriages, births or significant financial shifts.

For a codicil to be legally effective, it must follow the same formalities as the original will. This typically includes being signed by the testator and witnessed by individuals who meet the requirements under applicable state laws. Notarization is generally not necessary, except for in Louisiana, where a notary must be present.

While a codicil provides flexibility, frequent amendments can complicate estate planning and create room for misunderstandings. In some cases, drafting a new will may be more practical, especially when there are multiple changes or complex revisions involved.

Reasons for Creating a Codicil

A codicil allows the following adjustments to be made efficiently while preserving the original will’s overall structure:

- Changing beneficiaries: A codicil makes it possible to add new beneficiaries or remove individuals due to shifting personal relationships or life events, such as births, adoptions or estrangements.

- Updating executors or trustees: Replacing an executor or a trustee is something you can accomplish with a codicil if the original choice is no longer available or suitable.

- Revising asset distribution: Adjusting how assets are allocated, such as reflecting the sale or acquisition of property or changing the amounts left to specific heirs.

- Addressing marital changes: You may also use a codicil for modifying the will after marriage, divorce or remarriage to reflect new legal obligations or intentions.

- Incorporating new wishes: Adding charitable donations or other bequests that were not initially included in the will can be another reason to make a codicil.

- Correcting errors or omissions: A codicil may also come in use for fixing mistakes or clarifying vague language in the original will.

How to Create a Codicil

Creating a codicil involves a few straightforward steps, but careful attention is needed to ensure the codicil is legally valid and aligns with the original will. Following the proper process helps prevent disputes and ensures that the testator’s updated intentions are honored.

- Review the existing will: Carefully read the original will to understand which provisions need to be updated or clarified. This ensures consistency between the will and the codicil.

- Draft the codicil document: Clearly state which part of the will is being modified. Use precise language to avoid ambiguity, specifying any changes to beneficiaries, executors or asset distributions.

- Follow state requirements for signing: The codicil must be signed by the testator, typically in the presence of two adult witnesses who are not beneficiaries of the will. Some states may also require notarization.

- Attach the codicil to the will: Keep the codicil with the original will to maintain a complete estate plan. Both documents should be stored in a secure location, such as in a safe or with an attorney.

- Inform executors and key parties: Notify your executor and relevant family members about the codicil’s existence. This can reduce confusion when the will is executed.

- Review periodically: Revisit your will and codicil periodically to ensure they still align with your current wishes and financial situation.

Benefits of Using a Codicil

Using a codicil offers several advantages, particularly when only minor changes are needed. For one, a codicil helps save time and legal fees compared to drafting an entirely new will. Codicils also retain the original will’s intent, ensuring that only the modified sections are updated without altering other instructions.

Another benefit of using a codicil is flexibility. Life circumstances change, and codicils provide an efficient way to address those shifts while keeping the rest of the estate plan intact. This is especially helpful for individuals who experience incremental changes to their financial or family situations over time.

Drawbacks and Potential Risks of Codicils

While codicils offer convenience, they have some potential downsides as well. Multiple codicils attached to a will can create confusion, especially if they contradict each other or the original document. This may lead to misunderstandings among heirs or require court involvement to interpret the deceased’s intentions accurately. There is also the risk of the will and the codicil getting separated, which can open up confusion.

Codicils also carry the same legal requirements as a will. They must be signed, witnessed and meet state-specific legal standards to be considered valid. Any errors in execution could cause the codicil to be deemed invalid, complicating the probate process.

Additionally, frequent use of codicils may signal instability in the estate plan, which could invite legal challenges.

Bottom Line

A codicil provides a practical way to update a will without starting from scratch, helping individuals adapt their estate plans to changing circumstances. Whether adjusting beneficiaries, replacing executors or addressing marital changes, codicils allow for targeted modifications while preserving the original intent of the will. However, it’s important to consider whether multiple amendments might complicate matters, as drafting a new will can sometimes be a better option.

Estate Planning Tips

- If your estate includes assets that are expected to significantly appreciate in value over, consider establishing a grantor retained annuity trust (GRAT). These entities allow you to transfer appreciating assets to beneficiaries while minimizing gift taxes. The grantor funds the trust with assets expected to grow in value, and the trust pays the grantor an annuity for a fixed term. After the term ends, any remaining assets in the trust, including appreciation, pass to beneficiaries tax-free, provided the grantor survives the trust term.

- Some financial advisors specialize in estate planning or offer these services. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/JodiJacobson, ©iStock.com/DNY59, ©iStock.com/Neustockimages