As the holidays approach, some workers may look forward to a bump in their paychecks with employers paying out bonuses. Across the many different types of bonuses allotted to workers (i.e. referrals, cash profit-sharing, etc.), data from the Bureau of Labor Statistics (BLS) shows that end-of-year bonuses – which are generally determined by hard work and performance throughout the year – are the most common. In 2020, about one in 10 workers received an end-of-year bonus.

Workers may also be eligible for a holiday bonus. Compared to end-of-year bonuses, holiday bonuses are token gestures, and all employees usually receive the same amount. In 2020, only 5% of workers received a holiday bonus, indicating that even around the holidays employers are likely to prioritize rewarding and compensating hard work and performance.

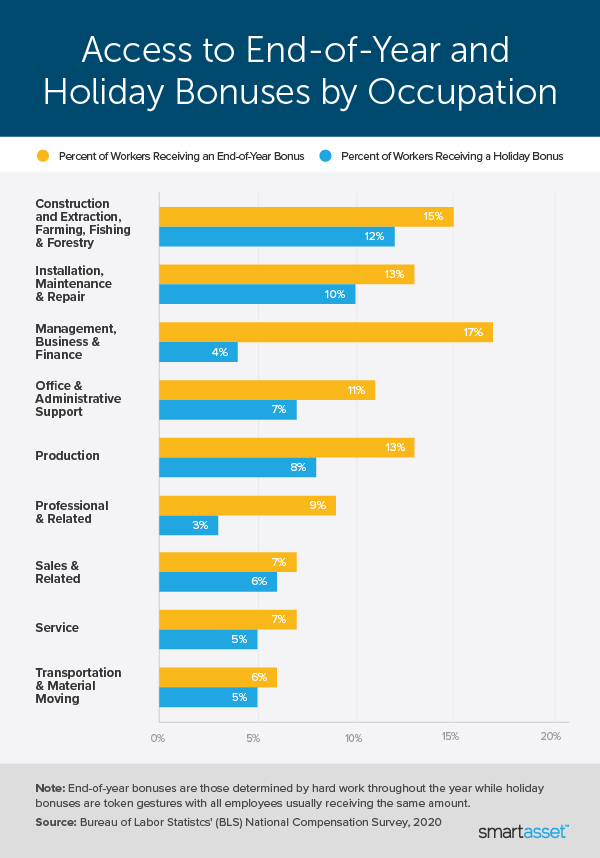

With end-of-year and holiday bonuses upcoming, we took a closer look at which workers should expect extra cash in their paycheck. Specifically, we compared the percentage of workers who typically receive an end-of-year or holiday bonus across nine industries, as defined by the BLS. For more information on our data and how we put it together, read our Data and Methodology section below.

Key Findings

- Holiday bonuses are less common today than they were 10 years ago. In 2010, holiday bonuses were just as common as end-of-year bonuses. However, from 2010 to 2020, the percentage of workers receiving holiday bonuses declined by four percentage points, from 9% to 5%. The percentage of workers receiving an end-of-year bonus increased by one percentage point, from 9% to 10%.

- In five industries, more than one in 10 workers is likely to receive an end-of-year bonus. The BLS reports additional compensation data for a total of nine industries. In five of those, more than 10% of workers have typically received an end-of-year bonus. The industries include management, business & finance; construction and extraction, farming, fishing & forestry; installation, maintenance & repair; production; and office & administrative support.

Across all industries, end-of-year bonuses are most common among management, business & financial workers, with almost one in five workers in this industry receiving an end-of-year bonus. Meanwhile, end-of-year bonuses are least common among transportation & material moving workers. Only 6% of transportation & material moving workers receive an end-of-year bonus.

In four industries, an average of less than one in 20 workers receives a holiday bonus. They include professional & related; management, business & finance; service; and transportation & material moving. In 2020, just 3% of professional and related workers receive a holiday bonus. Additionally, only 4% of management, business and financial workers receive a holiday bonus, a figure that falls below the national average of 5%.

Though not very common nationally and in many industries, holiday bonuses are most often received by construction and extraction, farming, fishing & forestry workers. BLS shows that about 12% of construction and extraction, farming, fishing & forestry workers received a holiday bonus in 2020. The bar graph below shows how common end-of-year and holiday bonuses are by industry.

Data and Methodology

Data for this report comes from the Bureau of Labor Statistics’ (BLS) National Compensation Survey and is for 2020. We considered only civilian workers, who include private industry along with state and local government workers. Federal government, military and agriculture workers are excluded from estimates.

Tips for Making the Most of Your Bonus

- If you do receive an end-of-year of holiday bonus, spend it wisely. Many economists have theorized that individuals not only view lump sum payments such as bonuses differently than if the money was paid evenly in incremental payments throughout the year, but also spend that money differently. For instance, some studies have shown that car sales spike around the holidays when many bonuses are paid out. While a new car may be a good investment, be sure to think about your retirement too. Our retirement calculator can help you determine what you’ve saved for retirement so far and how much more you may need.

- Pay attention to taxes. Whether you do it as an individual or coordinate with your employer, there are several different strategies to avoid or minimize the taxes you may pay on your bonus. Some include making a retirement or health savings account contribution while deferring a bonus to January means that taxes won’t be paid on it until the following year. Our guide here explains some of the most common strategies to make your bonus tax efficient.

- Consider a financial advisor. A financial advisor may help you be better in control of your money and make sure you are on the right track for retirement. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: iStock.com/AndreyPopov