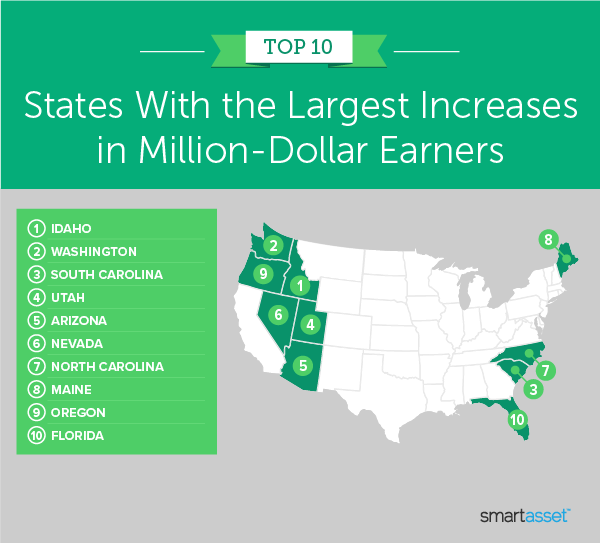

The IRS says that the number of million-dollar taxpayers has gone up in five years. In 2014, there were 410,110 taxpayers with an adjusted gross income (AGI) of $1 million or more, filing 0.28% of tax returns. In 2019, there were 554,340 million-dollar earners, filing 0.35% of tax returns. Keeping this in mind, SmartAsset took a closer look at the states where the number of million-dollar earners is growing the fastest.

To do this, we examined data from the IRS, comparing the percentage of all tax returns which were filed by million-dollar earners in 2014 and 2019. For more details on how we found and analyzed our data, read the data and methodology section below.

This is SmartAsset’s third study on the states with the largest increases in million-dollar earners. You can read the 2021 study here.

Key Findings

- There was an increase in all but two states. Nationwide, the number of million-dollar earners went up 0.35%. Our study shows that there was an increase in the number of filings in all states but Oklahoma and North Dakota, which saw dips.

- In the top states, the number of million-dollar earners went up by almost 40%. Million-dollar earners in the top 10 states rose from a total of 64,870 in 2014 to a total of 105,100 in 2019. That is an increase of 40,230 million-dollar earners (almost 38.28%).

1. Idaho

The percentage of million-dollar earners in Idaho grew from 0.142% in 2014 to 0.228% in 2019, which is an increase of 88.00%. There was a total of 1,880 million-dollar earners filing taxes in the state in 2019.

2. Washington

Washington state saw the percentage of million-dollar earners go up 78.74% between 2014 and 2019. There were a total of 15,890 filers earning at least $1 million in 2019, compared with 8,890 in 2014.

3. South Carolina

In 2014, 0.137% of filers in the Palmetto State earned at least $1 million. By 2019, that went up to 0.215%, an increase of 73.29%.

4. Utah

In Utah, the percentage of tax returns filed by million-dollar earners went up from 0.200% in 2014 to 0.291% in 2019, an increase of 70.49%. A total of 4,160 people in Utah filed tax returns claiming income of at least $1 million in 2019.

5. Arizona

Arizona’s million-dollar earners grew 69.07% between 2014 and 2019. The total number of million-dollar earners increased from 5,140 to 8,690.

6. Nevada

Nevada’s million-dollar earners grew 61.70% between 2014 and 2019. The total number of million-dollar filers in 2019 was 5,320, which is up from 3,290 in 2014.

7. North Carolina

The percentage of tax returns filed by million-dollar earners in the Tar Heel State was 0.170% in 2014. By 2019, that percentage jumped to 0.250%, which is a an increase of 61.29%. The total number of million-dollar earners filing in 2019 was 12,000.

8. Maine

Million-dollar earners in Maine grew 60.27% between 2014 and 2019. The total of filers earning at least $1 million went up from 730 to 1,170.

9. Oregon

Million-dollar earners in Oregon grew from 0.167% in 2014 to 0.231% in 2019, which is a 55.08% increase.

10. Florida

The number of million-dollar earners in Florida grew 54.15% between 2014 and 2019. The percentage of million-dollar filers in 2019 was 0.434%, the highest rate in the top 10 of this study.

Data and Methodology

To find the states with the biggest increase in million-dollar earners, we used IRS data to compare the number of tax returns filed in 2014 and 2019 (for all filing statuses) indicating earned income of at least $1 million. We then found the percentage increase over the course of those five years, and ranked the states from the largest increase to the smallest.

Financial Planning Tips

- Whether you’re a million-dollar earner or not, getting professional help can enable you to make the most of your money. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Income taxes start becoming very important as you make more money. Use SmartAsset’s free income tax calculator to see what you’ll owe Uncle Sam.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/turk_stock_photographer