Layoffs and unemployment were early economic consequences of the COVID-19 pandemic. But 20 months after the pandemic shut down large swathes of the economy, businesses are contending with a new challenge: a larger percentage of people are quitting their jobs in 2021 than ever before and many employers are struggling to hire. In September 2021, there were over 10 million jobs available across the economy. That’s 4 million more open jobs compared with a year earlier, according to Bureau of Labor Statistics data.

To find the places where small businesses are having the most trouble hiring workers, SmartAsset examined Census Bureau data for all 50 states and Washington D.C., as well as 41 of the largest metro areas in the country. Using the data, we calculated the percentage of small businesses in each that are actively hiring but have reported difficulties finding new employees. For details on our data sources and how we ranked areas, read the Data and Methodology section below.

Key Findings

- While the national picture has improved slightly, small businesses still face a hiring problem. Census data from November 15-22 says that 54% of small businesses that are actively hiring nationwide reported difficulties finding new employees. That’s a slight decrease from the 54.8% of small businesses that reported similar struggles three months earlier.

- Hiring is easiest in Mississippi and the Orlando metro area. At the state level, Mississippi’s small businesses are least likely to encounter hiring difficulties. Only 30.2% of small businesses that are actively hiring in the Magnolia State reported trouble adding new workers to their payrolls. And at the metro area level, only 42.3% of small businesses that are actively hiring in Orlando-Kissimmee-Sanford in central Florida have encountered difficulties finding new employees, the lowest percentage out of all the areas studied.

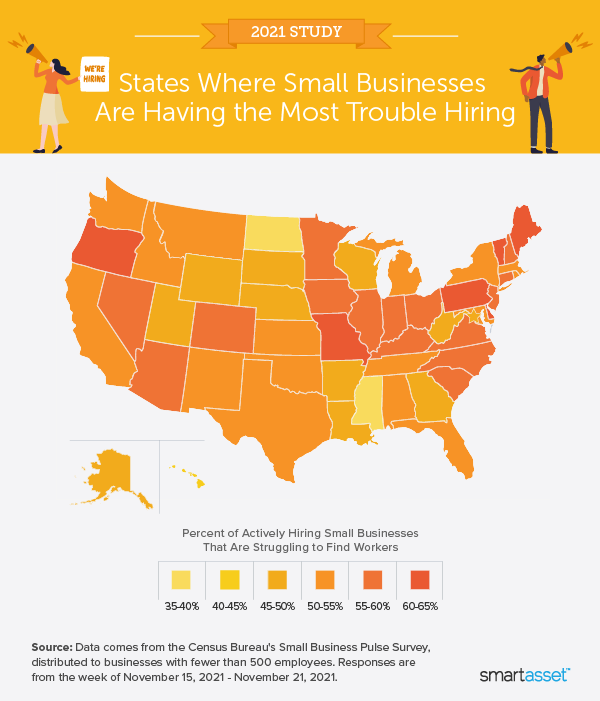

States Where Small Businesses Are Having the Most Trouble Hiring

Missouri is the state with the highest percentage of small businesses reporting hiring difficulties. We found that nearly 64% of small businesses that are actively hiring reported struggles finding new employees. This is roughly 10 percentage points higher than the national average.

Oregon has the second-highest percentage (62.6%) of small businesses that are trying to hire new workers but running into problems doing so, followed by Pennsylvania (62.3%), Maine (61.5%) and Delaware (61.2%).

In addition to Mississippi, other states with the lowest percentages of small businesses that are struggling to find workers despite actively hiring are: North Dakota (34.5%), Hawaii (37.2%), South Dakota (40.5%) and Wyoming (40.6%). The heat map below shows how other states stack up when it comes to the percentage of actively hiring small businesses struggling to find workers.

Metro Areas Where Small Businesses Are Having the Most Trouble Hiring

According to data from the Census Bureau’s Small Business Pulse Survey, the St. Louis metro area, which encompasses portions of eastern Missouri and southwestern Illinois, has the nation’s highest percentage of small businesses struggling to hire workers. In the St. Louis area, 68.4% of small businesses that are actively hiring are having difficulty finding new employees.

Following St. Louis, the Pittsburgh metro area has the second-highest percentage of employers experiencing hiring difficulties, as 67.7% of businesses with fewer than 500 employees reported struggles finding new workers. Meanwhile, the metro areas of Columbus, Ohio, Austin-Round Rock-Georgetown, Texas, and Phoenix-Mesa-Chandler, Arizona, have the third-, fourth-, and fifth-highest percentages of small businesses struggling to hire new employees, at 63.8%, 61.8% and 61.4%, respectively.

Data and Methodology

To find the states and metro areas where small businesses are having the most trouble hiring, we looked at two metrics:

- Percentage of small businesses that are experiencing hiring difficulties.

- Percentage of small businesses that are actively hiring.

All data comes from the Census Bureau’s Small Business Pulse Survey, distributed to businesses with fewer than 500 employees. Small business responses were collected between November 15, 2021 and November 22, 2021.

To put our final rankings together, we divided the percentage of small businesses that are experiencing hiring difficulties by the percentage of small businesses that are actively hiring. This left us with the percentage of actively hiring small businesses struggling to find workers. We ranked states and metro areas accordingly.

Financial Tips When Starting a New Job

- Enroll in your company’s retirement plan. When starting a new job, be sure to enroll in your company-sponsored retirement plan, especially if a match is available. Money saved early in your career has decades to grow, making it all the more valuable. For example, a worker who starts saving for retirement at age 25 will only need to contribute $400 to their plan each month to have over $1 million by the time they’re 65 (assuming a 7% annual rate of return). SmartAsset’s Retirement Calculator can help you plan your contributions.

- Beware of the lifestyle creep. If your new job comes with a higher salary than your previous position, be cognizant of any new spending habits that you may adopt. This inclination to spend more money now that you’re earning more is known as lifestyle creep. SmartAsset’s Budget Calculator can help you stick to a budget so you can make the most of your new income.

- Work with a professional. A financial advisor can help put your new earnings to work by building and managing an investment portfolio for you. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/ablokhin