Business growth is often top-of-mind for financial advisors. Many financial advisory firms follow an “economies of scale” model – that is, larger advisory firms generally tend to be more cost-efficient as they attract and service larger clients. This was shown recently by InvestmentNews’ 2020 Pricing and Profitability study, which found that firm revenue, average assets managed per client and average revenue per client are all positively correlated.

Business growth is often top-of-mind for financial advisors. Many financial advisory firms follow an “economies of scale” model – that is, larger advisory firms generally tend to be more cost-efficient as they attract and service larger clients. This was shown recently by InvestmentNews’ 2020 Pricing and Profitability study, which found that firm revenue, average assets managed per client and average revenue per client are all positively correlated.

Even financial advisors who are not actively interested in growing must pay some attention to prospecting new clients. An advisor’s book of business naturally ages as his or her clients grow older and shift their financial priorities from accumulation to distribution. In order to maintain a consistent income stream, advisors will eventually need to acquire new clients as their existing clients age.

To better understand how advisors measure and track growth, we surveyed more than 300 financial advisors who are a part of our SmartAdvisor platform that connects consumers with financial advisors. Specifically, we focused on different benchmarks advisors track, how advisors plan for growth, the business challenges they encounter and their future growth expectations. For more information on our survey data, read the Data and Methodology section below.

Key Findings

- Not all financial advisors set regular growth benchmarks. Growth within the investment advisory industry can often be unpredictable. This could be a reason that some financial advisors – almost one in five in our study (17.95%) – do not set regular growth benchmarks and goals. Notably, those advisors may have recently seen more muted business growth. About 62% of advisors with growth benchmarks saw assets under management (AUM) grow significantly over the past six months – compared to just 47% of advisors without growth benchmarks.

- Advisors are split when it comes to adding a more diverse set of services for clients, but most agree on the importance of investing in marketing. About 56% of surveyed financial advisors expect to offer additional client services – such as estate planning and small business services – as their firm grows, while the remaining 44% of advisors do not. Our data shows that a majority of advisors (65.43%) plan to invest additional capital that results from business growth in furthering their marketing efforts.

- Most advisors did not adjust growth benchmarks in response to the COVID-19 pandemic. We asked advisors if they adjusted growth benchmarks or goals last year in response to the COVID-19 pandemic. Almost 85% of financial advisors reported that they did not adjust growth goals. Meanwhile, about 15% of advisors adjusted their goals downwards. Though revising growth goals upwards was an option in our survey, not a single financial advisor reported shifting expectations upwards.

Measuring Growth: Frequency and Metrics

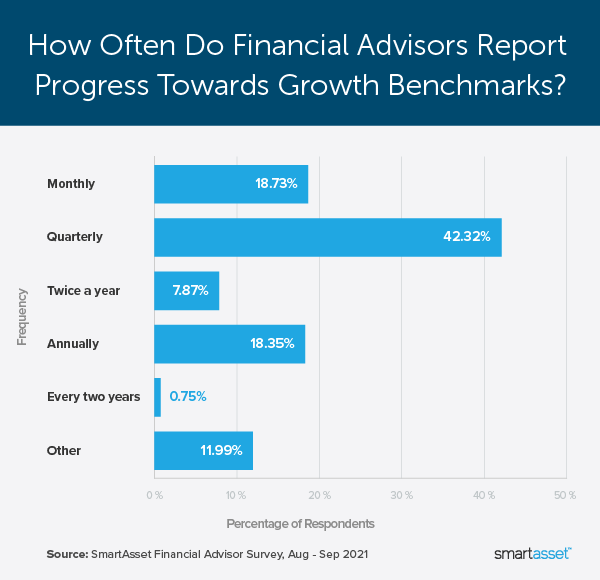

About four in five financial advisory firms (82.05%) define regular growth benchmarks and goals. Across firms that do set regular growth benchmarks, the frequency of formal measurement varies. Quarterly is the most common frequency, with about 42% of advisory firms that set regular growth benchmarks doing so at this rate. A roughly equal percentage of advisors – between 18% and 19% – set benchmarks either monthly or annually. The graph below shows advisors’ responses to our question: “How frequently do you formally report progress towards [your growth benchmarks and] goals?”

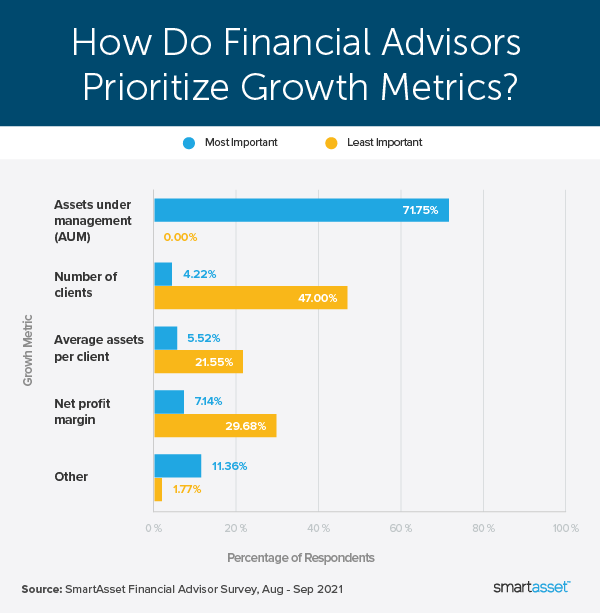

We identified the most common growth benchmarks used by financial advisors – AUM, number of clients, average assets per client (i.e. AUM divided by number of clients) and net profit margin – and asked financial advisors to identify which of those metrics they pay the most and least attention to when measuring the success of their business. Overwhelmingly, financial advisors cite AUM as the most important growth metric for business success. Additionally, within the broad category of AUM, they prioritize assets from new clients over other kinds of assets. Specifically, less than 12% of advisors prioritize new assets from existing clients and less than 3% of advisors prioritize increased AUM from investment performance. Meanwhile, the remaining 85.86% of advisors say assets from new clients is the most important form of AUM growth.

Advisors have mixed responses when it comes to the least important growth metric for business success. About 47% of advisors say it is the number of clients, roughly 22% say it is the average assets per client and almost 30% say it is net profit margin. The chart below shows advisor responses.

Growth Planning: Expanding Services and Business Challenges

Larger financial advisory firms may in part attract larger clients by offering more services for individuals. The most popular service that financial advisors plan on adding is estate planning, or the process of settling how a person’s assets and property will be distributed at death. Of advisors who plan on expanding their services, more than 60% are looking toward adding estate planning. A high percentage of advisors (59.57%) also plan to add small business services, while about 55% and 50% of advisors plan on adding philanthropic planning/giving and tax planning, respectively.

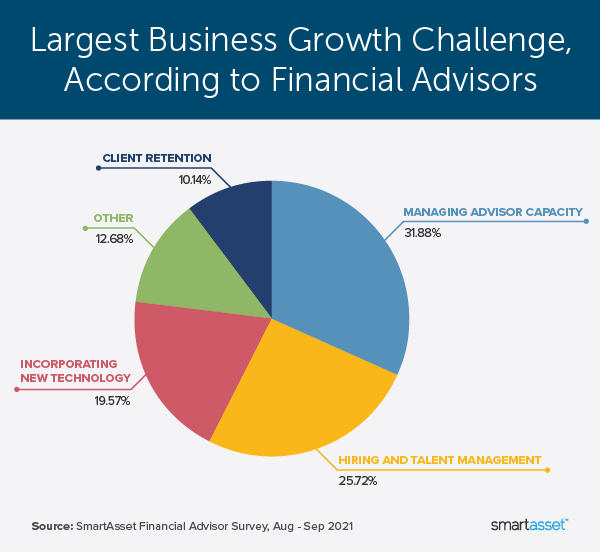

Business growth comes with its own set of challenges, raising an important question: How will the firm accommodate increases in AUM and client count? Almost 32% of advisors say that their biggest business challenge is managing advisor capacity. The second- and third-biggest business growth challenges are hiring and talent management (25.72%) and incorporating new technology (19.57%), respectively. Other cited growth business challenges according to surveyed advisors include maintaining consistent communication with clients, improving administrative support and ensuring sustainable growth.

Future Growth Expectations: September 2021 – February 2022

Looking forward, firms have higher expectations for growth in AUM than they do for client count – perhaps because of their focus on AUM. Almost 59% of firms expect AUM to grow significantly over the next six months (i.e. September 2021 – February 2022). By comparison, only about 36% of firms expect their client count to grow significantly over the same time. The chart below shows all advisor responses with regard to AUM and client count growth expectations.

Future growth expectations mirror how advisors reported performing over the previous six months (i.e. February 2021 – September 2021). About 60% of advisors report AUM growing significantly over that period, while roughly 38% of advisors say it grew slightly during the same time. Growth in the number of clients was more subdued across advisors. Less than 27% of advisors reported client count growing significantly, while about 68% said the number of clients grew slightly.

Data and Methodology

Survey data for this report was collected by SmartAsset between August 26, 2021 and September 10, 2021. A total of 312 financial advisors responded to our survey. Though the full survey was 14 questions, not all questions were applicable to all advisors and some advisors chose to skip certain questions. We used the largest sample possible when discussing results for any given question.

Tips for Sourcing Clients and Growing Your Advisory Business

- Pre-screen for prospects that meet your client profile. Consider using a service that can connect you directly with prospective clients. If you’re looking to grow your practice, SmartAdvisor connects advisors directly with local prospects. You pay only for investors that fit your client profile.

- Expand your radius. Many financial advisors rarely look for prospects outside of a short drive from their home or office. But 60% of prospects who completed a survey with SmartAsset indicated that they were willing to work with an advisor remotely. Consider broadening your search and working with investors who are comfortable with less frequent in-person meetings.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/FG Trade