Homeownership is often viewed as a fundamental pillar of investing and building wealth. While real estate markets vary from city to city, home values have historically risen over the decades. In fact, home values across the U.S. have increased by nearly 17% over the last year, rising to $298,933 by the end of July 2021, according to Zillow. But appreciation is just one financial component of homeownership. Closing costs, property taxes and insurance also factor into whether homeownership is a good investment for a prospective buyer.

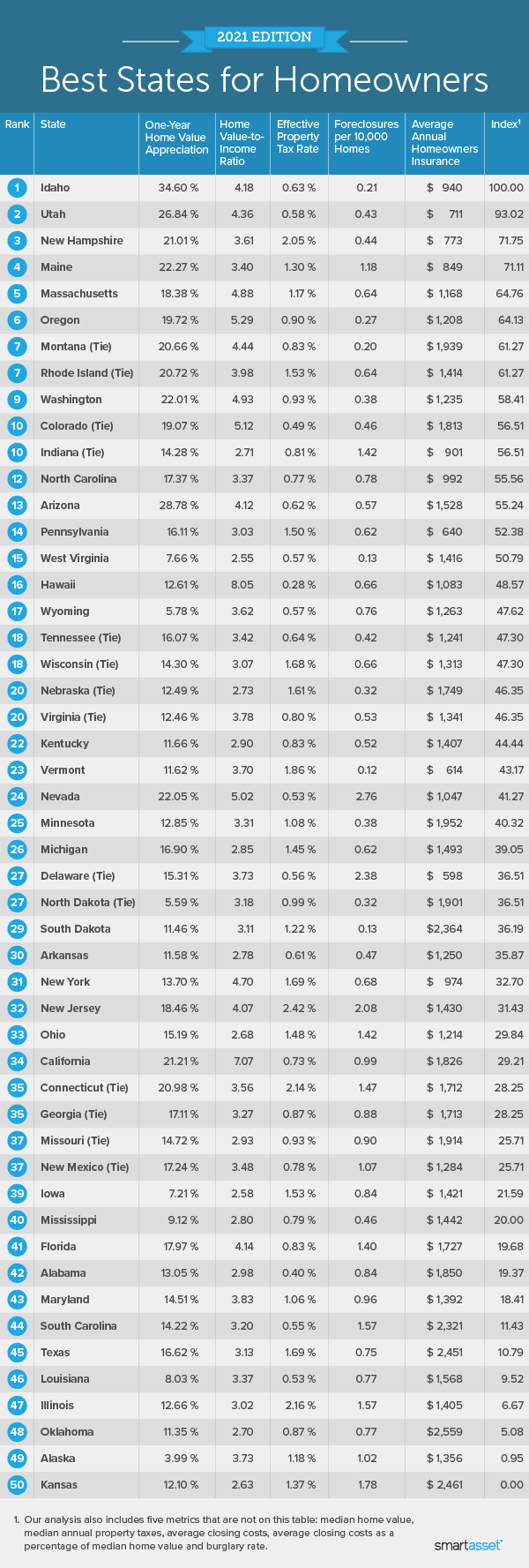

As real estate markets remain red hot, SmartAsset set out to determine which states are best for homeowners. We compared all 50 states across 10 metrics: median home value, home value appreciation, home value to household income ratio, foreclosures per 10,000 homes, average annual homeowners insurance, burglary rate, median annual property taxes, effective property tax rate, average closing costs and average closing costs as a percentage of median home value. For a breakdown of our data sources and how we put all the information together to create our final rankings, read the Data and Methodology section below.

This is SmartAsset’s seventh study on the best states for homeowners. The 2020 version can be found here.

Key Findings

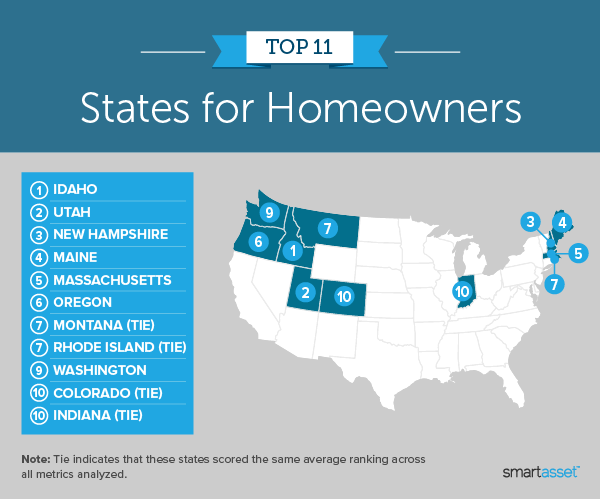

- Western and Northeastern states rank at the top. Although our methodology for this year’s study is slightly different from last year’s study, states in the West and Northeast continue to dominate the top 10. Idaho, which takes the top spot in this year’s study, leads a contingent of six Western states in the top 10, while four states in New England round out the upper echelon. A common trend? All 10 states were among the top 15 for the home value appreciation metric.

- A majority of the bottom 10 states are located in the South. Seven of the bottom 10 states in the study are located in the Southern U.S., according to Census regional divisions – Oklahoma, Louisiana, Texas, South Carolina, Maryland, Alabama and Florida. They all rank within the bottom half of the study for closing costs as a percentage of median home value as well as foreclosures per 10,000 homes.

- Kansas is last. With a median home value of just $159,981, Kansas ranks last on our list of the best states for homeowners. Kansas has one of the highest foreclosure rates in the nation (47th) at 1.78 per 10,000 homes, according to data from SoFi.

1. Idaho

Nowhere in the U.S. did home values increase more between July 2020 and July 2021 than in Idaho, where homes shot up in price by 34.60%. Idaho also has the fifth-lowest foreclosure rate in the nation, at just 0.21 per 10,000 homes, contributing to its spot atop the rankings. Meanwhile, the Gem State has the eighth-lowest average annual homeowners insurance ($940) and ninth-highest median home value ($308,236).

2. Utah

Utah ranks No. 2 in this study thanks in part to a 26.84% increase in home values between July 2020 and July 2021 (third-highest overall). Utah also ranks highly for median home value ($376,455), which is sixth-highest across our study. The state’s average annual homeowners insurance is fourth-lowest in the nation ($711), while closing costs are just 1.26% of the median home value, ninth-lowest of all 50 states. Utah also ranks 10th-lowest for effective property tax rate (0.58%).

3. New Hampshire

Homes in New Hampshire appreciated by more than 21% between July 2020 and July 2021, the eighth-highest rate across our study. Meanwhile, the Granite State has the lowest burglary rate (126.3 per 100,000 residents) and fifth-lowest average annual homeowners insurance ($773).

4. Maine

Maine is among the top 10 for three different metrics. The Pine Tree State had the nation’s fourth-largest increase in home values between July 2020 and July 2021, when homes gained 22.27% in value. Maine also has the fourth-lowest burglary rate (174.8 per 100,000 residents) and sixth-lowest average annual homeowners insurance ($849).

5. Massachusetts

The median home value in Massachusetts is $444,127, fourth-highest among all 50 states. Meanwhile, closing costs in Massachusetts are 1.06% of the median home value, fifth-lowest across the study. Like New Hampshire and Maine, the Bay State also has a relatively low burglary rate, about 179 burglaries per 100,000 residents (fifth-lowest).

6. Oregon

Closing costs in Oregon are just 1.05% of the median home value, fourth-lowest across the entire study. Oregon also has the sixth-fewest foreclosures per 10,000 homes (0.27) and the seventh-highest median home value ($381,871).

7. Montana

Montana ranks fourth for its low foreclosure rate (0.20 per 10,000 homes) and 10th for low closing costs as a percentage of median home value (1.32%). Montana home values rose by 20.66% between July 2020 and July 2021, the 11th-highest rate of appreciation across the entire study. Meanwhile, the median value of a home in Big Sky Country is $304,190 (15th-highest overall).

8. Rhode Island

The fourth New England state in this year’s top 10, Rhode Island has relatively low closing costs compared to median home values (1.16%), seventh-lowest overall. For those who might be contemplating the switch from renting vs. buying here, two other important points to consider are that the Ocean State has the 10th-highest median home value ($314,588) and 10th-highest appreciation between July 2020 and July 2021 (20.72%).

9. Washington

Washington State, which has the third-highest median home value ($434,216) in the nation, saw home values appreciate by 22.01% between July 2020 and July 2021 (sixth-largest increase). Closing costs in Washington are 1.09% of the median home value, sixth-lowest across the study. Meanwhile, Washington has the 10th-lowest foreclosure rate in the nation, just 0.38 per 10,000 homes.

10. Colorado

Colorado sports the third-lowest effective property tax rate (0.49%), while average closing costs are 1.02% of the median home value, also third-lowest. Colorado also has the fifth-highest median home value in the country ($421,063). More specifically, Aurora, Colorado takes a spot in our latest study on the top 10 rising housing markets in the U.S.

Data and Methodology

To find the best states for homeowners, we compared data for all 50 states across a total of 10 metrics. Six of those metrics were given a full weight, shown below:

- Median home value. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Home value appreciation. This is the percentage change in the median home value from July 2020 to July 2021. Data comes from Zillow.

- Home value to household income ratio. This is the median home value divided by the median household income. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Foreclosures per 10,000 homes. Data comes from SoFi and is for July 2021.

- Average annual homeowners insurance. Data comes from ValuePenguin and is for August 2021.

- Burglary rate. This is the number of burglaries per 100,000 residents. Data comes from the FBI and is for 2019.

We assigned a half weight to the remaining four metrics:

- Median annual property taxes. Data comes from the Census Bureau’s 2019 1-year American Community Survey.

- Effective property tax rate. This is the median annual property taxes paid divided by the median home value. Data for both components comes from the Census Bureau’s 2019 1-year American Community Survey.

- Average closing costs. Data comes from SmartAsset’s closing costs calculator and is as of August 2021.

- Average closing costs as a percentage of median home value. This is average closing costs divided by the median home value. Data comes from SmartAsset’s closing costs calculator and the Census Bureau’s 2019 1-year American Community Survey.

We ranked each state in every metric, and using the weightings described above, we found each state’s average ranking. From there, we created our final score. The state with the best average ranking received a score of 100 while the state with the worst average ranking received a score of 0.

Home Buying Tips

- Don’t overbuy. Knowing how much house you can actually afford is an important first step when buying a home. SmartAsset has a tool specifically designed to help you set a budget. Give it a try now.

- Plan for your mortgage. Once you’ve set a budget, use our mortgage calculator to figure out how much your monthly mortgage payments will be based on the price of the home you plan to purchase.

- Work with a financial advisor. From helping you save for a down payment to estimating your monthly mortgage payments, a financial advisor can provide valuable guidance during the home buying process. SmartAsset’s free matching tool can connect you with up to three advisors in a matter of minutes. If you’re ready to be matched, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/PeopleImages