Credit scores across the country are on the rise. Up about 1% on average, according to Experian data. But does that fact hold for every generation? Millennials sometimes have a reputation for not handling their finances well, are their credit scores also rising? We decided to investigate and found the places where millennial credit scores have risen the fastest.

Have a high credit score? You may qualify for the best rewards credit cards.

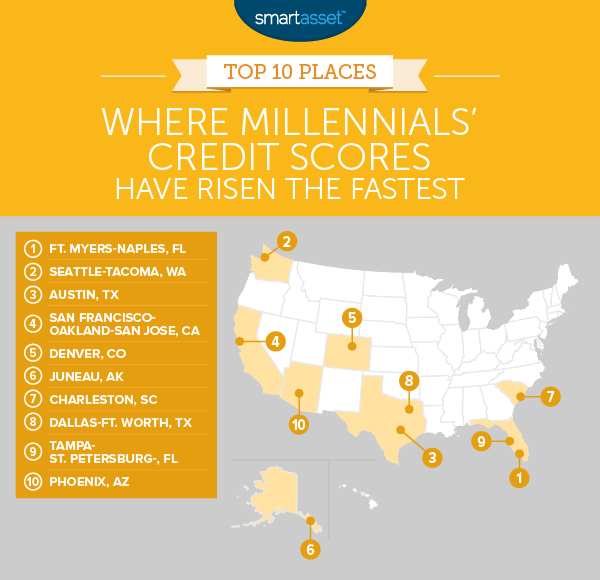

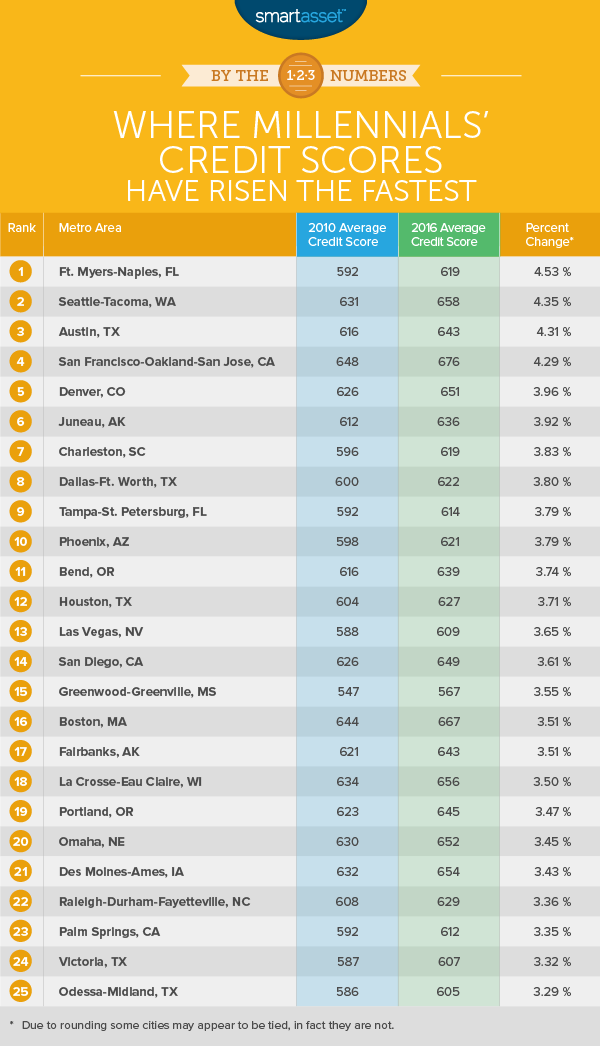

For the purposes of this study we looked at VantageScores across the country. To see where millennials’ credit scores have risen the fastest, we used metro level millennial credit scores from 2010 and compared it to millennial credit scores from 2016. Check out our data and methodology below to see where we got our data and how we put it together to create our rankings.

Key Findings

- Low 2010 credit scores – Back in 2010 the average millennial had a fairly low credit score. According to data from Experian, the average millennial’s credit score in 2010 was 611. By 2016, that number had risen to 624. The metro area with the lowest average millennial credit score was Greenwood-Greenville, Mississippi. Millennials there had an average credit score of 547 in 2010.

- Did the improving economy help credit scores? – There are a few plausible explanations for why millennials’ average credit scores rose from 2010 – 2016. One is the overall economic improvement. In 2010, the United States had an unemployment rate of 9.6%, according to the Bureau of Labor Statistics. By 2016 that had almost halved to 4.9%. This improvement in the economy may have enabled more millennials to find jobs and start improving their credit scores.

- Overall improvement – Out of the 211 metro areas we analyzed, only two had average millennial credit scores drop. Those were Presque Isle, Maine and Lafayette, Indiana. But in both of these metro areas, the average millennial credit score is above 620. The average metro area saw millennial credit scores improve by 13.7 points which equals an average increase of 2.24%.

1. Fort Myers-Naples, Florida

On average millennial credit scores in Fort Myers-Naples jumped over 26 points from 2010 to 2016. The average score went from 592.2 to 619.03. This translates to a percent increase of 4.53%: the largest growth in the country.

Millennials were not the only group to see their finances improve in Fort Myers-Naples. Every generation except the Silent Generation (those born from 1925 – 1945) saw their average credit scores improve.

2. Seattle-Tacoma, Washington

The Seattle-Tacoma area is home to some of the most financially responsible millennials in the country. Seattle-Tacoma millennials went from having the 32nd-highest average credit score in 2010 to having the 11th-highest average credit score in 2016. Overall their average credit scores improved from 630.8 to 658.2. That’s a percent increase of 4.35%.

With how expensive the Seattle area can be, millennials will be thankful for their improved credit scores as they now have better access to solid rewards credit cards and lower mortgage rates.

3. Austin, Texas

Back in 2010, Austin millennials were in a precarious financial position. They had an average credit score of 616, which is considered quite low. Fortunately they were able to improve that average credit score by 4.31%, from 616.2 in 2010 to 642.7 in 2016. While this means Austin millennials may not quite qualify for the best low APR credit cards with that score, they are certainly making progress.

4. San Francisco-Oakland-San Jose, California

As of 2016, San Francisco-Oakland-San Jose contains the most financially savvy millennials in the country, on average. With an average credit score of 676.1, San Francisco beat out Charlottesville, Virginia (671.7) and Minneapolis (669.9) for the city where millennials have the highest average credit score. In 2010 SF millennials’ average credit score was 648.3 and by 2016 it has risen by 4.29%.

In fact, if not for their high credit scores in 2010, San Francisco-Oakland-San Jose would have taken first on this list. This area had the largest absolute gain in credit score, but due to their higher 2010 credit score saw a lower percent growth.

5. Denver, Colorado

The average credit score across all age groups in Denver rose from 675 to 687. Millennials, more than any other group, powered the explosive credit score growth. From 2010 to 2016, the average credit score for Denver millennials rose from 626 to 650.8. This equals an increase of just under 25 points or 3.96%.

While 650 isn’t bad it doesn’t give Denver millennials, who may be looking to switch from renting to buying, access to the best mortgage rates. According to our mortgage rates table a Denver resident with a credit score of 650 would be looking at a mortgage rate of around 5%.

6. Juneau, Alaska

Juneau is the capital of Alaska, a state with a lot of debt and a few bad credit card habits. Overall Juneau millennials increased the average credit score from 611 to 635. That’s a 3.92% increase. There’s still room for improvement. Juneau millennials, on average, will struggle to qualify for good mortgage rates with a 635 credit score.

7. Charleston, South Carolina

In 2010 millennials in Charleston had an average credit score of 596. With a score that low, they were likely facing very high credit card APRs. This would have made any credit card debt Charleston millennials take on and don’t pay right away, very expensive. From 2010 to 2016 Charleston millennials did a better job managing their finances. Overall the average millennial’s credit score rose from 596.3 to 619.1. That’s a 3.83% increase.

8. Dallas-Fort Worth, Texas

Dallas-Fort Worth takes eighth place, barely beating Tampa-St. Petersburg by 0.001%. Overall Dallas-Fort Worth millennials have done a good job improving their credit scores. According to our data, millennials here went from having the 148th-highest average credit score (out of 211) in 2010 to having the 111th-highest average credit score in 2016. This 37-spot jump was brought on by a 3.79% increase in average credit score.

9. Tampa-St. Petersburg, Florida

As mentioned in the Dallas-Fort Worth blurb, Tampa-St. Petersburg just barely fell to ninth. Of all the cities in our top 10, Tampa millennials started in the worst financial position. The average millennial credit score was 591. Fortunately they’ve upped that figure to 614. There’s still some way to go to a truly healthy credit score however.

10. Phoenix, Arizona

Phoenix rounds out our top 10. The average millennial credit score jumped 23 points from 615.7 to 638.7. That’s a 3.73% increase. Our data suggests that it was not just millennials in the Phoenix area who worked on improving their financial well-being. Across the metro area the average credit score jumped 14 points, with Gen Xers and Baby Boomers also doing well.

Data and Methodology

In order to find out where millennial credit scores have risen the fastest, we looked at data on 211 metro areas. Specifically we looked at the following two metrics:

- 2010 average millennial credit score. Data comes from Experian’s 2016 State of Credit Report.

- 2016 average millennial credit score. Data comes from Experian’s 2016 State of Credit Report.

In order to create our final rankings, we found each city’s percent change in credit scores from 2010 to 2016. We ranked the metros from highest percent change to lowest.

Tip for Millennials Looking to Build Their Credit Score

Many millennials have lean credit files. This may mean that they don’t even have a credit score due to a lack of information/credit history. Here are some tips for millennials looking to build their credit.

The most accessible way for people to build credit is to use a credit card. However, one issue for people who are trying to build their credit score is that they often don’t qualify for the majority credit cards. For millennials in this position, a secured credit card is a great option. Pretty much anyone can qualify for a secured credit card regardless of credit score, including people without any credit history. One thing to keep in mind is that in order to get a secured credit card and start building your credit score, the credit card company will require a monetary deposit. This is often around $200.

Once you have a secured credit card, you can begin using it to create some credit history. Remember to make your payments in full and on time. Many secured credit cards have a low credit limit. This can be a good thing because it ensures you won’t rack up high charges that you’ll struggle to pay back. And you won’t be stuck with the low limit forever. In time, once you’ve built some credit history and hopefully have a solid credit score, you’ll begin to qualify for unsecured credit cards.

Questions about our study? Contact us at press@smartasset.com.

Photo credit: ©iStock.com/Marcio Silva