Renters in America face an uphill battle to create space in their budgets for saving. In fact, the latest Census Bureau data reveals that nearly 10 million renting households spent at least 50% of their income on rent in 2017. But there’s good news on the horizon for workers who rent in some cities. With unemployment rates near record lows and earnings starting to rise, some renters are actually finding themselves with more of an opportunity to sock away money. Below, we compare median earnings for full-time employees to average rents to see where rents are becoming more affordable for these workers.

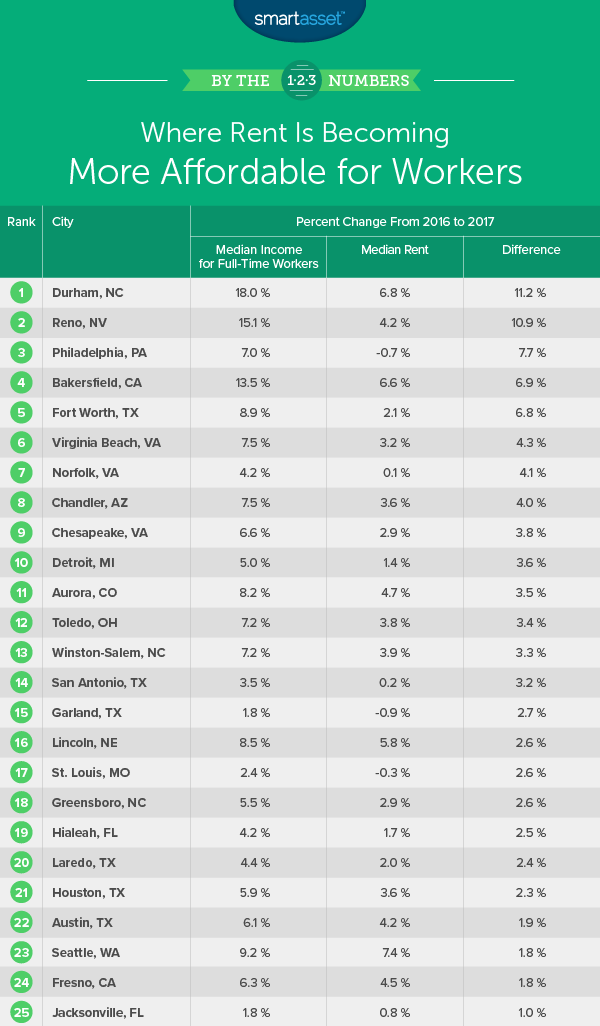

To find where rents are becoming more affordable for full-time workers, we looked at data on median income for full-time workers in 2016 and 2017 and compared it to median rent in 2016 and 2017. We then compared the percent change in the two figures. Check out our data and methodology below to see where we got our data and how we put it together to create our final rankings.

Key Findings

- Virginia full-time workers can celebrate – Three of the top 10 cities where rents are becoming more affordable for full-time workers are in Virginia. Specifically, those cities are Virginia Beach, Norfolk and Chesapeake.

- California salaries are no match for burdensome rents – There are only two California cities where the gains for full-time workers outpaced the increase in rents. The bottom two cities in our rankings of where rents most outpaced earnings are also California cities.

1. Durham, North Carolina

Full-time workers in Durham should rejoice. Census Bureau data shows that the median full-time worker in Durham saw his or her income rise by more than 18% from 2016 to 2017. Specifically, the average full-time worker earned just over $42,400 in 2016 and earned just over $50,000 in 2017. Over that same time period, rent also shot up a significant portion but not enough to wipe out the income gains. From 2016 to 2017, median rents rose just under 7%, from $949 to $1,014.

2. Reno, Nevada

Occupying the second spot is Reno, Nevada. The Biggest Little City in the World, as it’s known, is quite a bit more affordable for workers than it used to be. According to our research, the average full-time worker’s income rose by $5,712 per year, or 15%. That compares favorably to rent which only rose by 4%, from $908 per month to $946 per month.

3. Philadelphia, Pennsylvania

One of the largest cities in our top 10 and a popular spot for renters, Philadelphia takes the third spot. Of all the Northeast cities, Philadelphia is one of the more affordable. The average full-time worker in the City of Brotherly Love received a raise equal to 7% of his or her 2016 income. Specifically, the average full-time worker in Philadelphia earned just under $45,000 in 2017 compared to just under $42,000 in 2016. Rents have not kept up with the recent income rise. In fact, the median rent in Philadelphia held steady over the 2016 to 2017 time period. That meant full-time workers, for the most part, got to pocket their raises.

4. Bakersfield, California

California is afflicted with one of the most difficult housing markets for renters in the country. Rent in California has taken off without any sign of stopping. As a result, renters there are shelling out large portions of their incomes to their landlords. In 2005 the median rent in California was $970. In 2017, it was $1,450. Bakersfield renters are not immune to this uptick in rent. In just one year, from 2016 to 2017, rents increased by almost 7%, from $1,015 to $1,082 per month. Despite that frightening rise in rents, incomes have done better. From 2016 to 2017, the median full-time worker’s pay increased by almost 14%, from $42,300 to $48,000.

5. Fort Worth, Texas

Texas is traditionally known for cities that have an affordable cost of living. Fort Worth is not too different. According to our data, median rent in 2016 would have cost 28% of the average full-time worker’s income. After an income rise of nearly 9% and a rent increase of only 2%, that figured dropped to 26%. In total, the income increase in Fort Worth outpaced the rent increase by nearly 7 percentage points.

6. Virginia Beach, Virginia

Virginia Beach is the priciest locale in our top 10. The median rental cost $1,280 in 2016 and $1,321 in 2017. To meet the demands of those expensive rentals, Virginia Beach full-time workers need to have high incomes. And they do. The average Virginia Beach full-time worker earned just under $46,000 in 2016. Virginia Beach cracked this top 10 because of what happened in 2017. From 2016 to 2017, median earnings for full-time workers increased by 7.5%, a full 4.3 percentage points more than the rent increase.

7. Norfolk, Virginia

While rent has been trending upward and employment markets have been booming in other cities, things have been quiet in Norfolk. For the most part, Census Bureau data suggests renting in 2017 is no more expensive than renting in 2016. But at same time, incomes for full-time workers have risen, albeit at a modest rate. Over the time period analyzed, incomes are up a tick over 4%. But since rents have held steady, all the increase in incomes can go straight to Norfolk residents’ checking accounts.

8. Chandler, Arizona

Chandler is one of the most livable cities in the country for a reason. For the most part, residents here are able to find work that pays them well enough to cover their basic needs and allows them to save up for the future, whether that’s a down payment or retirement. Even renters here do well. The median rent in 2016 cost just under 28% of the median full-time worker’s rent in 2016. In 2017 that figure dropped to 26.9%. Principally, that drop came from the large increase in incomes that full-time workers earn. The median full-time worker’s income here increased by 7.5% from 2016 to 2017.

9. Chesapeake, Virginia

The third Virginia city to crack the top 10 is Chesapeake. Chesapeake is a fairly expensive city, and the cost of living is on the rise. From 2016 to 2017, the median rent in Chesapeake rose by just under 3%, from $1,184 to $1,218 per month. At the same time, though, incomes are pacing upward at a faster rate. From 2016 to 2017, the median full-time worker went from earning $48,600 to just under $52,000, an increase of 6.6%.

10. Detroit, Michigan

Our list rounds out in Detroit, the most affordable city in this list. The median rental in Detroit cost $771 in 2016 and $782 in 2017. That’s an increase of more than 1%. Incomes have increased even more, though — great news for local renters. From 2016 to 2017, earnings for full-time workers increased by 5%, from $32,140 to $33,743. In total, earnings for full-time workers outpaced median rent by 3.6% from 2016 to 2017.

Data and Methodology

In order to rank the places where rent is becoming more affordable for full-time workers, we looked at data on the 100 largest cities in the U.S. and compared them across the following two metrics:

- Percent change in earnings for full-time workers. This is the percent change in earnings for full-time workers from 2016 to 2017.

- Percent change in median rent. This is the percent change in median rent from 2016 to 2017.

To rank the cities, we subtracted the change in full-time workers’ earnings by the change in rent. We ranked the cities from highest to lowest based on this figure.

Data for all metrics comes from the Census Bureau’s 2016 and 2017 1-year American Community Survey.

Tips for Knowing When to Switch from Renting to Buying

- Renting gives flexibility – It’s taken as a truism in American society that if given the chance, you should be a homeowner. In some senses, this often held belief is correct. Instead of throwing away money to your landlord, you can build equity in your home. But people who put a premium on mobility should stick to renting, despite the investment opportunities offered by buying. The upfront costs of homeownership, including closing costs, mean it takes some time for homeownership to pay off. For more insight, our rent vs. buy calculator can help you do the math on whether it makes sense for you to continue to rent or invest in the housing market by getting a mortgage.

- Get an expert’s opinion – There’s an opportunity cost to investing in the housing market. If you buy a home, you are leveraging your finances to the point where it’s tough to invest in anything else. You need to save for a down payment first of all and then make mortgage payments, typically over the course of 30 years. Depending on your local market and personal finances, it may not make sense to be a homeowner. So if you’re not 100% confident in what you should do, you should probably ask a financial advisor. A financial advisor can help you divvy up your financial resources into their most productive purposes. If you are not sure where to find a financial advisor, check out SmartAsset’s free financial advisor matching tool. It will match you with up to three local financial advisors who fit your specific needs.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/PeopleImages