On March 20 of this year, the IRS announced that as a result of the global coronavirus pandemic, the 2020 tax deadline would be moved from the typical filing date of April 15 to July 15. Following the federal government’s lead, many states also extended their tax deadlines, meaning that the majority of Americans could wait to file both their federal and state individual income taxes without penalty. Some Americans may have opted to file earlier to receive their refunds more expeditiously to stay afloat during these challenging times. But in light of the postponed tax deadline, just how many Americans have delayed completing their taxes?

On March 20 of this year, the IRS announced that as a result of the global coronavirus pandemic, the 2020 tax deadline would be moved from the typical filing date of April 15 to July 15. Following the federal government’s lead, many states also extended their tax deadlines, meaning that the majority of Americans could wait to file both their federal and state individual income taxes without penalty. Some Americans may have opted to file earlier to receive their refunds more expeditiously to stay afloat during these challenging times. But in light of the postponed tax deadline, just how many Americans have delayed completing their taxes?

In this study, SmartAsset examined 2020 filing season statistics on federal tax returns to determine the extent to which coronavirus and the new filing deadline have affected tax season. Specifically, we compared this year’s data to statistics for the 2018 and 2019 filing seasons, looking at weekly and cumulative individual income tax returns received by the IRS as well as visits to the IRS website. For details on our data sources and how we put all the information together to create our findings, check out the Data and Methodology section below.

Key Findings

- Individual income tax return filings are down 16%. By April 19, 2019, the IRS had received a total of about 137 million returns for the 2018 tax year. This year, the IRS received fewer than 116 million returns by April 17, 2020, according to the government agency’s recently published filing season statistics.

- Three in four taxpayers have still filed this year. Despite the decline in filing relative to 2019, most taxpayers have filed their 2019 tax return. The roughly 116 million returns received so far in 2020 represent about 75% of taxpayers, as the IRS expects to receive about 155 million total individual income tax returns.

- IRS website traffic in 2020 is significantly higher than it was in 2018 or 2019. Though fewer individual income tax returns were filed through mid-April this year, compared to the same interval in 2018 and 2019, IRS website traffic is booming. There have been almost 745 million visits to irs.gov this tax season, compared to about 387 million and 422 million in 2018 and 2019, respectively.

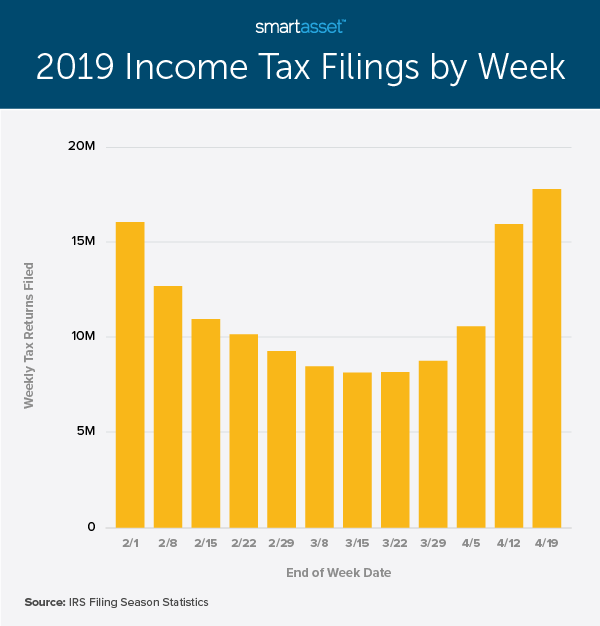

Americans have historically procrastinated on filing their taxes. In 2019, though many Americans filed during the last week of January – perhaps hoping to receive an early refund – the most popular week for filing was during the week of the tax deadline. Between April 13 and April 19, 2019, almost 18 million Americans submitted their individual income tax returns to the IRS, either via mail or online. The two previous weeks were additionally big filing weeks. Between March 30 and April 5, 2019, about 10.6 million tax returns were filed and between April 6 and April 12, 2019, almost 16 million returns were filed. The bar graph below shows the distribution of income tax filings by week in 2019, from the last week of January through mid-April.

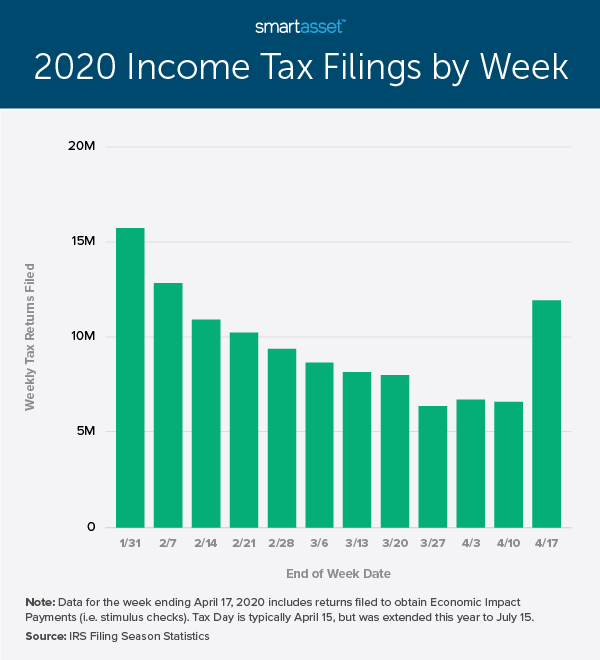

Due to the postponed 2020 tax deadline, the usual uptick in tax filings during the end of March and first half of April did not occur this year. In fact, following the new deadline announcement on March 20, 2020, fewer than seven million Americans filed their taxes in each of the following three weeks. That number jumped up for the week of April 15. Between April 11, 2020 and April 17, 2020, about 12 million individual income tax returns were filed, roughly a third less than the number of returns filed during the same week in 2019.

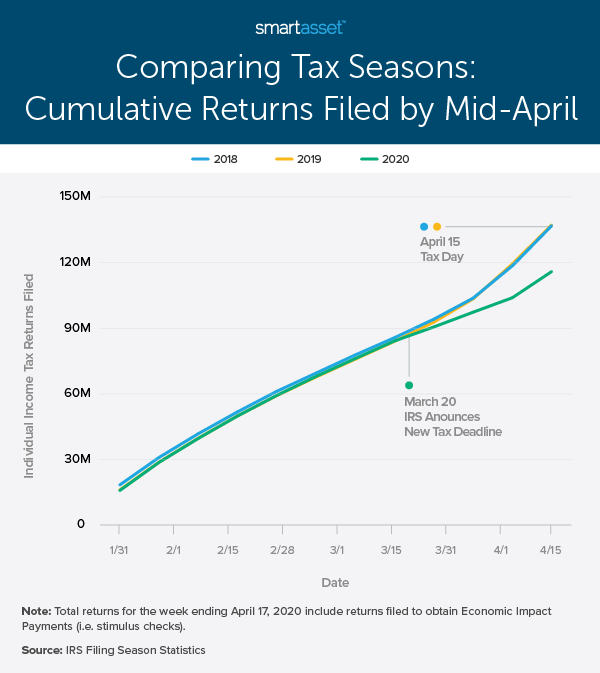

The total decline in tax filings following the change in the deadline this year as compared to 2019 can be easily seen when comparing cumulative returns filed between the last week of January and mid-April for both years. As 2019 filing season statistics were potentially skewed by the Tax Cuts and Job Act of 2017, which first affected individual income taxes for tax year 2018 (i.e. the 2019 filing season), the graph below compares cumulative filings through mid-April in 2020 to both 2019 and 2018.

In total, roughly 137 million returns were filed by individual taxpayers by Tax Day in both 2018 and 2019. This number represents about nine in ten total taxpayers, as there are about 155 million taxpayers each year. About 21 million fewer people have filed this year so far compared to this point in 2019. According to data from the IRS Filing Season Statistics, fewer than 116 million federal returns were received by April 17, 2020.

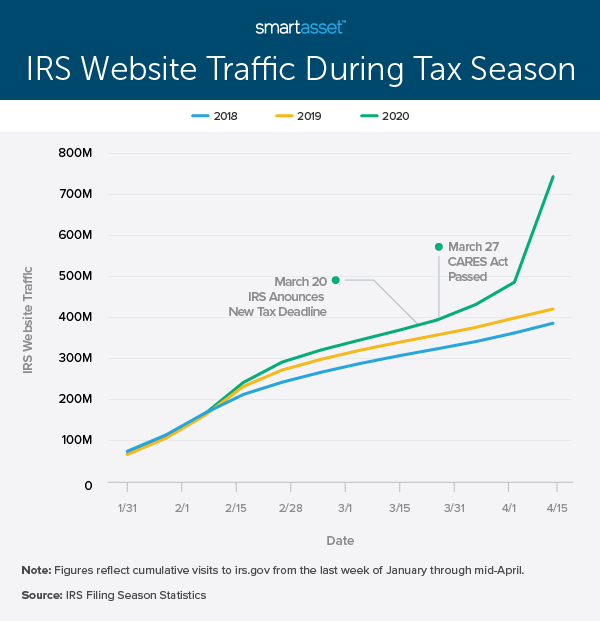

The decrease in returns filed this year contrasts the uptick in IRS website traffic. Through April 17, 2020, there have been almost 745 million visits to irs.gov. This is about 77% more traffic than 2019 through the same time period and about 92% more traffic than 2018. The graph below shows IRS website traffic through mid-April for the three past years (2018, 2019 and 2020).

Spikes in visits to the IRS website are perhaps unsurprising given recent events. Both the change in the tax deadline and uncertainty surrounding coronavirus stimulus checks were likely significant factors in this increased traffic. The graph above shows the dates for the change in the tax deadline and the passage of the CARES Act in 2020.

Data and Methodology

Data for this study comes from the IRS Filing Season Statistics. We looked specifically at federal individual income tax returns received by the IRS from the last week of January through mid-April for the years 2018, 2019 and 2020. Web usage looks at all visits irs.gov over the same time periods.

The coronavirus stimulus checks were administered through the IRS. Some taxpayers who typically do not file returns need to submit a simple tax return to receive the economic impact payments. Data for the week of April 11, 2020 through April 17, 2020 includes returns filed to obtain economic income payments. Here’s what to do if you have trouble getting your stimulus check.

Tips for Maximizing Your Tax Savings

- If you expect a refund, try to file sooner rather than later. With all that’s going on, the ability to push back filing your taxes may appear a godsend. But it may not be so beneficial for people expecting a refund. Take a look at our study on Tax Refunds in America and Their Hidden Cost to see why.

- Consider contributing to an IRA. The normal April 15 income tax deadline is also the IRA contribution deadline. The alignment of the two deadlines means that the new July 15 due date pushes back the 2019 IRA contribution deadline. Use our calculator to see if you are on track for a comfortable retirement and how adding to an IRA this year may help.

- Go beyond taxes to build a comprehensive financial plan. A financial advisor can help you make smarter financial decisions to be in better control of your money. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/PeopleImages