The average American family earns about $55,000 per year, according to Census Bureau estimates. Of course, that’s probably not enough to get by on in America’s most expensive cities, but there are plenty of places where the average American family’s income is sufficient for a satisfying life. These cities offer long-term financial stability by allowing average households to work and save for their future while providing opportunities for these families to enjoy themselves too. Below, we look at metrics related to all these factors to uncover the best cities to live on a $55,000 salary.

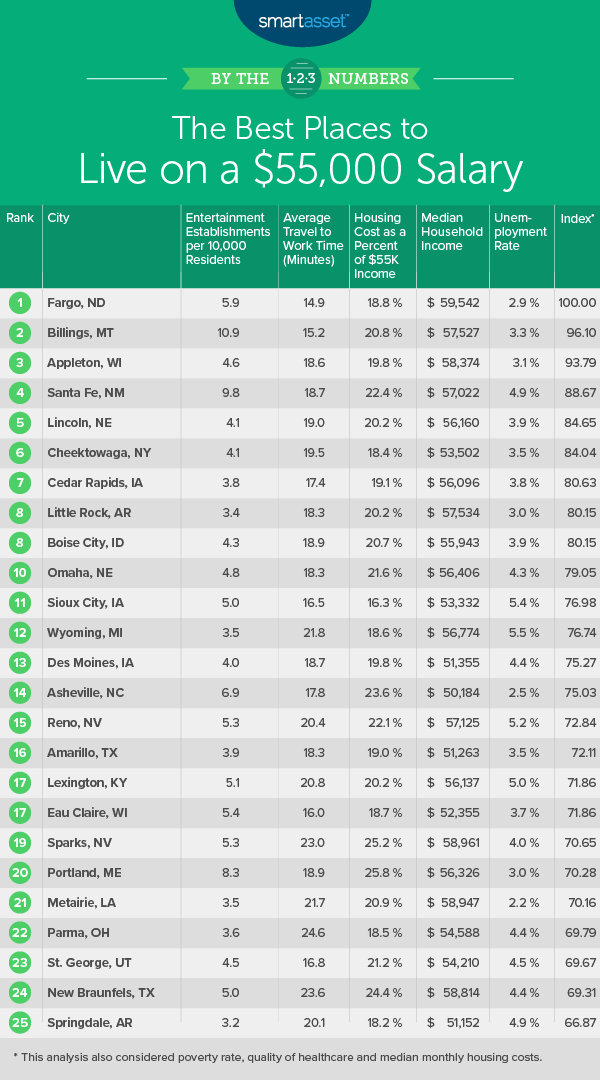

In total, we looked at nine different metrics to rank the best places to live on $55,000. Specifically, we looked at median household income, entertainment establishments per 10,000 residents, civic establishments per 10,000 residents, quality of local healthcare, average commute time, median housing cost, housing costs as a percent of median income, unemployment rate and poverty rate.

This is the 2018 version of this study. Check out the 2017 version here.

Key Findings

- Midwest tops the list – Four of the top 10 cities to live on $55,000 are in the Midwest. This includes the top-ranked city – Fargo, North Dakota – as well as the fifth-, seventh- and 10th-ranked cities.

- Capital cities are good bets – In total, four of the top-10 cities to live on $55,000 are capital cities. These cities tend to have strong economies buoyed by employment from the state government. Along with that, these cities have plenty of avenues for civic engagement.

- $55,000 won’t cut it in California – Nine of the bottom-10 cities to live on $55,000 are in California. These California cities tend to cost more than your average city and have fairly limited job prospects.

1. Fargo, North Dakota

Fargo tops the ranking as the best place to live on $55,000. This city scores in the top 15 in all of our economic metrics, making it a secure place to live and work. For the most part, residents in Fargo don’t have to worry about losing their jobs and falling into poverty. This city has an unemployment rate under 3%. Fargo also scores well in some livability metrics as well. For example, few cities offer residents better commute options than Fargo. The average commute here is under 15 minutes.

2. Billings, Montana

Billings ranks highly in our economic indicators, which is why it secured the second spot. Compared to earning opportunities in Fargo, though, those in Billings are slightly limited. This city ranks 21st for median household income and has an unemployment rate of 3.3%. But for people who place a larger emphasis on entertainment when thinking about livability, Billings may be a better spot land. Billings has nearly 11 entertainment establishments per 10,000 residents, a top-10 rate.

3. Appleton, Wisconsin

Our list continues with another Midwest city: Appleton, Wisconsin comes in third. This city owes its inclusion in the top three to strong economic indicators and affordable housing. Appleton has the sixth-lowest unemployment rate in our study and the ninth-lowest poverty rate. Finding affordable housing and becoming a homeowner are also more feasible here than in many other cities. Appleton ranks no worse than 20th for median housing costs and median housing costs as a percent of $55,000.

4. Santa Fe, New Mexico

Sante Fe, New Mexico is a great place to live for someone earning $55,000 and looking to maximize quality of life. For starters, Santa Fe has strong healthcare indicators. This city topped all other cities with the lowest rate of preventable hospitalizations in our study. Another perk to living in Santa Fe is a large number of civic institutions. In fact, Santa Fe has the third-highest rate of civic institutions per 10,000 residents in the study. Getting to and from work won’t add additional stress to Sante Fe residents’ busy lives either. Santa Fe has a top-20 commute time.

5. Lincoln, Nebraska

Nebraska’s capital takes the fifth spot. With an unemployment rate south of 4% and affordable housing, it isn’t too hard to see what makes Lincoln so livable. It should go without saying, as well, that secure employment goes a long way in making a city livable. Only 14 of the cities we analyzed have a better unemployment rate than Lincoln. But a good job isn’t much use if all your earnings go to paying to keep a roof over your head. Fortunately, housing in Lincoln is on the affordable side. The median home in Lincoln costs under $930 per month.

6. Cheektowaga, New York

Cheektowaga is the only Northeast city to crack the top 10. Northeastern cities were hurt in this study because of their high housing costs. Unaffordable housing leads to housing cost-burdened residents. In a domino effect, that leads to low savings rates, which can hurt residents’ ability to fund their retirement. Cheektowaga pushes against this Northeast trend. The median home here costs just over $840 per month, the seventh-lowest in our study. Jobs are also plentiful and poverty uncommon. In both those metrics, Cheektowaga secured a top-20 ranking.

7. Cedar Rapids, Iowa

Cedar Rapids takes seventh. This city comes in with a median household income of just under $56,100. The average residents in Cedar Rapids should have no problem saving for the future. But even someone earning $55,000 per year won’t struggle with the local cost of living. The median home here costs $877 per month, which is equal to about 19% of monthly income for someone earning $55,000 per year. Cedar Rapids also has a low unemployment rate and a low poverty rate. Cedar Rapids falls to seventh, because it ranks slightly low on other livability metrics. For example, this city ranks 58th for entertainment establishments per 10,000 residents.

8. (tie) Little Rock, Arkansas

You should be able to live a comfortable life in Arkansas’ capital on $55,000. The local median household income is actually above $55,000, suggesting there is some potential to increase earnings. Furthermore, as a capital city, Little Rock offers residents plenty of opportunities to get involved as citizens. This city ranks second for civic establishments per 10,000 residents.

8. (tie) Boise, Idaho

Another capital city comes in eighth. Boise has the second-highest rate of preventable hospitalizations, a sign that healthcare options in the area are pretty good. Boise also ranks in the top 30 for the unemployment rate and poverty rate. In fact, Boise is notable for how balanced its scores are. It only scores in the top 10 once but also only outside the top 50 once. This makes Boise an all-around livable city for people living off $55,000.

10. Omaha, Nebraska

Our list ends in Omaha, the second appearance from a city in the Cornhusker State. The median household income in Omaha is $56,400, just a bit over $55,000. Omaha does not stand out in any single metric. Its highest-ranked metric was average commute time. The average commute is Omaha is only 18.3 minutes. But there is also nothing to be overly concerned about when it comes to living in Omaha. Its worst ranked metric was preventable hospitalizations, but even in that metric, Omaha ranked in the top half.

Data and Methodology

In order to find the best cities to live on a $55,000 salary, we first created a list of all the cities where the median household income was between $50,000 and $60,000. We did this in order to find cities where living on a $55,000 salary was within the range of how the average household lives. This left us with a list of 126 cities, which we ranked across the following nine metrics:

- Median household income. Data comes from the Census Bureau’s 2017 1-Year American Community Survey.

- Median monthly housing cost. Data comes from the Census Bureau’s 2017 1-Year American Community Survey.

- Housing cost as a percent of income. We calculated this by finding the median monthly housing cost as a percent of a $55,000 salary. Data comes from the Census Bureau’s 2017 1-Year American Community Survey.

- Entertainment establishments per 10,000 residents. Data comes from the Census Bureau’s 2016 Business Patterns Survey. It is measured at the county level.

- Civic establishments per 10,000 residents. Data comes from the Census Bureau’s 2016 Business Patterns Survey. It is measured at the county level.

- Number of unnecessary emergency room visits for Medicare enrollees. This measures how often people go to emergency care for issues that did not require such a visit. It is measured at the county level per 1,000 Medicare enrollees. Data comes from the countyhealthrankings.com and is for 2015.

- Average travel time to work. Data comes from the Census Bureau’s 2017 1-Year American Community Survey.

- Unemployment rate. Data comes from the Census Bureau’s 2017 1-Year American Community Survey.

- Poverty rate. Data comes from the Census Bureau’s 2017 1-Year American Community Survey.

We ranked each city across all nine metrics, giving each metric equal weighting. After, we found the average ranking for each city. We based the final score off this average ranking. The city with the best-average ranking received a 100, and the city with the worst-average ranking received a 0.

Tips for Making the Most of Your Savings

- Build an emergency fund – Once you’ve done the hard work, creating a budget and sticking to it, you don’t want to throw away all your good work by not allocating your savings correctly. The first step in any investing and saving master plan is to have an accessible pot of money in case any emergencies arise. That could be a sickness that forces you out of work for a while or damage to your mode of transportation that you need to repair. Having an emergency fund will mean you don’t need to take out any expensive loans to cover the cost of your emergency.

- Save in a high-yield account – Savings accounts aren’t the best way to make money; investing your money is. But savings accounts offer accessibility and liquidity that make them useful financial tools. Of course, just because savings accounts traditionally don’t offer good APYs, doesn’t mean you should just ignore them. By using online-only savings account at banks like Ally or Synchrony, you can get an APY above 1%.

- Ask an advisor – There are so many different ways to use your savings: Sock money away for retirement, prepare for a down payment or invest for the short term. But with so many decisions to make and your future at risk, why not ask an expert? A financial advisor can tell you what the best ways to use your savings are. If you are not sure where to find a financial advisor, check out SmartAsset’s financial advisor matching tool. It will match you with up to three local financial advisors who fit your investing needs.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/damircudic