Though financial advisors expertly help clients plan for their future, they sometimes neglect to apply the same forethought to their own firms. In fact, only 27% of financial advisors have a succession plan or any formal preparations to transition their business, according to a 2018 Financial Planning Association (FPA) report. The need to have such arrangements in place is all the more urgent since the average age of financial advisors is 55, and about one in five financial advisors is aged 65 or older, according to a 2019 J.D. Power study. The fact that so many financial advisors are near retirement age begs the question: What is their legacy strategy?

To answer this question, SmartAsset conducted a survey of financial advisors on our platform to get a more recent look at succession planning within the financial planning industry. We surveyed more than 460 financial advisors, asking them questions ranging from the type of succession plan at their firm to whether the COVID-19 impacted how their firm thinks about succession planning. For more information on our data and how we put it together, check read our Data and Methodology section below.

Key Findings

- The number of financial advisors with a succession plan has increased. Our findings align closely with the 2018 FPA report, as 27% of financial advisors have had a succession plan in place for six or more years. However, we additionally found that 38% of surveyed advisors implemented a succession plan in the last several years. Thus, our findings show that as of February 2022, roughly two-thirds of financial advisors (64.36%) have a succession plan.

- Most financial advisors without a succession plan intend on creating one at some point in the future. Of surveyed advisors without a succession plan, roughly 56% say that they plan on creating one at some point in the future. The remaining 44% of those advisors (or about one in five respondents of all advisors surveyed) have no plan to transition or sell their business and do not intend on forming one.

- Financial advisor succession planning is not top-of-mind for most individuals. Though the lack of a financial advisor succession plan poses a potential risk to clients, only about one in four financial advisors (25.05%) say that clients ask about their firm’s succession plan.

Succession Planning: Types and Years in Place

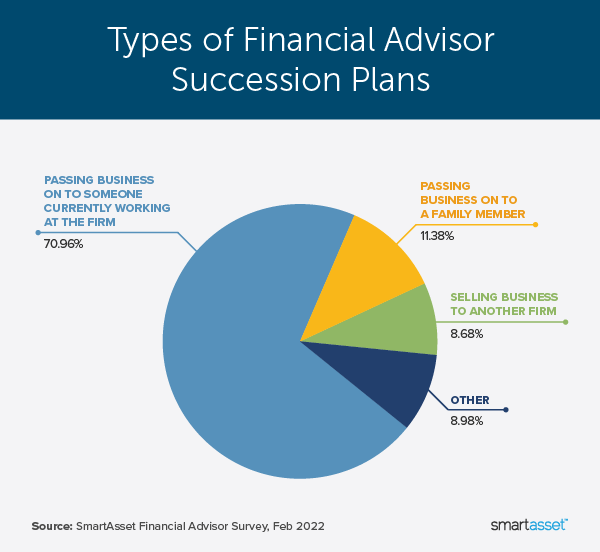

The two major types of succession plans are internal and external. With an internal succession, the firm is passed to someone currently working at the firm while an external succession includes either an outside advisor taking the lead or other external events (i.e. advisory firm sold, advisory firm merges with another, etc.).

Across firms surveyed, most advisors plan on an internal succession. Almost 71% of advisors who have a succession plan intend on passing their business on to someone currently working at the firm. Another roughly 11% of advisors plan on passing their business to a family member. In contrast, less than 9% of financial advisors plan on selling their business to another firm.

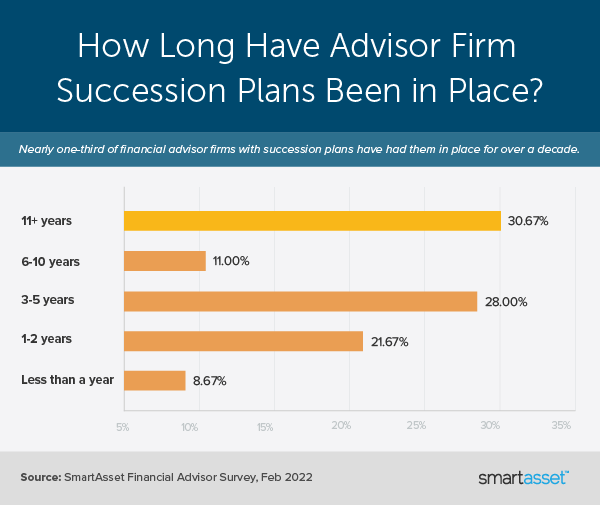

Across advisors with a succession plan, we asked how long their plan has been in place. Most succession plans have been in writing for at least a decade, with almost 31% of firms answering 11+ years to the question: “How long has your succession plan been in place?” There was an uptick in the number of financial advisors creating a succession plan in the last one to five years. About 28% of advisors with a succession plan created their plan three to five years ago while almost 22% of advisors formed a plan one to two years ago.

Did COVID-19 Impact Succession Planning?

Though the COVID-19 pandemic changed many things for financial advisors, perhaps most notably how they communicate with clients, most financial advisors’ succession plans were unaffected. Though about 20% of advisors created a succession planning during 2020 or 2021, roughly 93% of financial advisors say that the pandemic did not change how their firm thinks about succession planning.

Of firms that did notice a change, most advisors point to succession planning being seen as more of a necessity and top-of-mind. One advisor said that with the threat of COVID-19, they must consider what happens to their clients and revenue in a worst-case scenario. Others note their desire to benefit from the hard work they put in over the years, and with that in mind, it is important to have an exit strategy.

Data and Methodology

Survey data for this report was collected by SmartAsset between February 3, 2022 and February 21, 2022. A total of 463 financial advisors responded to our survey. Though the full survey was six questions, not all questions were applicable to all advisors and some advisors chose to skip certain questions. We used the largest sample possible when discussing results for any given question.

Tips for Managing Your Advisory Business

- Iron out your succession plan. If you are a financial advisor without a succession plan and don’t know where to start, check out our introductory guide here. We walk through the basic steps in setting up a business transition plan.

- Want to grow your business? Pre-screen for prospects that meet your client profile. Consider using a service that can connect you directly with prospective clients. If you’re looking to grow your practice, our platform SmartAdvisor connects advisors directly with local prospects. You pay only for investors that fit your client profile.

Questions about our study? Contact us at press@smartasset.com

Photo credit: ©iStock.com/skynesher